Surety Bond Claim Letter Sample

What is Surety bond claim letter sample?

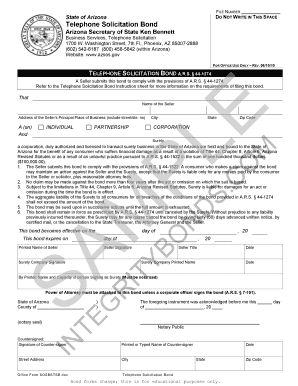

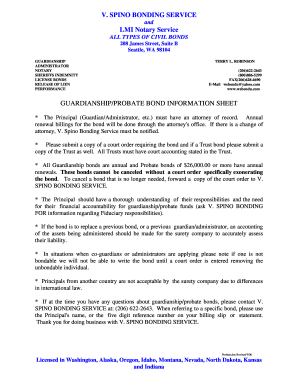

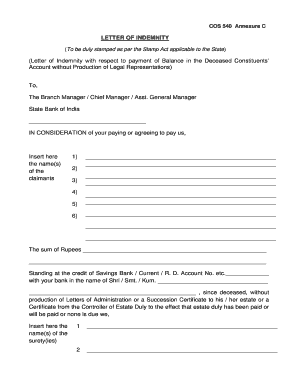

A Surety bond claim letter sample is a formal document submitted to a surety company by a party who believes a bond principal has failed to meet their contractual obligations. It outlines the specifics of the claim and requests compensation as per the terms of the surety bond.

What are the types of Surety bond claim letter sample?

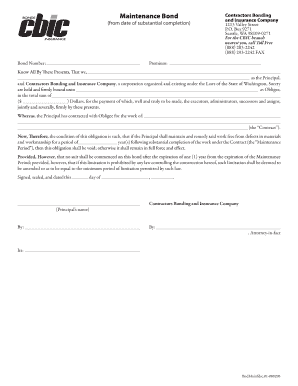

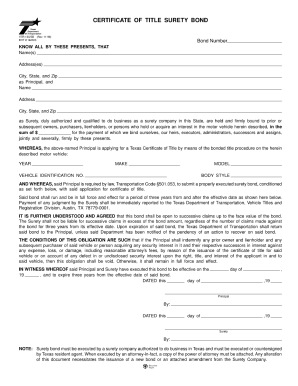

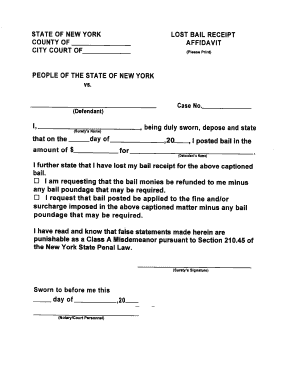

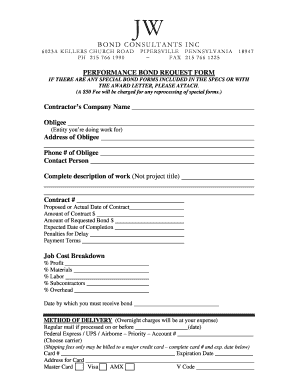

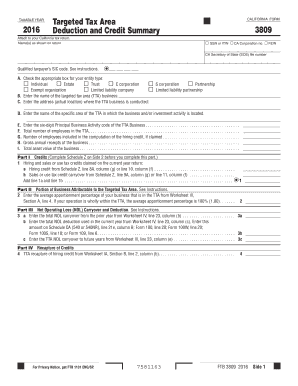

There are several types of Surety bond claim letter samples, including performance bond claim letters, payment bond claim letters, bid bond claim letters, and maintenance bond claim letters. Each type is specific to the nature of the surety bond involved.

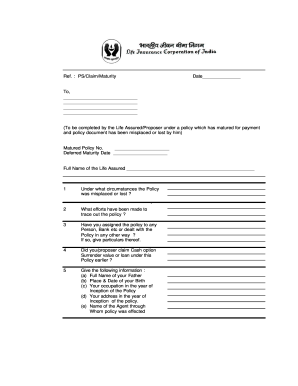

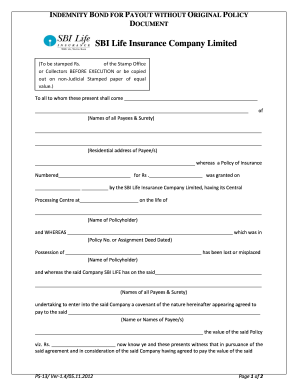

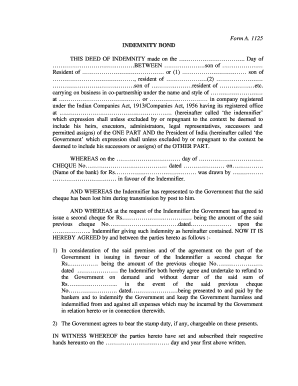

How to complete Surety bond claim letter sample

To complete a Surety bond claim letter sample effectively, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.