Form 15g Download In Word Format

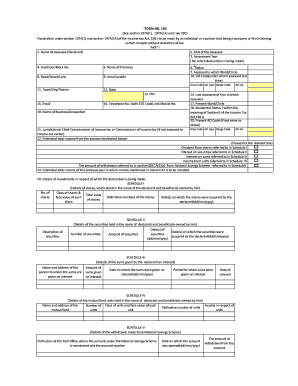

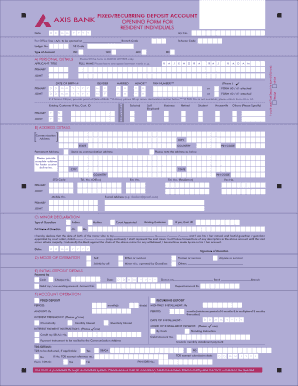

What is Form 15g download in word format?

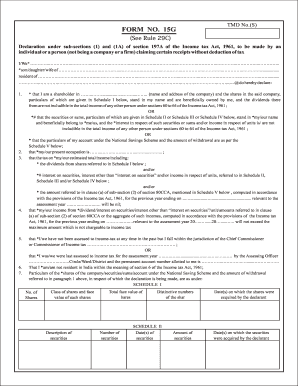

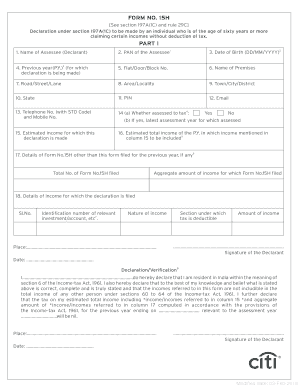

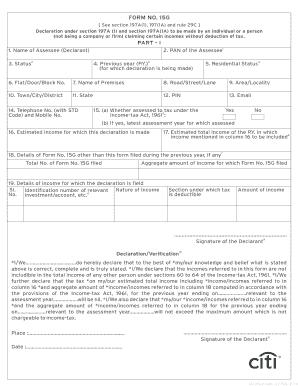

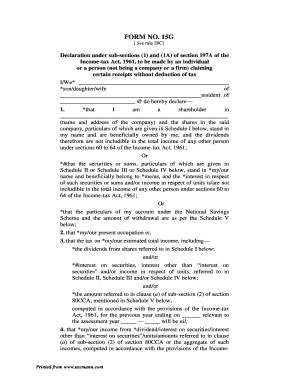

Form 15g download in word format is a document required by financial institutions to declare that an individual's income is below the taxable limit and hence, no TDS deduction should be made on it.

What are the types of Form 15g download in word format?

There are two main types of Form 15g download in word format: Individual Form 15g for individuals below 60 years of age and Senior Citizen Form 15g for individuals above 60 years of age.

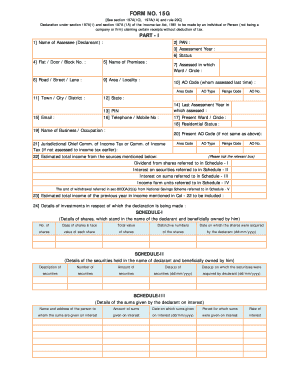

Individual Form 15g

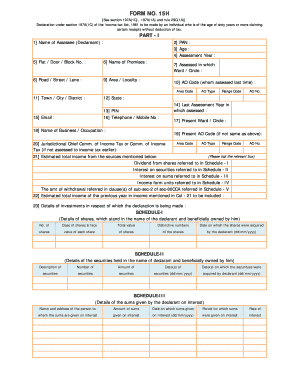

Senior Citizen Form 15g

How to complete Form 15g download in word format

To complete Form 15g download in word format, follow these steps:

01

Fill in your personal details such as name, address, PAN, and contact information.

02

Specify your income details and the sources of income.

03

Declare that your income is below the taxable limit and sign the form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

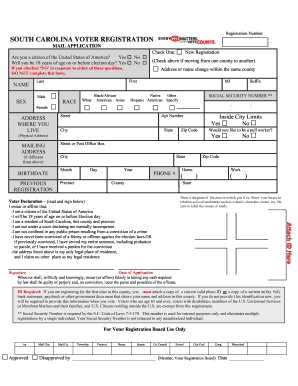

How do I fill out a g15 form?

How to fill Form 15G? Name of Assesse (Declarant) – Enter your name as per income tax records & PAN number as per your PAN card, Status – Input whether you are an individual or HUF. Previous Year –Input the current financial year for which you are filing up the form.

How can I download and fill Form 15G?

How to fill Form 15G Online Log into your bank's internet banking with applicable User ID and Password. Click on the online fixed deposits tab which will take you to the page where your fixed deposit details are displayed. On the same page, you should have the option to generate Form 15G and Form 15H.

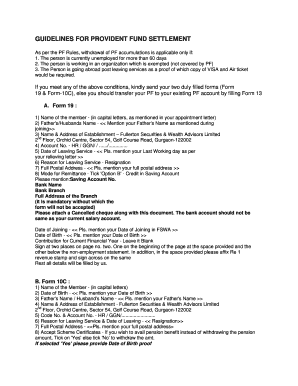

How can I download Form 15G for PF?

Where to Get Form 15G? Form 15G can be easily found and downloaded for free from the website of all major banks in India as well as the official EPFO portal. Additionally, this form can also be easily downloaded from the Income Tax Department website.

Can Form 15G be filled online?

Bank customers can also submit Form 15G or Form 15H online from the convenience of their home. You can submit Form 15G or Form 15H either through the Internet Banking of the bank or through the mobile app of the bank.

How can I download Form 15G?

Here's how you can do it: Log into your bank's internet banking with applicable User ID and Password. Click on the online fixed deposits tab which will take you to the page where your fixed deposit details are displayed. On the same page, you should have the option to generate Form 15G and Form 15H.

How can I see 15G form?

To view the status of uploaded file, Go to My account –>View Form 15G/15H.

What is Form 15G for PF withdrawal PDF?

Download 15G Form PDF For PF Withdrawal Form 15G is meant for individuals who want to claim no-deduction of TDS on certain incomes. It should be filled out by fixed deposit holders (less than 60 years) to ensure that no TDS (tax deduction at source) is deducted from their interest income in a year.

Can we fill Form 15G online for PF withdrawal?

You can now upload Form 15G / Form 15H and submit along with your EPF online withdrawal claim form. Kindly visit EPFO Member Interface portal and login with your credentials. Click on Online Services menu tab and click on Claim (Form 31, 19, 10C) option. Verify last 4 digits of your bank account.

Can I fill 15G form online?

Account holder to login internet banking www.onlinesbi.com. Under “e-services” select > Submit form 15G/H option as applicable to you. Select 15G if you are below 60 years and 15H if above 60 years. Select the CIF number and click on submit.

How can I download Form 15G for EPF?

# Click on ONLINE SERVICES >> Claim (Form 31, 19, 10C). # Then you will see the EPF withdrawal form. # Below I want to apply for, you will see Upload Form 15G as shown in the below image. # Download the Form 15G HERE.