Structure Subsidize Application Gratis

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

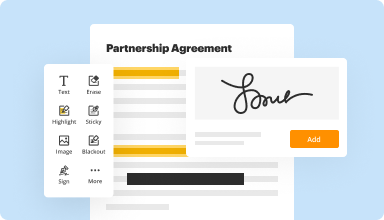

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

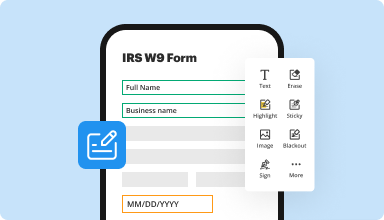

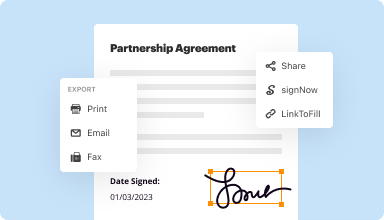

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

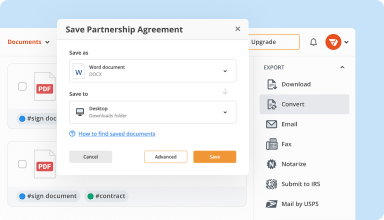

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

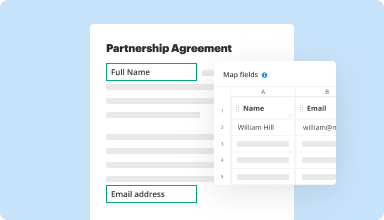

Collect data and approvals

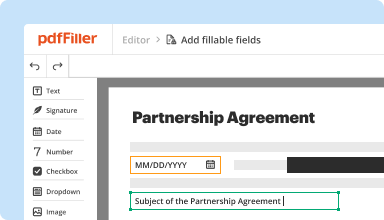

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

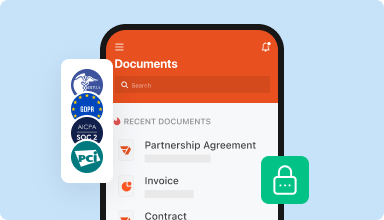

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

PDF Filler is great. I started with the free trial, then went to the pro, but now I've switched to Basic. I got this for signing contracts on buying and selling my home. Awesome!

2019-04-13

The support with this company surpasses…

The support with this company surpasses anything I have ever dealt with. Honestly, I NEVER write reviews because I have never been moved to do so; however, today I was. Quick response, did exactly what I wanted, no questions asked just solutions. We can all learning something from this great customer service. This is too few and far between nowadays. "Sam" is who helped me today and I hope he gets the recognition that they deserve!

2019-04-10

I have tried many PDF editors and to be honest this has the best user experience and least learning curve. I will recommend to others. The pricing is good and the fact that paypal is an option is awesome. Others only accept credit cards.

2023-12-06

I was able to make a Loan Agreement in purchasing a Manufactured Home in Florida for my x-husband so we could have it and a POA for him at the closing on May 23, 2022. Thanks for your help in this free document service that finally worked for me. I live in Michigan and needed to protect my interest in this new home for him and two others that used to live in his Adult Foster Care Home in Grand Rapids, MI seventeen years ago. So I really appreciated your documents that we both will sign and he will have his Notarized at the Closing.

Thanks again,

Wilma Forsythe

2022-05-26

pdfFiller is simple, flexible, and robust! 10 stars!!

Absolutely love how easy pdfFiller is to use for filling out, signing, and even re-arranging pdfs. To import & export docs in multiple in formats is a breath of fresh air in this modern tech world. THANK YOU pdfFiller team - You Rock!!

2021-11-20

Kara did an excellent job

Kara did an excellent job. She was patient, kind and able to help me resolve the problem. Give her a raise so she can take a vacation to sunny Myrtle Beach.

2021-06-17

What do you like best?

I love that you can store your signature in the program. Also much more professional look over using a pen to fill forms.

What do you dislike?

The extra level of security when logging in slows you down a little. Its probably actually a good thing as your forms are stored in the system

Recommendations to others considering the product:

I have tried to figure out ways to fill pdfs without signing on to this system, it was a foolish waste of time. I am not the type of person that signs on to programs like this, I always felt like they were scams. I am so very happy with this program, I wish that I had signed up for this much sooner. I am not even using all of the features of this program and Its totally worth every cent!

What problems are you solving with the product? What benefits have you realized?

When companies email me a form that needs to be filled out and returned, pdfFiller makes it so much quicker, easier and more professional

2021-02-28

great experience!

great experience both using the software and the customer service,I highly recommend this to anyone needing the services they provide,

2020-09-15

I've been very happy with this product!

I've been very happy with this product! It has helped me tremendously file insurance claims and do work since my husband has been in the hospital since 5/30/20. I did the free trial but will be purchasing it for the year.

2020-06-27

Structure Subsidize Application Feature

The Structure Subsidize Application feature offers an efficient way for organizations to manage and optimize their subsidy processes. By streamlining applications, this feature saves time and reduces errors, ensuring that you can focus on what truly matters.

Key Features

User-friendly interface that simplifies application submission

Real-time status tracking for transparency

Customizable templates to meet various needs

Integrated reporting tools for data analysis

Automated notifications for deadlines and updates

Potential Use Cases and Benefits

Nonprofits seeking funding opportunities

Educational institutions applying for grants

Small businesses looking for financial support

Government agencies managing subsidy programs

Community organizations distributing resources

With the Structure Subsidize Application feature, you can effectively address the common challenges faced during the subsidy application process. By simplifying submissions and providing clear insights, you can minimize confusion and ensure timely responses, ultimately allowing your organization to thrive.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Do you have to pay back health care subsidies?

If you earned more than you estimated, and you got a subsidy for your health insurance, you may have to pay back some subsidy. The maximum amount of payback is tied to your actual income.

Will I have to pay back healthcare subsidy?

You Might Have to Pay the Health Insurance Subsidy Back If you overestimated your income for the year, then the subsidy the government paid in advance to your insurer was smaller than it should have been. No harm. No foul. The difference will be added to your tax refund or will decrease the amount of taxes you owe.

Do I have to repay premium tax credit?

A tax credit you can take in advance to lower your monthly health insurance payment (or premium). If at the end of the year you've taken more premium tax credit in advance than you're due based on your final income, you'll have to pay back the excess when you file your federal tax return.

How can I avoid paying back my premium tax credit?

The easiest way to avoid having to repay a credit is to update the marketplace when you have any life changes. Life changes influence your estimated household income, your family size, and your credit amount. So, the sooner you can update the marketplace, the better. This ensures you receive the correct amount.

How does health insurance subsidy affect tax return?

You Might Have to Pay the Health Insurance Subsidy Back If you overestimated your income for the year, then the subsidy the government paid in advance to your insurer was smaller than it should have been. No harm. No foul. The difference will be added to your tax refund or will decrease the amount of taxes you owe.

What if I overestimate my income for Obamacare 2019?

If you overestimate your income AND you purchase your health insurance on the federal exchange (or state marketplace, depending on where you live), then you will receive all of your qualify subsidy as a tax credit when you file taxes at the end of the year. So let's say I do overestimate my income.

Do you have to pay back the tax credit for health insurance?

This is officially called the premium tax credit. The amount of the premium assistance is based on your estimated income and the amount of your health insurance premiums. However, at higher income levels, you'll have to pay back the entire amount you received, which could be a lot.

Do you have to pay back premium tax credit?

A tax credit you can take in advance to lower your monthly health insurance payment (or premium). If at the end of the year you've taken more premium tax credit in advance than you're due based on your final income, you'll have to pay back the excess when you file your federal tax return.

#1 usability according to G2

Try the PDF solution that respects your time.