Protected Sum Form Gratis

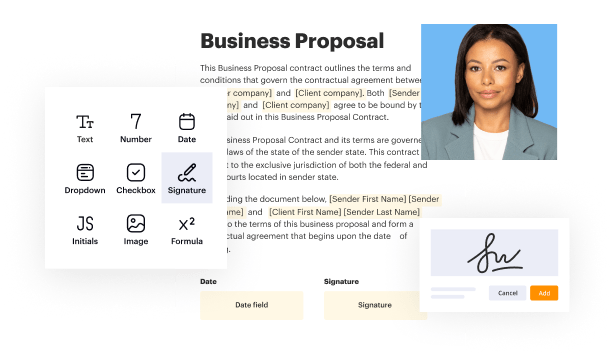

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

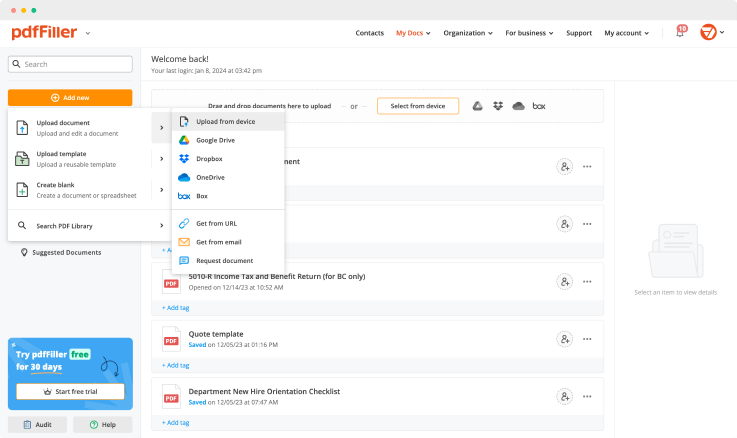

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

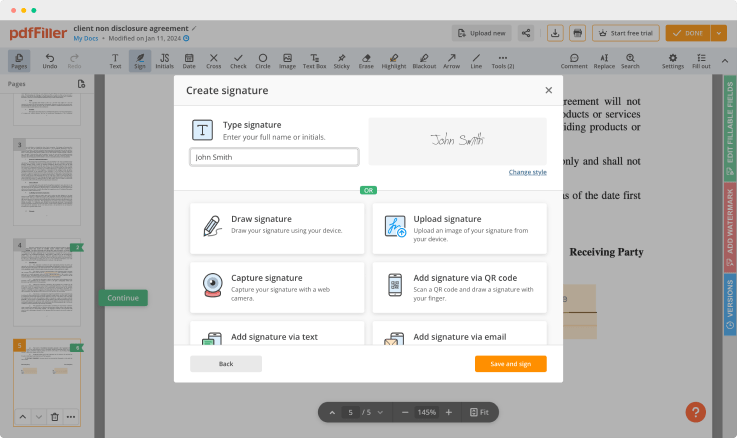

Generate your customized signature

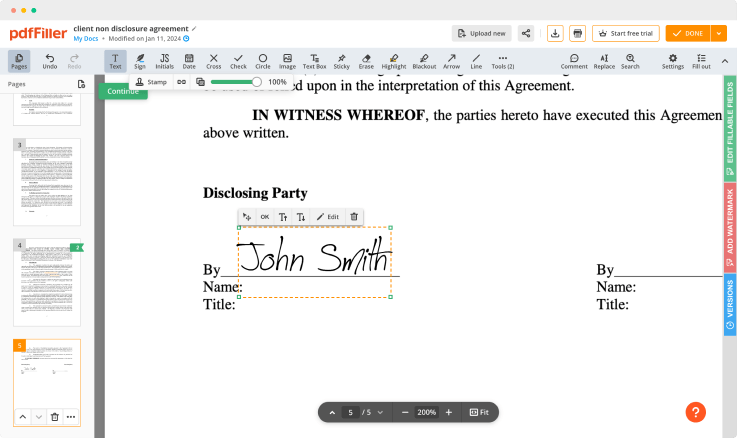

Adjust the size and placement of your signature

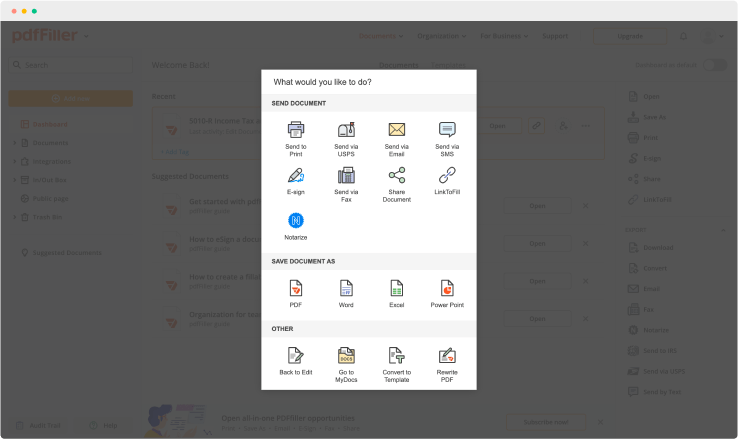

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Protected Sum Form Feature

The Protected Sum Form feature empowers you to manage data with confidence. By offering a way to secure and calculate sums, it ensures you maintain accuracy and integrity in your reports and analyses. This feature is simple to use, yet effective for various applications.

Key Features

User-friendly interface for easy navigation

Customizable forms to suit specific needs

Real-time calculations for immediate feedback

Secure data protection to keep your information safe

Integration with other tools for seamless workflow

Use Cases and Benefits

Financial institutions can ensure accurate sum calculations for transactions

Non-profits can track donations while maintaining data privacy

Businesses can generate reliable reports to assess financial health

Educators can evaluate student performance with precision

Healthcare providers can safeguard patient data while managing costs

By using the Protected Sum Form feature, you can eliminate errors caused by manual data handling. It offers a secure and efficient way to manage sensitive information while providing peace of mind. With its flexibility, you can tailor it to meet your specific needs, saving you time and improving your overall productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I revalue a protected tax-free cash?

First, determine the member's tax-free cash entitlement on 5 April 2006, and revalue this by 20% Secondly, calculate 25% of any growth in value of pension rights since 5 April 2006.

What is protected tax-free cash?

If the member's tax-free cash entitlement at 5 April 2006 is less than £375,000 but more than 25% of the benefits value, it can be protected through scheme specific tax-free cash protection. Protection means that the tax-free cash amount can be increased.

How is protected tax-free cash calculated?

First, determine the member's tax-free cash entitlement on 5 April 2006, and revalue this by 20% Secondly, calculate 25% of any growth in value of pension rights since 5 April 2006.

Is protected tax-free cash a safeguarded benefit?

It depends on what you mean by protected tax-free cash, but if you mean money that's in a defined contributions pension scheme (i.e. you add money to it every month and drawdown from it at the end), that's a money purchase scheme, so likely not safeguarded. It's not, the DSP issued a clarification in January.

What is tax-free cash?

The cash lump sum (PCs) and tax Any amount that you take as a PCs is free of all taxes when it is paid to you. Members of defined contribution pension schemes have complete flexibility around how they can draw down their remaining pension pot after taking any PCs, but these amounts withdrawn will be taxed as income.

Is tax-free cash lost at age 75?

Pension payments and cash withdrawals above the allowance is subject to 25pc tax. He said: “The bottom line is that if you don't have any lifetime allowance concerns then you can take your tax-free lump sum either before or after age 75 with no problems, as long as your provider allows it.”

Can you take tax-free cash from protected rights?

Protected Rights were not allowed to be converted into a tax-free cash and a pension income before 6 April 2006, you could only receive an income, but Pension Simplification laws now allow people to receive a tax-free lump sum up to 25% of the fund value with the balance buying an income.

Is protected tax-free cash lost on transfer?

Scheme specific tax-free cash protection is lost on transfer, unless it's a block (or buddy) transfer or a transfer on wind-up of a scheme. A block (or buddy) transfer has a number of conditions: More than one member of the scheme must transfer at the same time to the same scheme.

Ready to try pdfFiller's? Protected Sum Form Gratis

Upload a document and create your digital autograph now.