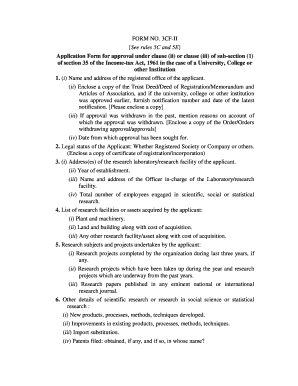

How do I fill out a section C form?

Steps to Completing Schedule C Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. And If You Have a Business Loss.

What documents do you need to fill out a 1040 form?

What do I need to fill out Form 1040? Social Security numbers for you, your spouse and any dependents. Dates of birth for you, your spouse and any dependents. Statements of wages earned (for example, your W-2 and 1099s). Statements of interest or 1099-DIV forms for dividends from banks or brokerages.

How do I fill out a 1040 V form?

What is the process for filling out Form 1040-V? Line 1: Enter your Social Security Number (SSN). ... Line 2: If you are filling out a joint return, enter the second SSN listed on your Form 1040. Line 3: Enter the amount you owe and are paying by check or money order. Line 4: Enter your name(s) and address.

What is the first tax form you fill out?

Form W-4 is an Internal Revenue Service (IRS) form that you complete to let your employer know how much money to withhold from your paycheck for federal taxes.

How do I get old tax forms online?

Order a Transcript Online Using Get Transcript. They can use Get Transcript Online on IRS.gov to view, print or download a copy of all transcript types. ... By phone. The number is 800-908-9946. By mail. Taxpayers can complete and send either Form 4506-T or Form 4506T-EZ to the IRS to get one by mail.

How do I get a copy of my filer form?

Get the current filing year's forms, instructions, and publications for free from the Internal Revenue Service (IRS). Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

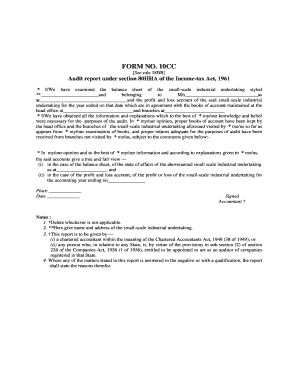

Form 16/ 16A is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. These certificates provide details of TDS / TCS for various transactions between deductor and deductee. It is mandatory to issue these certificates to Tax Payers.

Tax assessment, or assessment, is the job of determining the value, and sometimes determining the use, of property, usually to calculate a property tax. This is usually done by an office called the assessor or tax assessor. Governments need to collect taxes in order to function.

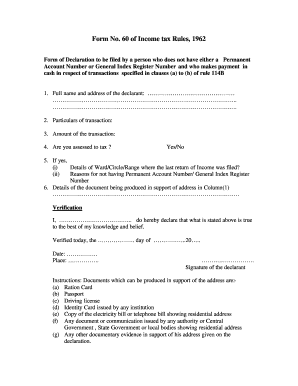

How do I fill out Form 60 61?

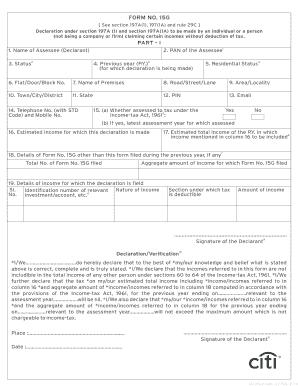

How to Fill up Form 60 or 61 Full name and address of the declarant: Mention Your Full Name. Particulars of transaction: enter the types transaction for which you are filling form 60 or 61. ... Amount of the transaction: value of the transaction. ... Are you assessed to tax: select if you are assessed to income tax. ... If yes,

Where can I download form 60?

The form 60 pdf is available on the official website of the Income Tax Department. Follow these steps to download the form 60. Land on the official portal of the Income Tax Department. On the menu bar, tap on 'Forms/Download'.

How do I fill out a No 60 form?

It has 24 items that an individual must fill in FORM 60 while submitting: First name, middle name and surname. Date of Birth in DDMMYYYY format. Address as per official documents – Flat Number, Name of premises, Block name, Street, Lane, Area, Locality, City, town, District and Pin Code.

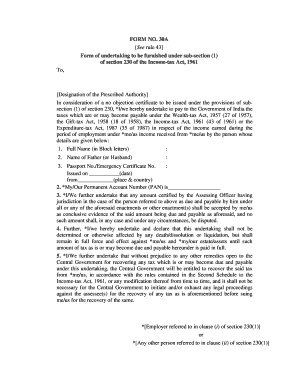

[See second proviso to rule 114B] Form for declaration to be filed by an individual or a person (not being a company or. firm) who does not have a permanent account number and who enters into any. transaction specified in rule 114B.

How can I download Form 16?

Visit the official website of the Income Tax Department (https://www.incometaxindia.gov.in/Pages/default.aspx). Under the 'Forms/Download' section, you will find the 'Income Tax Forms' option, click on it. Next, you will find the 'PDF' and 'Fillable Form' options available under 'Form 16'. Click on the relevant option.

Is Form 60 required for every transaction?

Form 60 is required when an individual does not possess a PAN card and wants to get into financial transactions mentioned below: Purchase or sale of an immovable property that has a value of Rs. 5 lakh or above. Purchase or sale of any motor vehicle.

Where can I get free IRS forms?

During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD. By Mail.

Procedure for furnishing Form 60/ Form 61 Ration Card. Passport. Driving License. Identity Card issued by any institution. Copy of the electricity bill or telephone bill showing the residential address. Any document or communication issued by Central/State Govt or any Local Authority showing the residential address.