Start-up Capital Estimate Template

What is Start-up Capital Estimate Template?

A Start-up Capital Estimate Template is a document that helps entrepreneurs calculate the initial amount of money needed to start a new business. This template typically includes various categories of expenses that need to be considered when estimating start-up capital.

What are the types of Start-up Capital Estimate Template?

There are several types of Start-up Capital Estimate Templates available, including:

Simple Start-up Capital Estimate Template

Detailed Start-up Capital Estimate Template

Industry-specific Start-up Capital Estimate Template

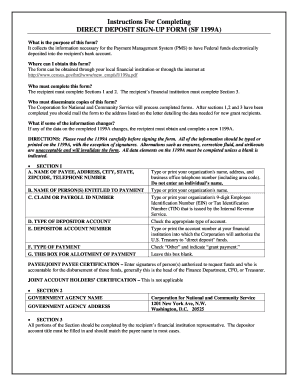

How to complete Start-up Capital Estimate Template

Completing a Start-up Capital Estimate Template is a crucial step in planning for your new business. Here are some steps to help you effectively fill out the template:

01

Gather information on all start-up expenses such as equipment, marketing, rent, and supplies.

02

Estimate the cost of each expense item and enter it into the template under the corresponding category.

03

Total up all the estimated expenses to determine the total start-up capital required.

04

Review and adjust the estimates as needed to ensure accuracy.

05

Once completed, use the Start-up Capital Estimate Template to create a solid financial plan for your new venture.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are examples of start-up costs?

What are examples of startup costs? Examples of startup costs include licensing and permits, insurance, office supplies, payroll, marketing costs, research expenses, and utilities.

How do you find startup capital?

How to Find Startup Capital Start Small. Determine Your Needs. Where to Find Investors. Ask Family and Friends. Borrow Money. Government Sources. Use Credit Cards.

How can one estimate the needed capital that would be used to start a business?

You need to estimate your startup expenses, which you will pay just once. You can do that by summing up the costs of business registration and agency fee, insurance, fixed assets (rent, buildings, machinery, equipment, land and furniture), start-up production capital, professional fee, starting inventory and others.

How do you evaluate start-up costs?

How to calculate startup costs Identify your expenses. Start by writing down the startup costs you've already incurred — but don't stop there. Estimate your costs. Once you've developed a list of your business needs, note the average cost for each category. Do the math. Add a cushion. Put the numbers to work.

What is estimated startup capital?

Startup capital includes funds for any expenses to be incurred before launching a company, and capital required after launch to run the company until it reaches positive cash flow -- when revenues are higher than expenses.

How do I create a startup budget?

How do I create a startup budget? Determine all your essential one-time costs and capital expenditures. List all your fixed and variable monthly expenses. Estimate funding from investments, bank loans, and savings. Estimate your expected monthly revenue. Calculate a break-even point.

Related templates