Real Estate Promissory Note Template

What is Real estate promissory note template?

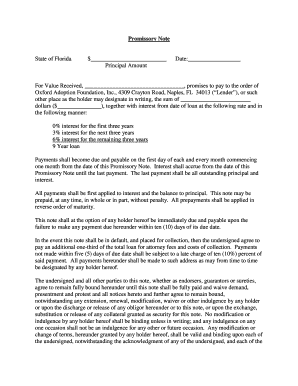

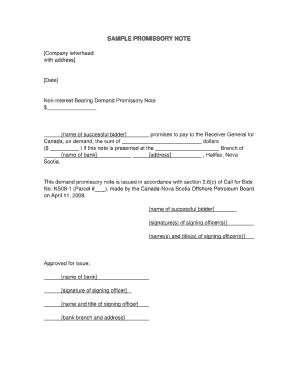

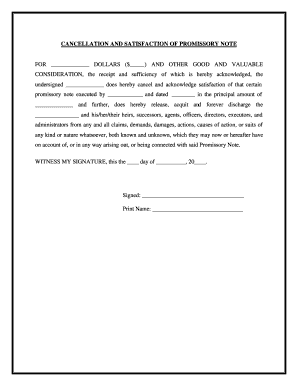

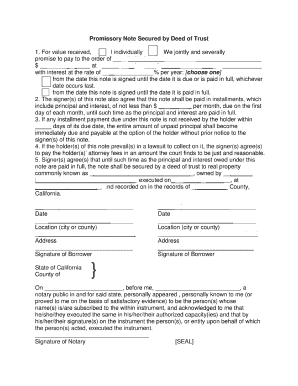

A Real estate promissory note template is a legally binding document that outlines the terms of a loan agreement between a borrower and a lender in the context of a real estate transaction. It details the amount borrowed, the interest rate, repayment schedule, and consequences of default.

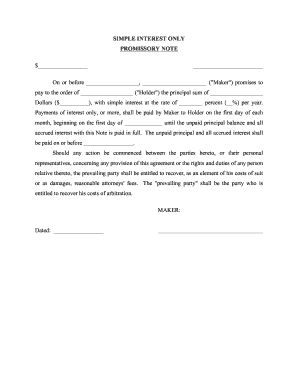

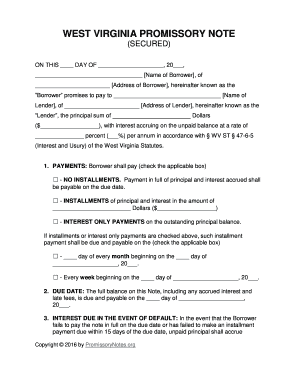

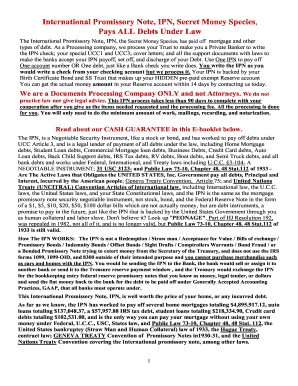

What are the types of Real estate promissory note template?

There are several types of Real estate promissory note templates based on the specific terms and conditions of the loan agreement. Some common types include:

How to complete Real estate promissory note template?

Completing a Real estate promissory note template is a straightforward process that involves the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.