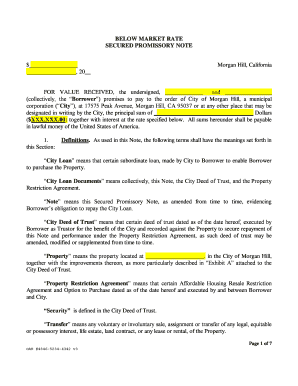

Secured Promissory Note Template California

What is Secured promissory note template california?

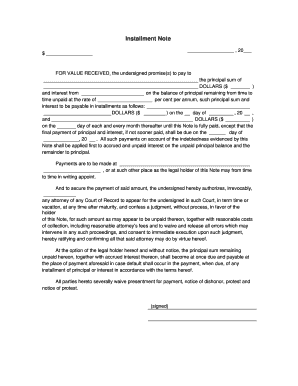

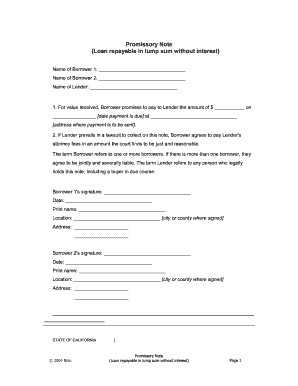

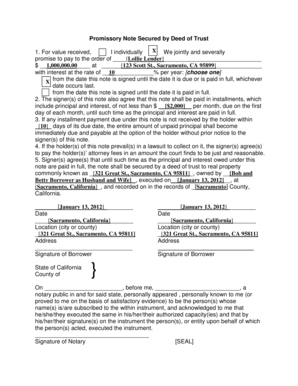

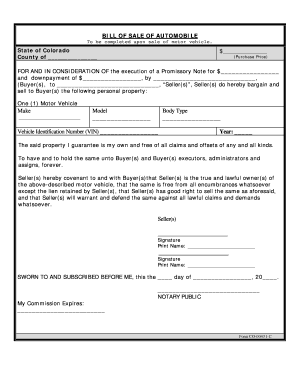

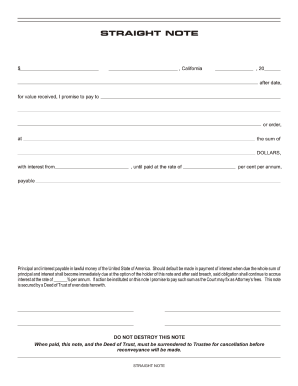

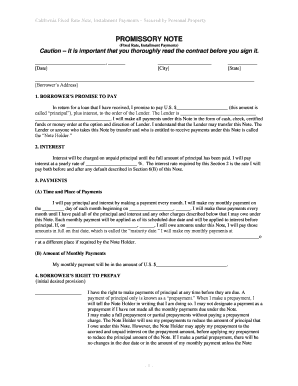

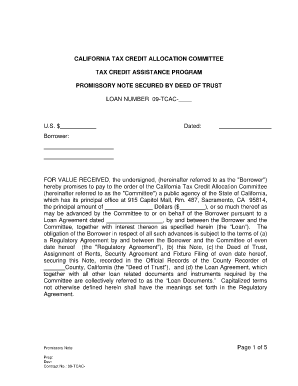

A secured promissory note template in California is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender, backed by a valuable asset as collateral. This type of note provides a level of security to the lender by allowing them to claim the collateral in case the borrower defaults on the loan.

What are the types of Secured promissory note template california?

There are several types of secured promissory note templates in California, including: 1. Real Estate secured promissory note 2. Vehicle secured promissory note 3. Business assets secured promissory note 4. Personal property secured promissory note

How to complete Secured promissory note template california

Completing a secured promissory note template in California is a straightforward process. Here are the steps to follow: 1. Fill in the borrower and lender information 2. Describe the loan amount and repayment terms 3. Detail the collateral being used to secure the loan 4. Include any additional terms or clauses that both parties agree upon

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.