Convert On Salary Settlement Gratis

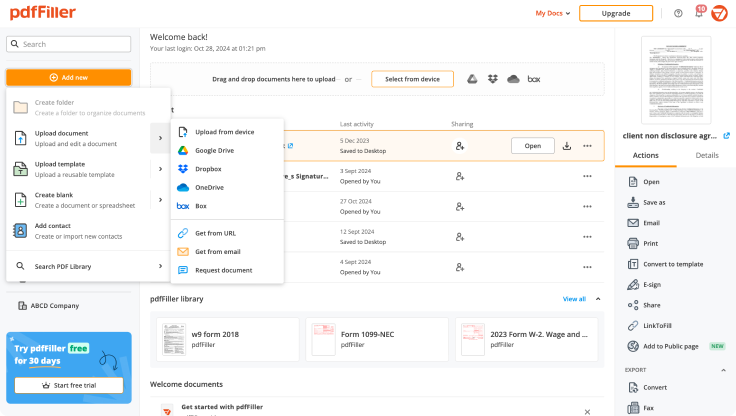

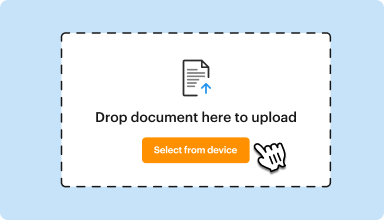

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

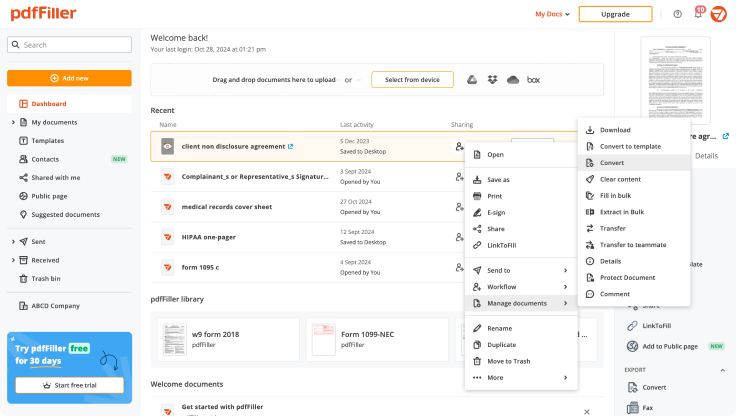

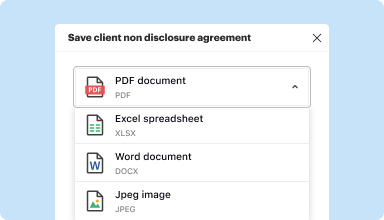

Edit, manage, and save documents in your preferred format

Convert documents with ease

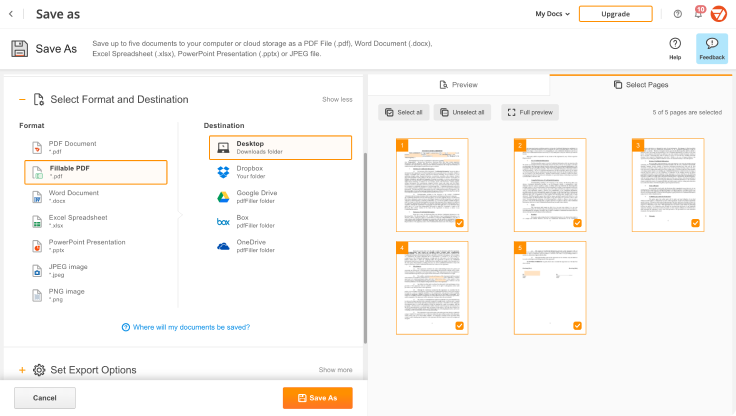

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

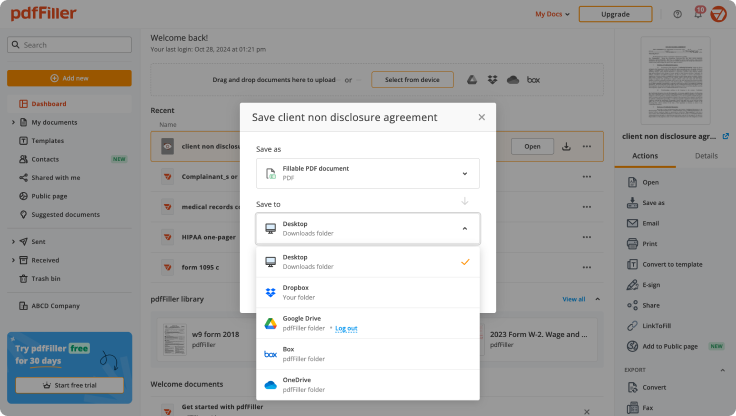

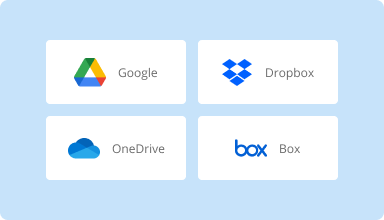

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

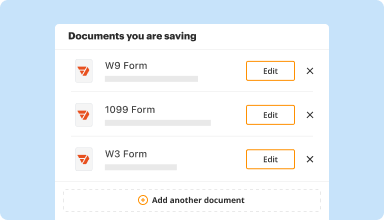

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

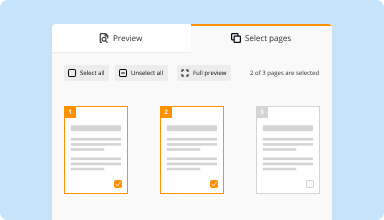

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

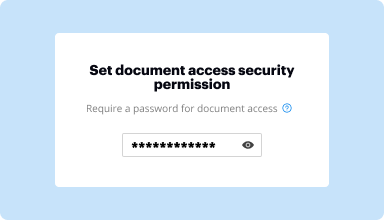

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I LOVED IT, BUT I REALIZED THAT I THOUGHT THIS WAS SOMETHING I WOULD NEED ALL THE TIME AND IT IS NOT, SO SORRY TO SAY... I WILL BE CANCELING THIS PDF FILLER AT THIS TIME.. BUT I KNOW WHEN AND IF I NEED SOMETHING. I KNOW WHO I CAN COUNT ON AND WHO I CAN REFER TO IF PEOPLE ARE LOOKING FOR CERTAIN FORMS. THANK YOU

2015-11-17

I've been really happy with how easy it…

I've been really happy with how easy it is to find certain forms, then fill them in and print them, but I wasn't able to find a few forms I needed and had to look for them elsewhere. I'd be ecstatic if all the forms I needed were all in one place.

2023-10-26

First time user

First time user. It was fast and easy to learn. I hate doing govt forms and this was so simple to use and completed what takes me hours in mionutes.

2023-04-30

What do you like best?

I can upload any document. I can fill out forms sent to me by others and resend them on the quickness.

What do you dislike?

I have not found anything that I dislike about it.

What problems are you solving with the product? What benefits have you realized?

I save time by not having to print and scan forms and also saves paper.

2022-02-14

A great online software

A great online software, easily linkable with Google Drive. You can modify as far as you want your documents, make signature and so much modifications.

Really useful and safe for any documents.

2021-11-17

Very helpful website that is also…

Very helpful website that is also realistic in allowing its customers a reasonable free trial. Very efficient and well thought through.

2021-10-25

Trial Offer

We were reviewing this application and thought we had agreed to the trial offer. Actually, we didn't want the trial offer. When sending an email to their support team, they immediately responded and took care of our request, no questions asked.

2020-09-16

Prompt and honest.

They answered my query online immediately and refunded for an incorrectly charged (not their fault) subscription fee within the hour! Was not expecting such prompt service and honesty to be fair, but so grateful they are honourable.

2020-09-06

I am not sure why it took me so long to…

I am not sure why it took me so long to find pdffiller, it makes my life so much easier. I love all the things I can do in here.

2025-05-23

Convert On Salary Settlement Feature

The Convert On Salary Settlement feature provides a seamless solution for managing salary settlements. This tool makes it easy for employees to convert their salary into different options, improving flexibility and financial management.

Key Features

Flexible conversion options for salary management

User-friendly interface for easy navigation

Real-time updates on conversion rates

Secure transaction process

Personalized notifications for users

Potential Use Cases and Benefits

Employees can manage their salary in a way that fits their lifestyle

Organizations can reduce payroll processing time

Financial planning becomes simpler for users

Increased employee satisfaction boosts productivity

Ability to invest or save based on personal goals

This feature addresses common financial challenges. By allowing your salary to be converted into preferred options, you can enhance your budget management. Whether you wish to save, invest, or spend, this feature ultimately offers a path to greater financial control and peace of mind.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is the formula for salary calculation?

Here the basic salary will be calculated as per follows Basic Salary + Dearness Allowance + HRA Allowance + conveyance allowance + entertainment allowance + medical insurance here the gross salary 594,000. The deduction will be Income tax and provident fund under which the net salary comes around 497,160.

What is the formula to calculate salary?

Here the basic salary will be calculated as per follows Basic Salary + Dearness Allowance + HRA Allowance + conveyance allowance + entertainment allowance + medical insurance here the gross salary 594,000. The deduction will be Income tax and provident fund under which the net salary comes around 497,160.

How monthly salary is calculated?

First, to find your yearly pay, multiply your hourly wage by the number of hours you work each week, and then multiply the total by 52. Now that you know your annual gross income, divide it by 12 to find the monthly amount. Finally, dividing by 12 reveals a gross income of $2,080 per month.

Is salary calculated for 30 days?

In some organizations, the per-day pay is calculated as the total salary for the month divided by a fixed number of days, such as 26 or 30. In the fixed days' method, an employee, whether he joins or leaves the organization in a 30 day or a 31-day month, will get the same pay amount for the same number of pay days.

How annual salary is calculated?

Calculating an Annual Salary from an Hourly Wage Multiply the number of hours you work per week by your hourly wage. Multiply that number by 52 (the number of weeks in a year). If you make $20 an hour and work 37.5 hours per week, your annual salary is $20 x 37.5 × 52, or $39,000.

What does a monthly salary mean?

Gross monthly income is the amount of income you earn in one month, before taxes or deductions are taken out. Your gross monthly income is helpful to know when applying for a loan or credit card.

How do you calculate an employee's salary?

Gross pay for salaried employees is calculated by dividing the total annual pay for that employee by the number of pay periods in a year. For example, if a salaried employee's annual pay is $30,000, and the employee is paid twice a month, the gross pay for each of the 24 pay periods is $1250.

What is the formula to calculate basic salary?

Here the basic salary will be calculated as per follows Basic Salary + Dearness Allowance + HRA Allowance + conveyance allowance + entertainment allowance + medical insurance here the gross salary 594,000. The deduction will be Income tax and provident fund under which the net salary comes around 497,160.

#1 usability according to G2

Try the PDF solution that respects your time.