How To Fill Form 15g New Format

What is How to fill form 15g new format?

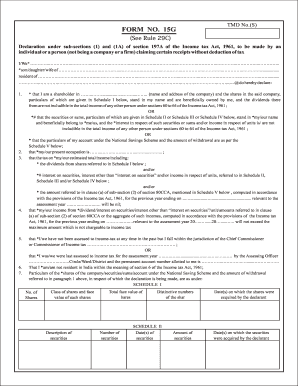

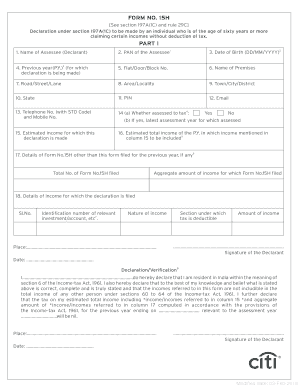

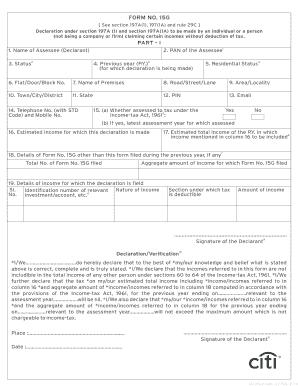

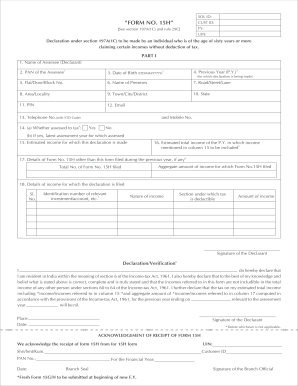

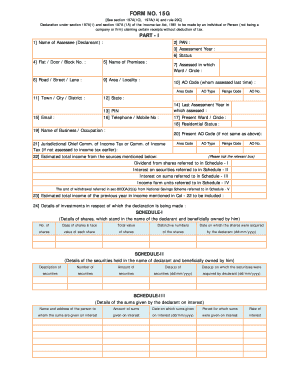

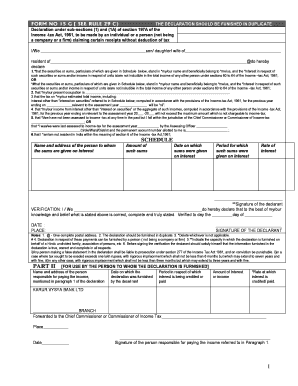

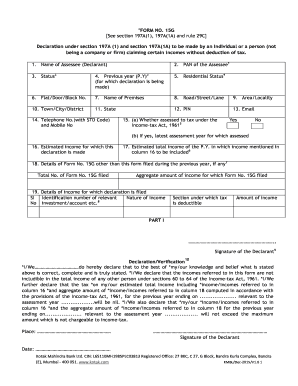

Filling out Form 15G in the new format is a simple process that allows individuals to declare that their income is below the taxable limit. This form is mainly used by individuals who want to avoid TDS deductions on their income.

What are the types of How to fill form 15g new format?

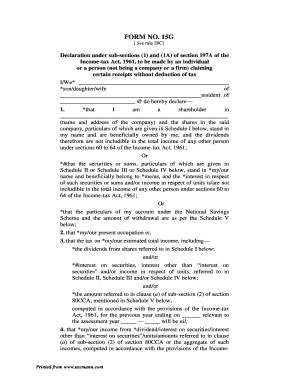

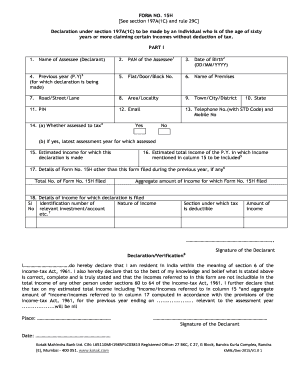

There are two main types of Form 15G in the new format: Form 15G for individuals below 60 years of age, and Form 15H for senior citizens above 60 years of age. These forms are used to declare that the individual's income is below the taxable limit.

How to complete How to fill form 15g new format

To complete the new format of Form 15G, follow these simple steps: Fill in the personal details section, including name, address, PAN number, and contact information. Declare your income details and provide the relevant financial year's details. Sign and date the form to certify the information provided is true.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.