Sample Donation Acknowledgement Letter Non-cash

What is Sample donation acknowledgement letter non-cash?

A Sample donation acknowledgement letter non-cash is a formal document that recognizes a non-monetary donation made by an individual or organization. It serves as a receipt for the donation and is essential for tax purposes.

What are the types of Sample donation acknowledgement letter non-cash?

There are several types of non-cash donations that can be acknowledged through a letter, including:

In-kind donations (goods or services provided instead of money)

Donated securities or stocks

Real estate contributions

Vehicle donations

Artwork or collectibles gifts

How to complete Sample donation acknowledgement letter non-cash

To complete a Sample donation acknowledgement letter for a non-cash donation, follow these steps:

01

Start by addressing the donor by name and expressing gratitude for their contribution.

02

Clearly describe the donated item or service, including its estimated value.

03

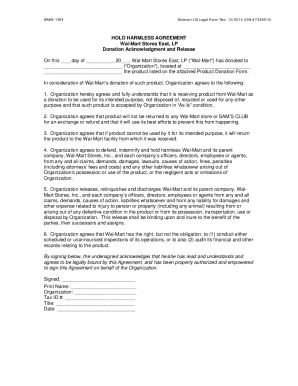

State that no goods or services were provided in exchange for the donation, if applicable.

04

Provide information on the organization's tax-exempt status and offer to answer any questions regarding the donation.

05

Close the letter with a heartfelt thank you and contact information for further correspondence.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Sample donation acknowledgement letter non-cash

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is an example of a donation Acknowledgement?

Example 2: Individual Acknowledgment Letter Hi [donor name], We're super grateful for your contribution of $250 to [nonprofit's name] on [date received]. As a thank you, we sent you a T-shirt with an estimated fair market value of $25 in exchange for your contribution.

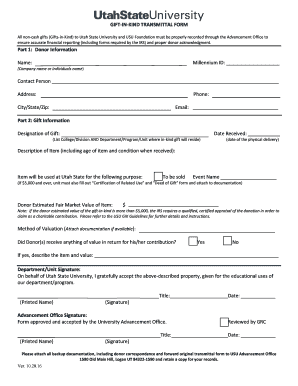

How do you write an in-kind donation receipt?

You should always have the following information on your donation receipts: Name of the organization. Donor's name. Recorded date of the donation. Amount of cash contribution or fair market value of in-kind goods and services. Organization's 501(c)(3) status.

What is legally required to be on a donor thank you letter?

There are several details that the IRS requires you to include: The name of your donor. The full legal name of your organization. A declaration of your organization's tax-exempt status.

How do I record non-cash donations?

Recording In-Kind Donations of Goods: Record the fair market value of the donated items on the day that they were received (or pledged, if not delivered immediately). Classify the revenue as “in-kind revenue” or the appropriate revenue account on your chart of accounts.

What is the documentation for non-cash contributions?

Noncash contributions over $500 require IRS Form 8283, Noncash Charitable Contributions , to be completed and filed with the tax return for the year of the donation.

How do I account for non-cash donations?

For many nonprofit organizations, non-cash gifts are an important source of support for their mission, providing goods and sometimes services that they would otherwise have to purchase. The accounting treatment of such gifts which can be used or sold, calls for them to be valued at “fair value” at the date of the gift.