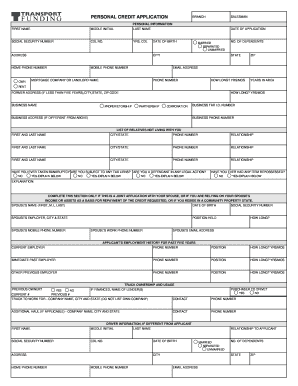

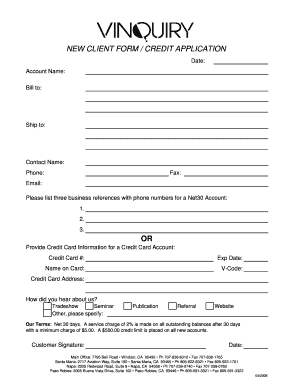

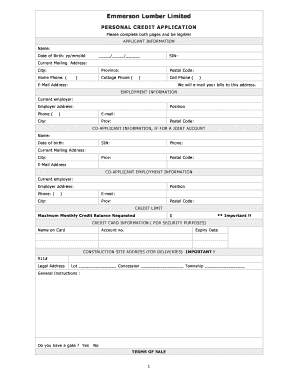

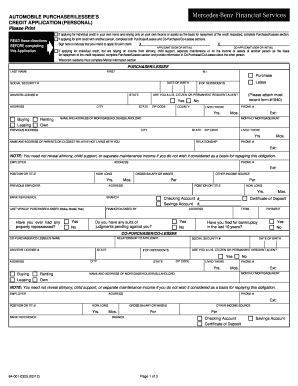

Personal Credit Application Form

What is personal credit application form?

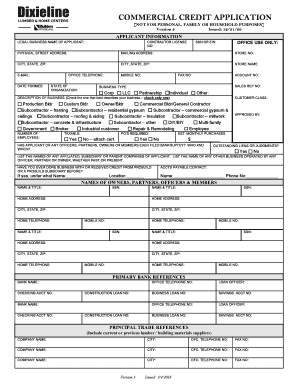

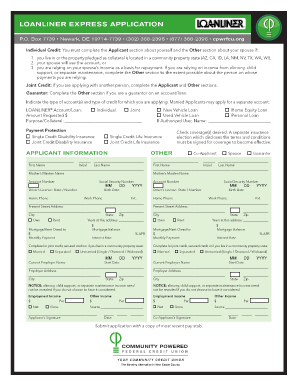

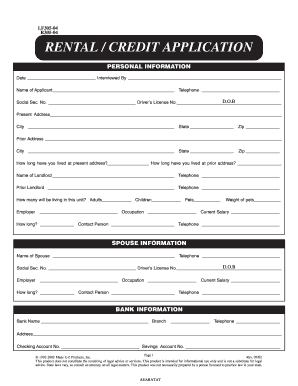

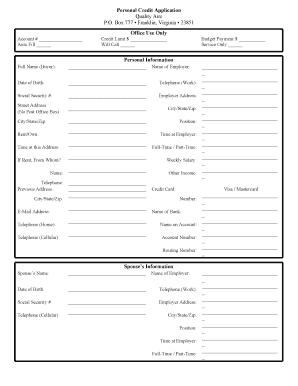

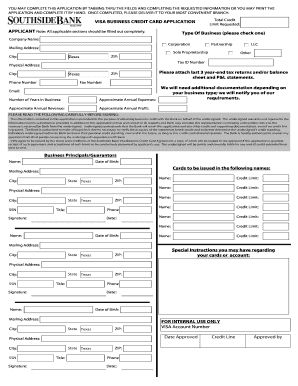

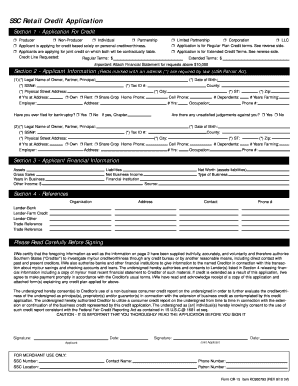

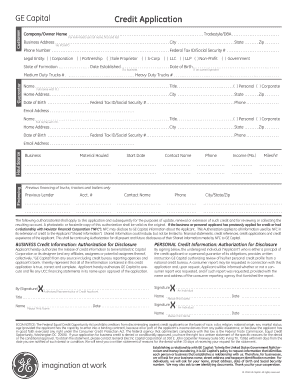

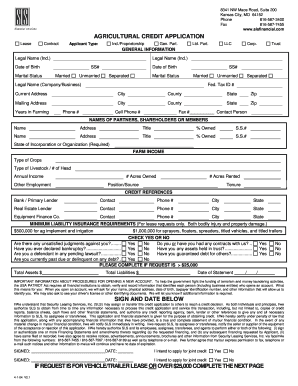

A personal credit application form is a document used by individuals to apply for credit from financial institutions or lenders. It contains personal information, such as name, address, contact details, employment history, and income details. The form also includes sections for the applicant to provide information about their credit history, assets, and liabilities. By completing this form, individuals can formally request credit and provide the necessary information for the lender to assess their eligibility and creditworthiness.

What are the types of personal credit application form?

There are various types of personal credit application forms available, depending on the specific financial institution or lender. Some common types include: 1. Standard Personal Credit Application Form: This is a basic form that covers essential personal and financial information. 2. Business Credit Application Form: This form is designed for individuals who are applying for credit on behalf of a business. 3. Joint Credit Application Form: This form is used when multiple individuals are applying for credit together. 4. Student Credit Application Form: This form is specifically for students who are applying for credit. 5. Secured Credit Application Form: This form is used when the credit being applied for is secured by collateral, such as a vehicle or property. It's important to check with the specific lender or financial institution to determine which type of form is required for the desired credit application.

How to complete personal credit application form

Completing a personal credit application form is a straightforward process. Here are the steps to follow: 1. Gather the necessary information: Collect all the personal, employment, and financial details required on the form. 2. Read the instructions carefully: Understand the specific requirements and guidelines provided with the form. 3. Provide accurate and complete information: Fill in all the sections of the form accurately and honestly. Make sure to double-check for any errors or missing information. 4. Attach supporting documents: If required, attach the necessary supporting documents, such as proof of income, identification, or address verification. 5. Review and submit: Before submitting the form, review it thoroughly to ensure all information is correct. If everything looks good, submit the completed form to the lender or financial institution. By following these steps, you can effectively complete a personal credit application form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.