Convert On Salary Record Gratis

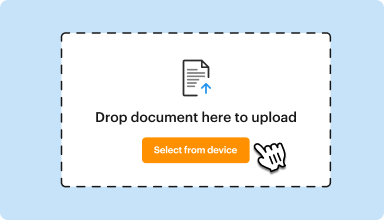

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

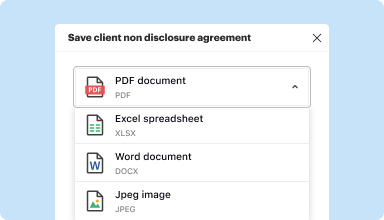

Edit, manage, and save documents in your preferred format

Convert documents with ease

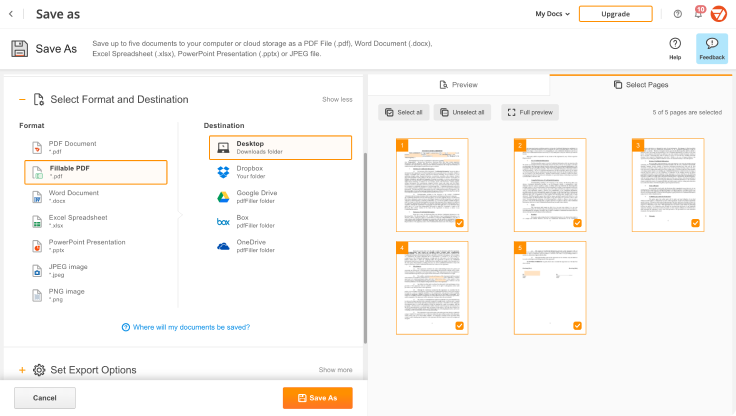

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

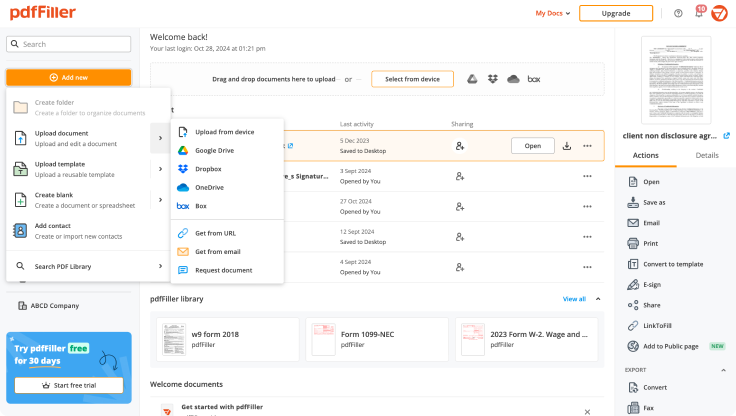

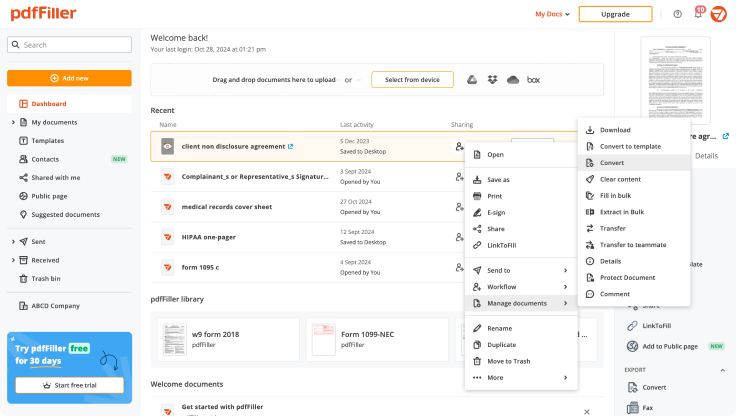

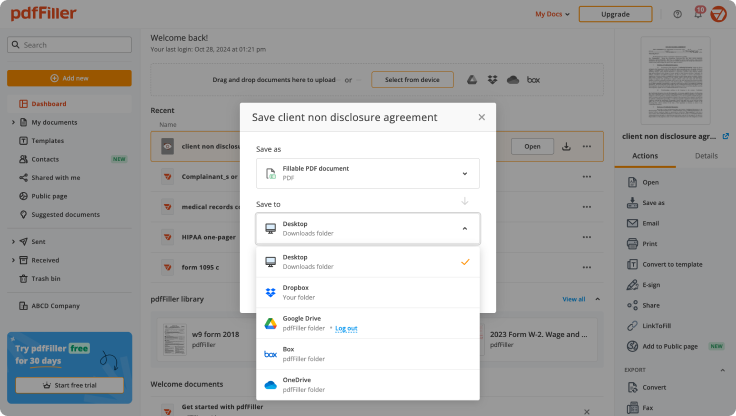

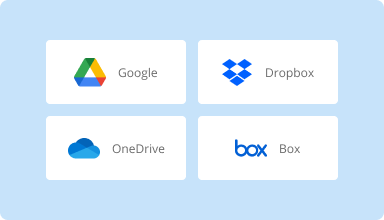

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

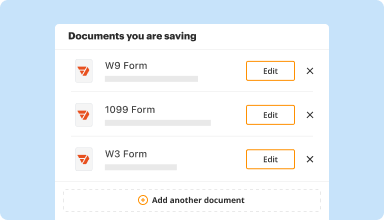

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

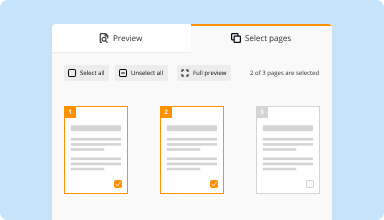

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

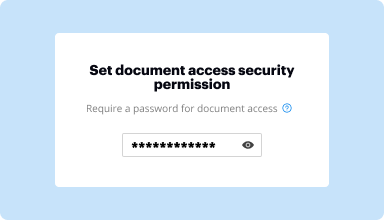

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I was please to see that I could edit my spreadsheet. I would suggest that once a work or set of numbers are highlighted that the program automatically is able to identify the font and size of the writing. Otherwise I was very pleased.

2014-08-13

Surprised to find out, after filling out the form, that it is a paid service. Customer Service (Sam) was very helpful and pleasant, and sorted things our for me.

2014-08-14

I like the site and the program. I do not appreciate being told of the cost until I had invested significant time filling it out. Not nice. Felt compelled to buy product - not fair.

P.S. Even though I felt I had to buy it, I like it and have since used it multiple times.

2014-08-28

It was hard to figure out how to get started, and I made some mistakes in the beginning. I saved two files too soon and now I don't know how to erase them because when I try it says if I delete it it will no longer be shared. Is it okay to delete it anyway?

2015-09-25

It's great to be able to fill out any pdf online. It looks so much more professional. I find the site to be very intuitive and self-explanatory. I've been able to figure out everything I needed just by doing it. I wish the subscription wasn't so expensive though because I don't feel I can afford it. The free trial is a great introduction.

2019-06-28

This web site is quick and easy to use…

This web site is quick and easy to use and their support is amazing. I have used the live chat when I was in the middle of a project and gotten an answer in minutes. It takes a lot of the stress out of the process.I saw a review on another site warning people not to supply a credit card. The fact that this person found their template on a site that did not warn them it was a paid service is not the fault of PFDfiller. When you got to their web site, they immediately let you know that you can sign up and get a free trial period, then ask for your payment information, which is SOP for online services as far as I know and gives you the option not to use the service if you don't want to do so.

2019-02-28

the two forms that I needed to fill out…

the two forms that I needed to fill out for Social Security,SSA-3368 and SSA-827 ,your system had the forms to fill out and to print up the filled out forms so I can fax the document to them. very easy to follow steps to make sure you fill out the form fully

2023-06-03

Great software program

Great software program, lots of useful and dynamic features, good trial offer - better than all comp., fairly user friendly interface given some basic computer skills, etc. There are a few limitations or features that if were avail., I would increase my rating to 5 instead of 4. Thank you..

2021-10-21

This PDF filler works like a charm

This PDF filler works like a charm. Comes in handy when you need it. Nice to have on hand. Price could be cheaper as it's not something that's needed often

2021-02-02

Convert On Salary Record Feature

The Convert On Salary Record feature simplifies your payroll processes by streamlining salary calculation and record management. It allows businesses to easily convert salary data for various needs, ensuring accuracy and efficiency in financial reporting and employee management.

Key Features

Automated salary conversion based on predefined parameters

Seamless integration with existing payroll systems

Real-time updates to salary records

User-friendly interface for easy navigation

Secure data handling to protect employee information

Potential Use Cases and Benefits

Accountants can maintain accurate payroll records and produce reports with ease

HR departments can quickly adjust salaries and communicate changes to employees

Businesses can improve compliance with local regulations concerning payroll

Managers can enhance decision-making through precise financial insights

Organizations can save time and reduce errors in salary calculations

By implementing the Convert On Salary Record feature, you address common challenges in payroll management. This tool helps you eliminate manual errors, reduces time spent on repetitive tasks, and empowers you to make informed financial decisions. It ultimately leads to better employee satisfaction and trust, as staff see the transparency in how their salaries are managed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you calculate hourly rate for salaried employees?

To calculate the hourly rate for a salaried employee, divide the yearly salary by 52. For example, divide an annual salary of $37,440 by 52, which equals a weekly pay amount of $720. When the employee normally works 40 hours per week, divide the weekly pay of $720 by 40 to calculate the hourly rate.

How do you calculate hourly rate from monthly salary?

If you know you work 40 hours a week for 50 weeks a year then you would multiply the hourly stated wage by 2,000 to get the annual total & then divide by 12 to get the monthly equivalent.

How do you calculate hourly wage from monthly salary?

For hourly employees, the calculation is a little more complicated. First, to find your yearly pay, multiply your hourly wage by the number of hours you work each week, and then multiply the total by 52. Now that you know your annual gross income, divide it by 12 to find the monthly amount.

How do you calculate your hourly rate?

To calculate the hourly rate for a salaried employee, divide the yearly salary by 52. For example, divide an annual salary of $37,440 by 52, which equals a weekly pay amount of $720. When the employee normally works 40 hours per week, divide the weekly pay of $720 by 40 to calculate the hourly rate.

How do you calculate hourly rate from gross pay?

When figuring the hourly rate, use the gross pay to the employee, rather than after-tax pay. Multiply the number of overtime hours by 1.5 because overtime hours pay time and a half. For example, if the employee worked 40 regular hours and 10 overtime hours, multiply 10 by 1.5 to get 15.

How do you calculate daily salary from monthly salary?

Daily Rate = (Monthly Rate X 12) / Total working days in a year.

How do I calculate my hourly pay?

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This number is the gross pay per pay period. Subtract any deductions and payroll taxes from the gross pay to get net pay.

How do I calculate my biweekly salary?

Biweekly to annual: To convert biweekly income to annual income you would typically multiply your biweekly income by a number between 24 and 26. There are 52 weeks per year. Divide weeks by 2 in order to covert them into biweekly pay periods.

#1 usability according to G2

Try the PDF solution that respects your time.