Simple Promissory Note Template

What is Simple promissory note template?

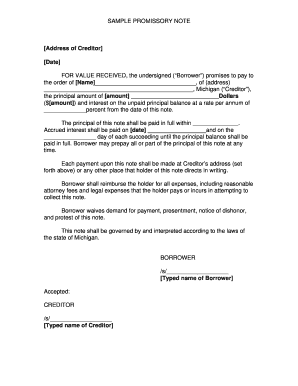

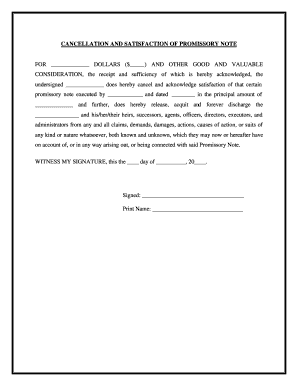

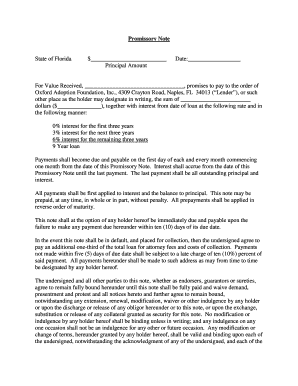

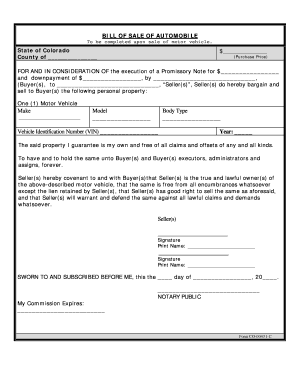

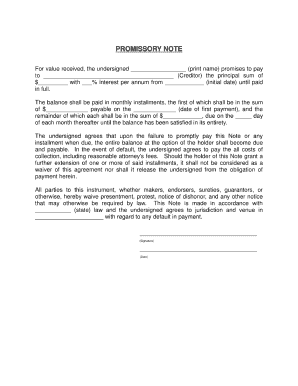

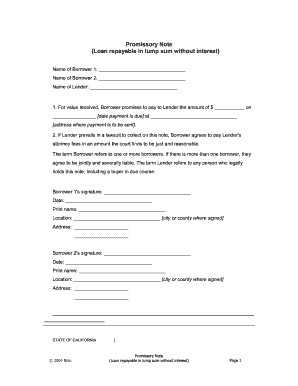

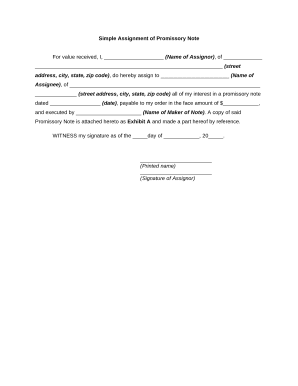

A simple promissory note template is a written agreement where one party promises to pay a sum of money to another party at a specified time. It includes details like the borrower and lender's names, the amount borrowed, interest rate (if any), repayment terms, and any collateral involved.

What are the types of Simple promissory note template?

There are several types of simple promissory note templates that cater to different situations. Some common types include:

Secured promissory note

Unsecured promissory note

Demand promissory note

Installment promissory note

How to complete Simple promissory note template

Completing a simple promissory note template is easy with the following steps:

01

Fill in the borrower and lender's names

02

Specify the loan amount and repayment terms

03

Include any interest rate or collateral information

04

Sign and date the promissory note

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Simple promissory note template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a promissory note example?

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

How do you write a simple promissory note?

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Can I write my own promissory note?

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

What is the format of promissory note?

The format of a promissory note holds the principal amount, issuance date and place, interest rate, due date, parties' contact details, etc. One can make the payment in instalments or as a lump sum, thus ensuring flexibility.

What is a simple promissory note?

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

How do I write a simple promissory note?

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.