Enter Year Invoice Gratis

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

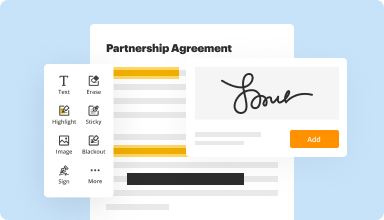

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

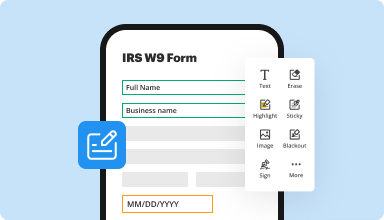

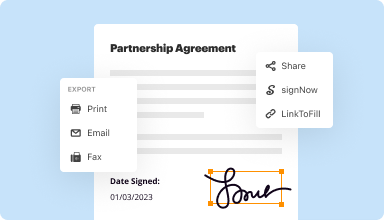

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

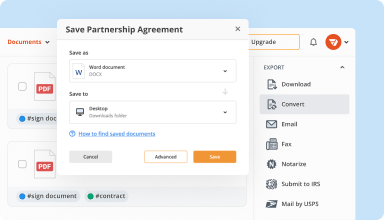

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

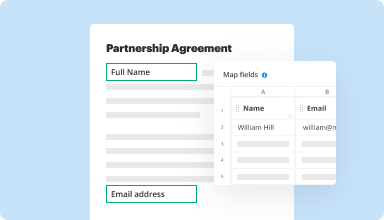

Collect data and approvals

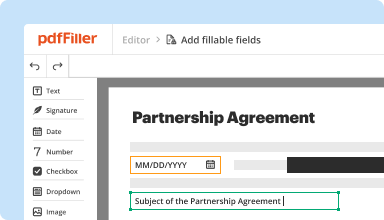

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

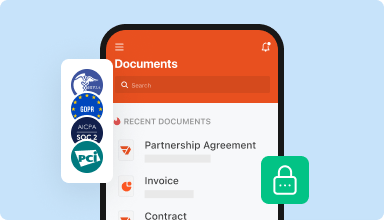

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

At first, not good....too expensive for a one time use. Sarah's response was great and her instructions were, too. She convinced me to use the program gratis to see how it works. It was fantastic.

2018-05-11

I like that I can erase parts and add text of size and font that I like and move it around so it's where I want it. When I erase part it doesn't cause the rest of the document to move around. It stays put. That is essential when I am editing a document with a puzzle at the bottom.

2020-04-10

Essential software

Being able to fill in pdf's is great! It saves so many steps and looks more professional. Before I would have to print a form, fill it in by hand, scan it back into the computer and then send it on. Now I can fill in necessary information, neatly typed and send it on.

Once in awhile I have a hard time making it do what I want when I am trying to change a document.

2019-07-16

Features & functionality

I use it a lot when responding to discovery requests

The variety of features & functionality for PDF's

Not easy to navigate website, site not visually appealing

2019-05-16

I had some troubles purchasing my subscription after my free trial and had a long wait using the chat feature. However, I called into the customer support line and had immediate amazing customer service in resolving my issue. My customer service rep was very detail in listening to my concerns and offering resolution. Because of the excellent customer service experience my PDfFiller representative delivered I proceeded with a one-year commitment of service and recommended these services to my family member.

2024-10-11

Mobile and Remote Offices will LOVE this program

Love that I can send / receive faxes, sign documents, and accept payments ... It's a well put together process. Easy downloads and uploads, right at the tips of your fingers. Notifies you of faxes when received and easily downloadable to your device. Absolutely a 5 start program!

2023-03-24

Fair and excellent experience

I did not manage to effectively cancel my subscription during the trial period but pdfFiller did refund me the license fee with no problem at all

2023-02-28

Your website is great! You guys have really helped me in my hour of need by providing a site that pulls it all together for the customer. Your efforts on integration of features and services makes it a very valuable place to get your work done in a more efficient manner! Thank you so much for being there! Sincerely, Floyd and Carol Abel

2022-10-27

I printed five copies of 47 pages that…

I printed five copies of 47 pages that were pretty easy to print, collate, print from my printer overall my experience was that it is a pleasant experience.

2022-08-17

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What happens when an invoice is posted?

When you post an invoice in a cash environment, ACS links the invoice amount to the vendor. Nothing is posted to the general ledger until the invoice is paid. After the invoice is paid, the amount is cleared out of (debited) the Accrual Liability account and credited to the appropriate checking account.

What does it mean when an invoice is posted?

Posting in accounting is when the balances in subledgers and the general journal are shifted into the general ledger. For example, ABC International issues 20 invoices to its customers over a one-week period, for which the totals in the sales subledger are for sales of $300,000.

What does it mean to process an invoice?

Invoice processing is the entire process your company's accounts payable team uses to handle supplier invoices. It starts when you receive an invoice and finishes when payment has been made and recorded in the general ledger. You can receive paper invoices, PDF, or other electronic means.

How long does it take to process an invoice?

Time to process an invoice Manual invoice processing can take a toll on your Accounts Payable department. In fact, the average small-to-mid-sized company takes about 25 days to process a single invoice when using a manual process.

How do you process an invoice for payment?

Step 1: Verifying and Tracking Information. A purchasing company needs to verify the purchase, ensure correct payment and deliver the payment within the agreed upon terms. Step 2: Data Entry and General Ledger Coding. Step 3: Forwarding and Receiving Approval.

What does post invoice mean?

Posting in accounting is when the balances in subledgers and the general journal are shifted into the general ledger. For example, ABC International issues 20 invoices to its customers over a one-week period, for which the totals in the sales subledger are for sales of $300,000.

What is PO invoice in accounts payable?

What is a PO Invoice? A PO invoice should include the purchase order number and details of the goods or services provided as agreed between the buyer and supplier. Arriving at accounts payable, the PO invoice will be matched against the purchase order to ensure all details correspond.

Is an invoice an expense?

Related Expense or Asset. The vendor invoices received by a company could involve the following: A vendor invoice may be a bill for a repair or maintenance service. Under the accrual method of accounting the expense is reported in the accounting period in which the service occurred (not the period in which it is paid).

#1 usability according to G2

Try the PDF solution that respects your time.