Promissory Note Secured By Real Property - Page 2

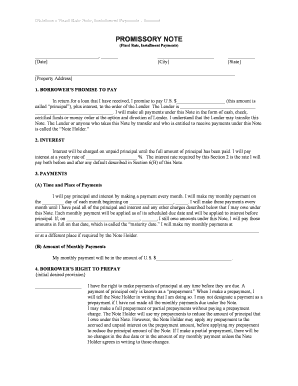

What is a Promissory Note Secured by Real Property?

A promissory note secured by real property is a legal document that outlines the terms of a loan agreement where the borrower promises to repay a specific amount of money to the lender. In this type of note, the borrower pledges real property, such as a house or land, as collateral to secure the loan.

What are the Types of Promissory Notes Secured by Real Property?

There are several types of promissory notes secured by real property, including: 1. Mortgage Notes: where the borrower pledges real estate as collateral 2. Deed of Trust Notes: where a third party trustee holds the property title until the loan is paid off 3. Land Contract Notes: where the seller finances the purchase of real estate and retains legal title until the loan is repaid

How to Complete a Promissory Note Secured by Real Property

Completing a promissory note secured by real property involves the following steps: 1. Fill in the borrower and lender information 2. Specify the loan amount and terms of repayment 3. Describe the real property being used as collateral 4. Include any additional terms or conditions agreed upon 5. Sign and date the document to make it legally binding

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.