Itemize Footer Letter Gratis

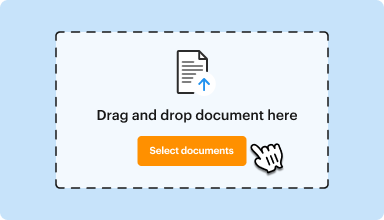

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

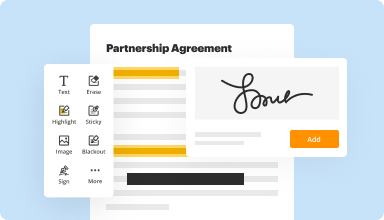

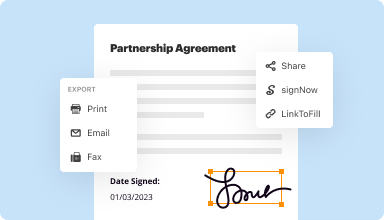

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

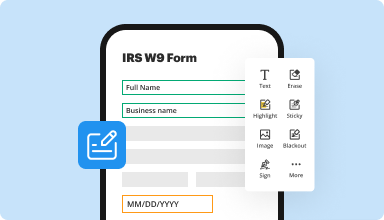

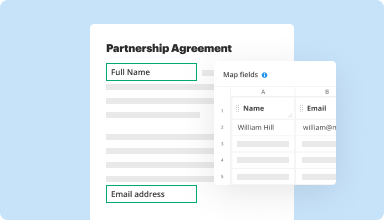

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

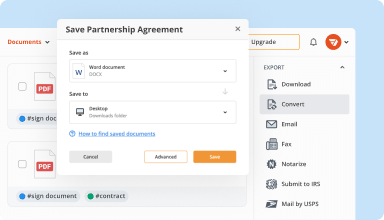

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

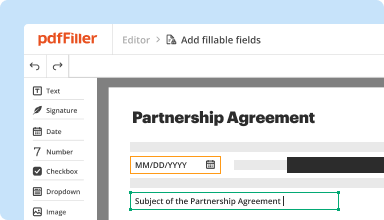

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

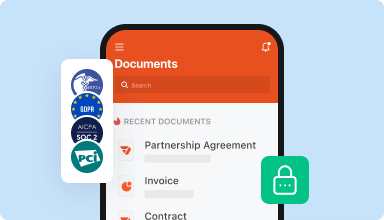

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

easy, well organized, love the signature options especially. Ability to share and distribute is a fine function. I live in Germany and did my girlfriends USA taxes all electronically and send to her to sign and submit.

2016-03-31

Its been a good experience so far. Although I have only used the service approximately 5 times it has been an efficient way to produce some general documents.

2016-12-22

Pauline took care of my concerns in a…

Pauline took care of my concerns in a timely, polite and expeditious manner. I wish more customer service representatives were like here. She is a boon to her company.

2024-09-20

I used the free trial to compile rent due ledgers for the ************** requirement. I did not cancel on time and was charged $180 dollars. I reached out to support and ****** returned my email within minutes. I provided my information to customer service specialist ****** and he fixed the problem. There wasn't any back and forth emails. It was straight to the point. Thank you ****** for being quick and professional.

2022-04-05

I always receive excellent customer…

I always receive excellent customer service! any issues or questions I have are always resolved in a professional and timely manner.

Thank you!

2022-02-09

it's been satisfactory so far how ever with the limitations i can't justify the cost especially the requiired annual payment in which i can't afford at this time and the use of the product will be limited and not on a consistent basis therefore i can't pay the annual fee at one time

2021-10-19

AMAZING CUSTOMER SUPPORT!! A+++

Product outperformed other PDF software for my needs at the time! Customer services are A++, an annual subscription fee was taken as I had forgotten to stop this after my use, upon emailing pdfFiller's 'Live chat' the refund was processed and I received a confirmation email of this from PayPal in less than 30 seconds! If it wasn't for Covid19, I would have continued the subscription, but after losing my job my finances are paramount! Hopefully I will be in a position to return to your service in future! Thankyou pdfFiller!

2021-01-10

I've had a good experience with pdfFiller but I'm still having difficulty navigating what exactly or how exactly to get blank forms that would help me in my current job, which is office manager for a plumbing company.

2020-12-03

Your company is great. At this time, the govt is advising us to show them payroll and W2. W. On this note I will conceal my free trial. Sincerely. Elizabeth Obi

2020-05-09

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Do foundations need tax receipts?

Year-end substantiation receipts: Federal tax laws require that foundation donors receive written verification of their charitable donations at year-end. We send these letters on behalf of our foundation clients.

Do charities have to issue tax receipts?

Issuing charitable receipts is NOT mandatory For example, many charities do not issue tax receipts for any donations below a certain threshold. Other charities may only issue receipts for cash gifts, not gifts in kind.

Do I need a receipt for a charitable donation?

There is no specific charitable donations limit without a receipt, you always need some sort of proof of your donation or charitable contribution. For amounts up to $250, you can keep a receipt, cancelled check or statement. Donations of more than $250 require a written acknowledgement from the charity.

What is the minimum donation to get a tax receipt?

The receipt can be a letter, a postcard, an e-mail message, or a form created for the purpose. Any donations worth $250 or more must be recognized with a receipt. The charity receiving this donation must automatically provide the donor with a receipt.

Can a non-profit issue tax receipts?

Non-profits do not register with the CRA, so they are not able to issue official donation receipts for income tax purposes. Therefore, you cannot receive any the tax credits. For income tax purposes, you can only claim charitable donations that have official receipts from registered charities.

Are churches required to provide contribution statements?

Are churches legally obligated to provide contributions statements or donor receipts every year? The quick and easy answer is no. There is no obligation on the church or ministry to provide a statement of giving to donors who have made a donation to the church in the previous year.

Does benefit issue tax receipts?

Donations made through Benefit also have costs. Donors still receive a tax receipt for 100% of their donation amount.

What are donation tax receipts?

Donation receipts are records of charitable contributions. By providing receipts, you let donors know their contribution has been well-received. Donations can reduce income tax levels for a given year. Donors must have a written official confirmation to claim a deduction for cash or any monetary gift.

Video Review on How to Itemize Footer Letter

#1 usability according to G2

Try the PDF solution that respects your time.