Get the free FORM NO. 15G 197A(1A) 29C 2. - ICICI Bank

Show details

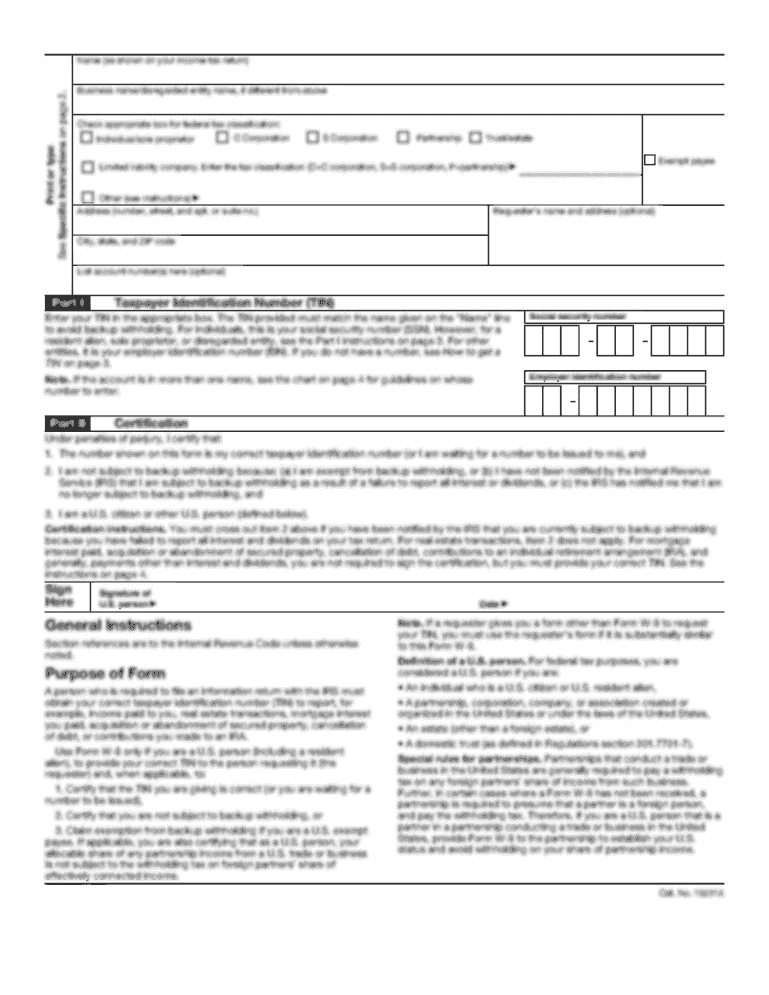

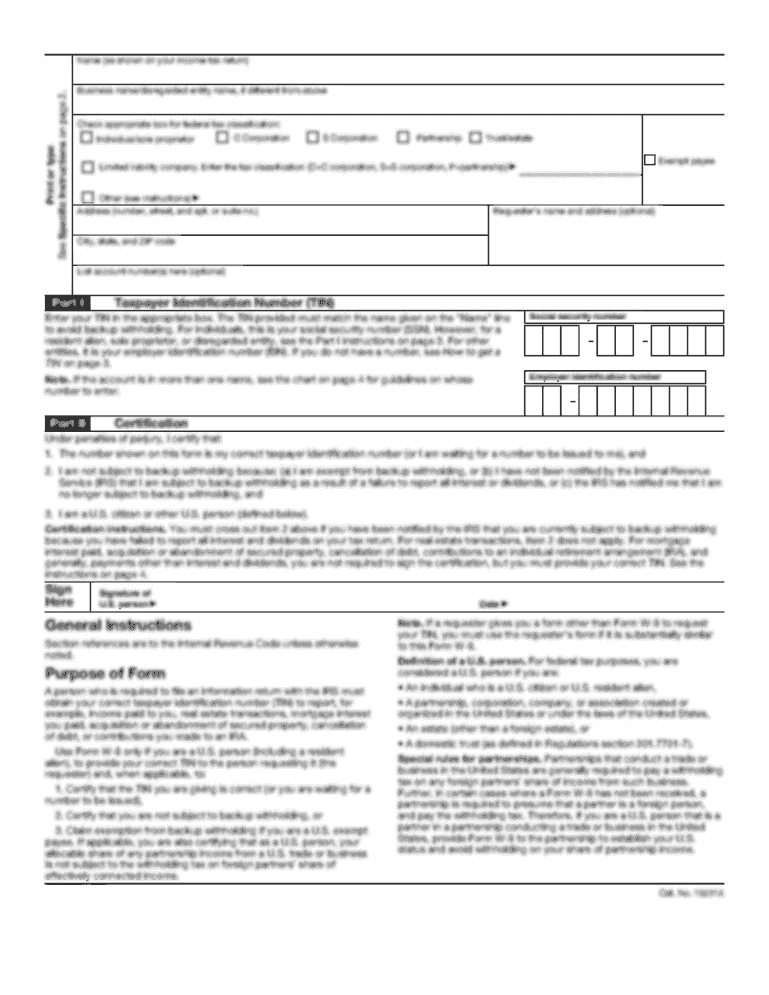

“FORM NO. 15G See section 197A(1), 197A(1A) and rule 29C Declaration under section 197A(1) and section 197A(1A) of the Income?tax Act, 1961 to be made by an individual or a person (not being a company

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form no 15g 197a1a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form no 15g 197a1a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form no 15g 197a1a online

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form no 15g 197a1a. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out form no 15g 197a1a

How to fill out form no 15g 197a1a:

01

Gather all the necessary information and documents. You will need your personal details such as name, address, and contact information, as well as your Permanent Account Number (PAN) and bank account details.

02

Identify whether you are an individual or a Hindu Undivided Family (HUF) as this form is specifically for these entities.

03

Carefully read and understand the instructions provided on the form. Familiarize yourself with the eligibility criteria for submitting form no 15g 197a1a.

04

Fill in the required fields accurately. Provide your name, PAN, and address as mentioned in your PAN card.

05

Enter your age as it is an important criterion for eligibility. Only individuals who are below the age of 60 years, or for HUFs, the eldest member should be below 60 years, can submit this form.

06

Mention the previous year for which the declaration is being made. Ensure that it falls within the specified financial year.

07

Provide details of your income from different sources such as interest, dividends, or any other income mentioned in the form. Make sure to include all relevant information and calculate the total income correctly.

08

Declare that your total income is below the taxable limit by ticking the relevant box.

09

Sign and date the form. In the case of HUFs, the eldest member should sign the form.

10

Submit the filled-out form to the appropriate financial institution, usually the bank where you have your account. Keep a copy of the form for your records.

Who needs form no 15g 197a1a?

01

Individuals who are below the age of 60 years and whose total income is below the taxable limit.

02

Members of a Hindu Undivided Family (HUF) where the eldest member is below the age of 60 years and the total income of the HUF is below the taxable limit.

03

Individuals and HUFs who want to avoid the deduction of tax at source on their income from fixed deposits, recurring deposits, interest on securities, dividends, etc.

04

Those who meet the eligibility criteria mentioned in the instructions provided with the form and want to avail the benefits of submitting form no 15g 197a1a.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form no 15g 197a1a?

Form no 15g 197a1a is a declaration form for individuals who wish to receive income without deduction of tax.

Who is required to file form no 15g 197a1a?

Individuals whose total income is below the taxable limit are required to file form no 15g 197a1a.

How to fill out form no 15g 197a1a?

Form no 15g 197a1a can be filled out by providing personal details, PAN number, income details, and declaration of no tax liability.

What is the purpose of form no 15g 197a1a?

The purpose of form no 15g 197a1a is to declare that the individual's income is below the taxable limit and hence no tax deduction is required.

What information must be reported on form no 15g 197a1a?

The information reported on form no 15g 197a1a includes personal details, PAN number, income details, and declaration of no tax liability.

When is the deadline to file form no 15g 197a1a in 2023?

The deadline to file form no 15g 197a1a in 2023 is usually before the first payment of income without tax deduction.

What is the penalty for the late filing of form no 15g 197a1a?

The penalty for the late filing of form no 15g 197a1a can result in a deduction of tax at a higher rate or other penalties as per the tax laws.

How do I edit form no 15g 197a1a in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your form no 15g 197a1a, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my form no 15g 197a1a in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your form no 15g 197a1a right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out form no 15g 197a1a using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign form no 15g 197a1a and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your form no 15g 197a1a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.