Fiscal Sponsorship Models

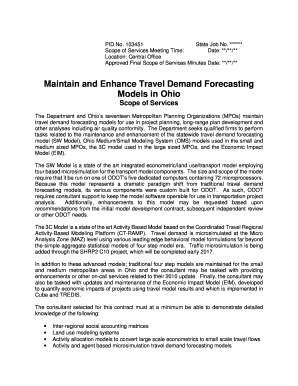

What is Fiscal sponsorship models?

Fiscal sponsorship models are a way for organizations to collaborate and share resources. In this arrangement, a nonprofit organization provides support and oversight to another organization, allowing them to operate under its tax-exempt status.

What are the types of Fiscal sponsorship models?

There are several types of fiscal sponsorship models available, including: 1. Comprehensive fiscal sponsorship - the sponsoring organization provides full financial and administrative support. 2. Pre-approved grant relationship - the sponsor passes funds to the sponsored organization for specific projects. 3. Shared administrative services - the sponsor offers administrative support while the sponsored organization maintains its independence.

How to complete Fiscal sponsorship models

Completing fiscal sponsorship models involves the following steps: 1. Choose the type of fiscal sponsorship model that best suits your needs. 2. Establish a formal agreement with the sponsoring organization outlining roles and responsibilities. 3. Maintain regular communication and transparency to ensure a successful partnership.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.