Forms Of Security Interest Over An Item Of Property - Page 2

What are Forms of security interest over an item of property?

When it comes to securing ownership rights or financial obligations related to a particular item of property, there are various forms of security interests that can be put in place. These interests serve to protect the interests of the parties involved in the transaction.

What are the types of Forms of security interest over an item of property?

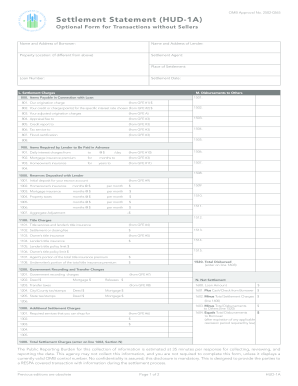

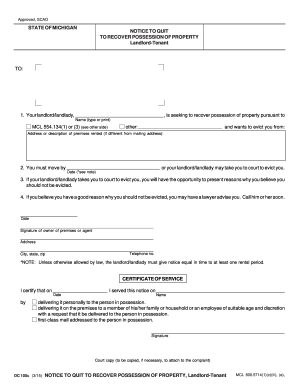

The types of forms of security interest that can be established over an item of property include: 1. Mortgages 2. Liens 3. Pledges 4. Chattel mortgages 5. Security agreements 6. Conditional sales agreements

How to complete Forms of security interest over an item of property

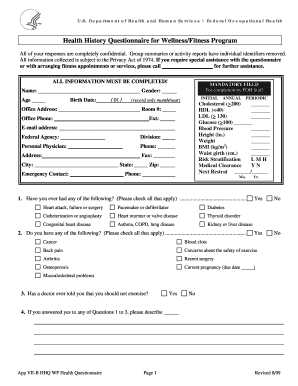

Completing forms of security interest over an item of property requires careful attention to detail and a thorough understanding of the specific requirements for each type of security interest. Here are the steps to successfully complete these forms:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.