Consent And Indemnity Form Meaning

What is Consent and indemnity form meaning?

Consent and indemnity forms are legal documents that outline the agreement between two parties regarding the assumption of risk and release of liability. These forms grant permission for certain actions or activities to take place while also protecting the parties involved from potential legal consequences.

What are the types of Consent and indemnity form meaning?

There are several types of Consent and indemnity forms, including but not limited to:

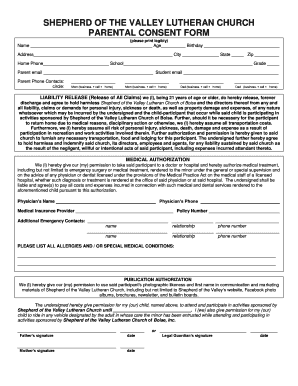

General Consent Form

Medical Consent Form

Activity Waiver Form

Photography Release Form

Liability Waiver Form

How to complete Consent and indemnity form meaning

To complete a Consent and indemnity form, follow these simple steps:

01

Fill in the necessary personal information

02

Specify the details of the agreement or activity

03

Review the terms and conditions carefully before signing

04

Sign and date the form to indicate your consent

05

Keep a copy of the signed form for your records

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Consent and indemnity form meaning

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What does indemnity mean in insurance?

Indemnity is one party's promise to compensate another for potential losses or damages. Indemnification is the act of compensating another party after a loss has occurred. In an indemnity contract, the indemnitee is protected from liability and the indemnitor holds the indemnitee harmless.

What does indemnity form mean?

Indemnity is a comprehensive form of insurance compensation for damage or loss. It amounts to a contractual agreement between two parties in which one party agrees to pay for potential losses or damage caused by another party.

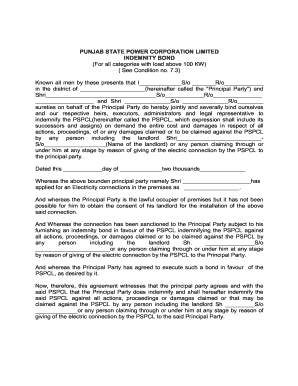

Who is the owner or contractor in indemnification?

Indemnification clauses are contractual provisions that require one party (the “Indemnitor”) to indemnify another party (the “Indemnitee”) for losses that the Indemnitee may suffer. In prime contracts, the owner usually is the Indemnitee and the contractor is the Indemnitor.

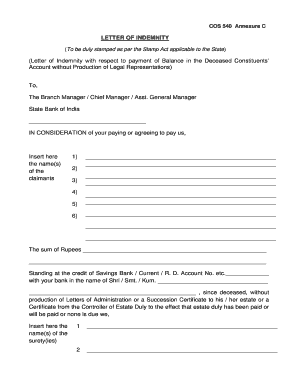

Who fills an indemnity form?

In a business transaction, a letter of indemnity (LOI) is a contractual document guaranteeing that specific provisions will be met between two parties in the event of a mishap leading to financial loss or damage to goods. An LOI is drafted by third-party institutions such as banks or insurance companies.

What is the purpose of an indemnity form?

It is primarily intended to protect the person who is providing goods or services from being held legally liable for the consequences of actions taken or not taken in providing that service to the person who signs the form. Indemnity clauses vary widely.

Who writes letter of indemnity?

Introduction to Letter of Indemnity Typically, these letters are prepared and drafted by a third-party institution, such as banks and insurers, who agree to compensate either of the party when the other party fails to meet the terms of the contract.