Underwrite Signature Block Request

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

Users trust to manage documents on pdfFiller platform

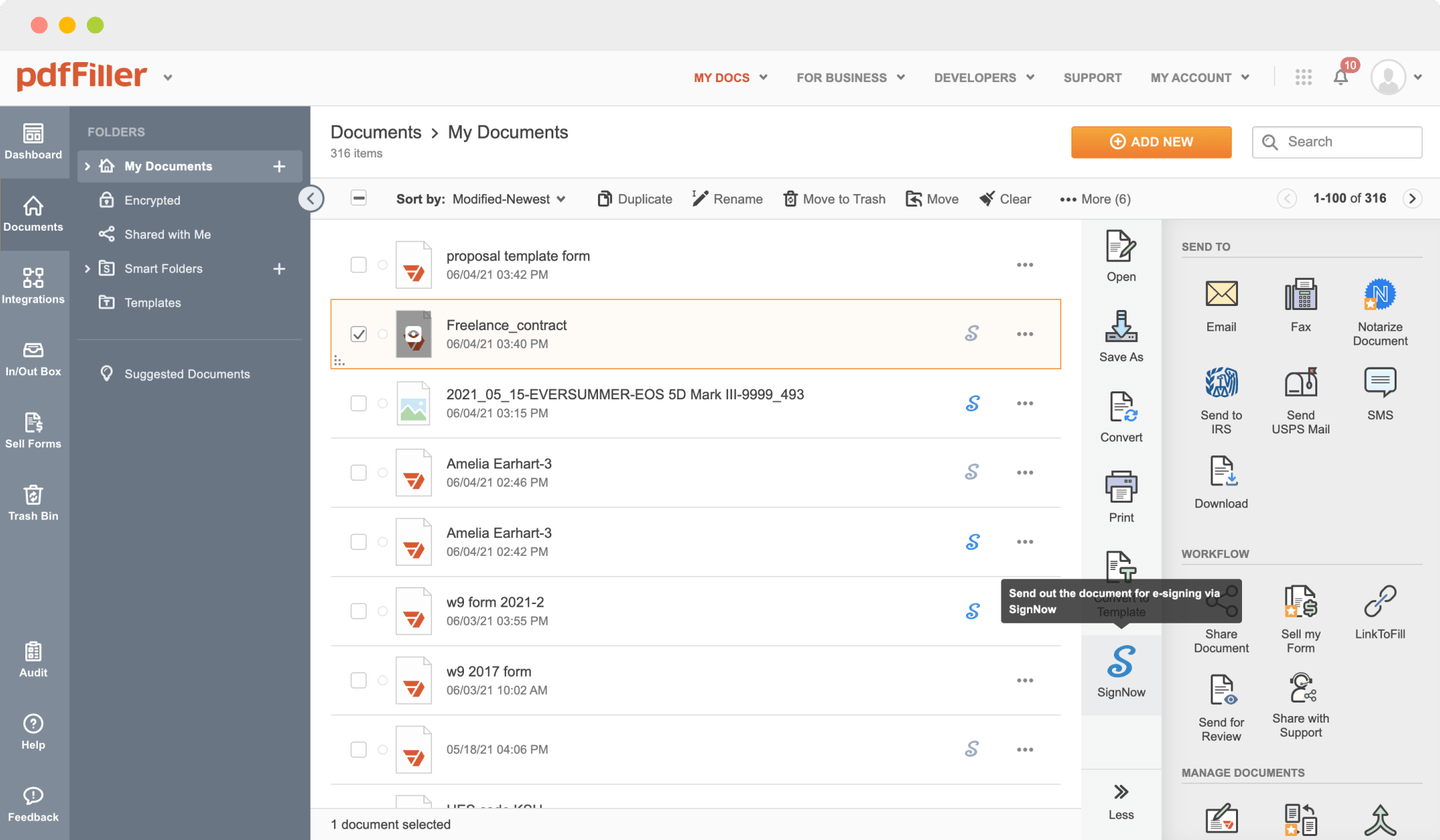

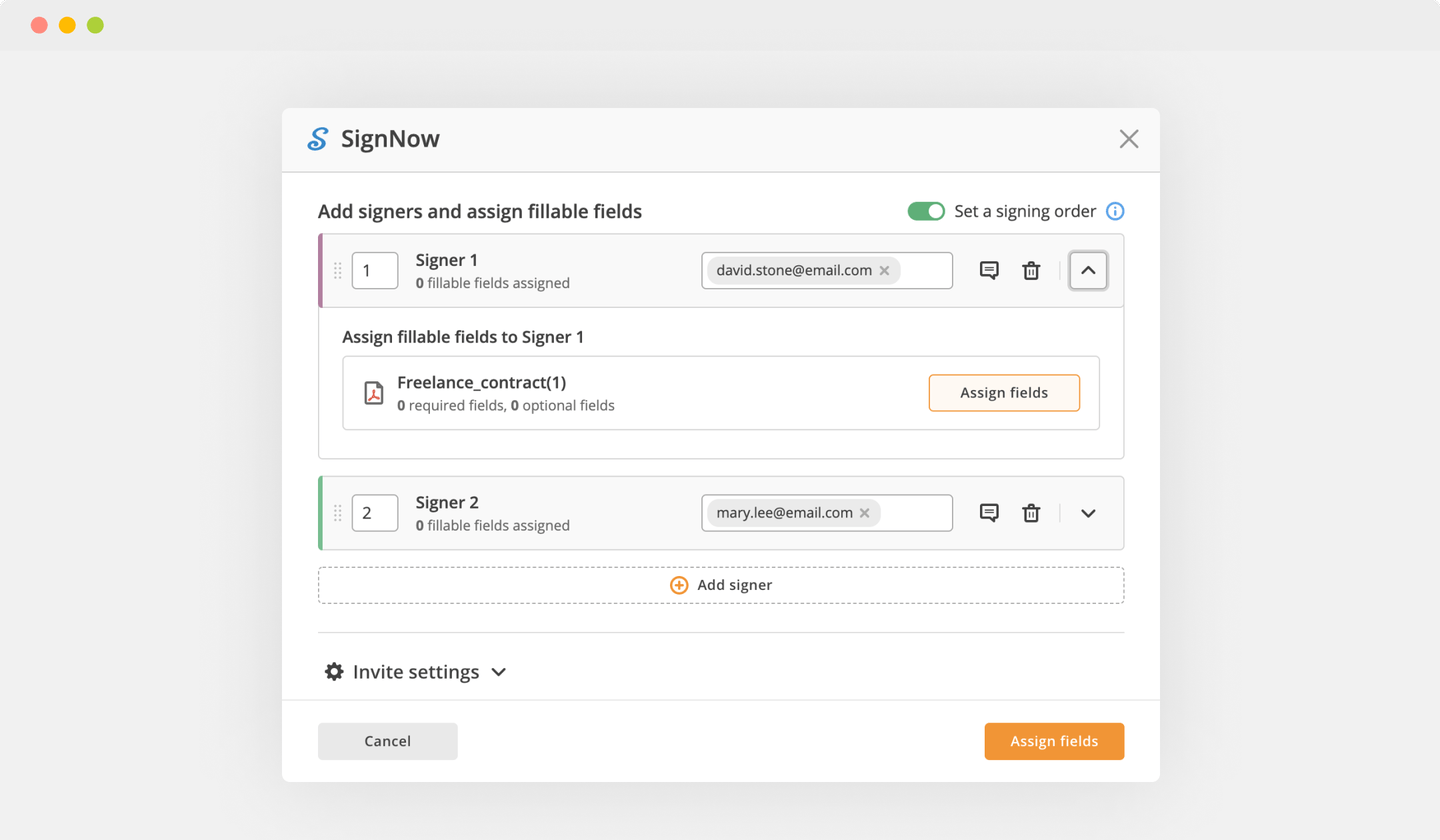

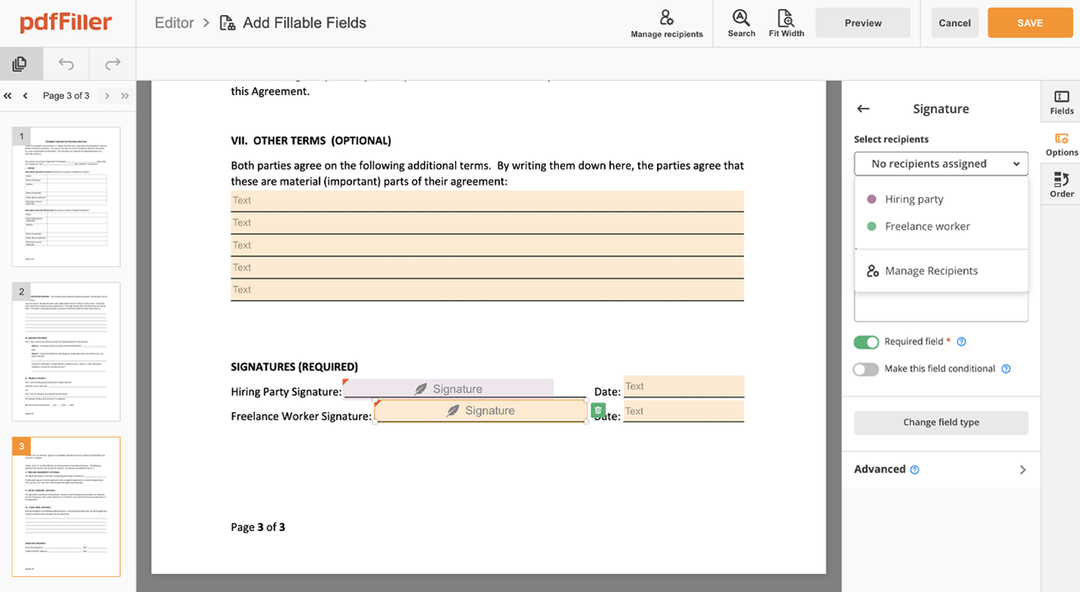

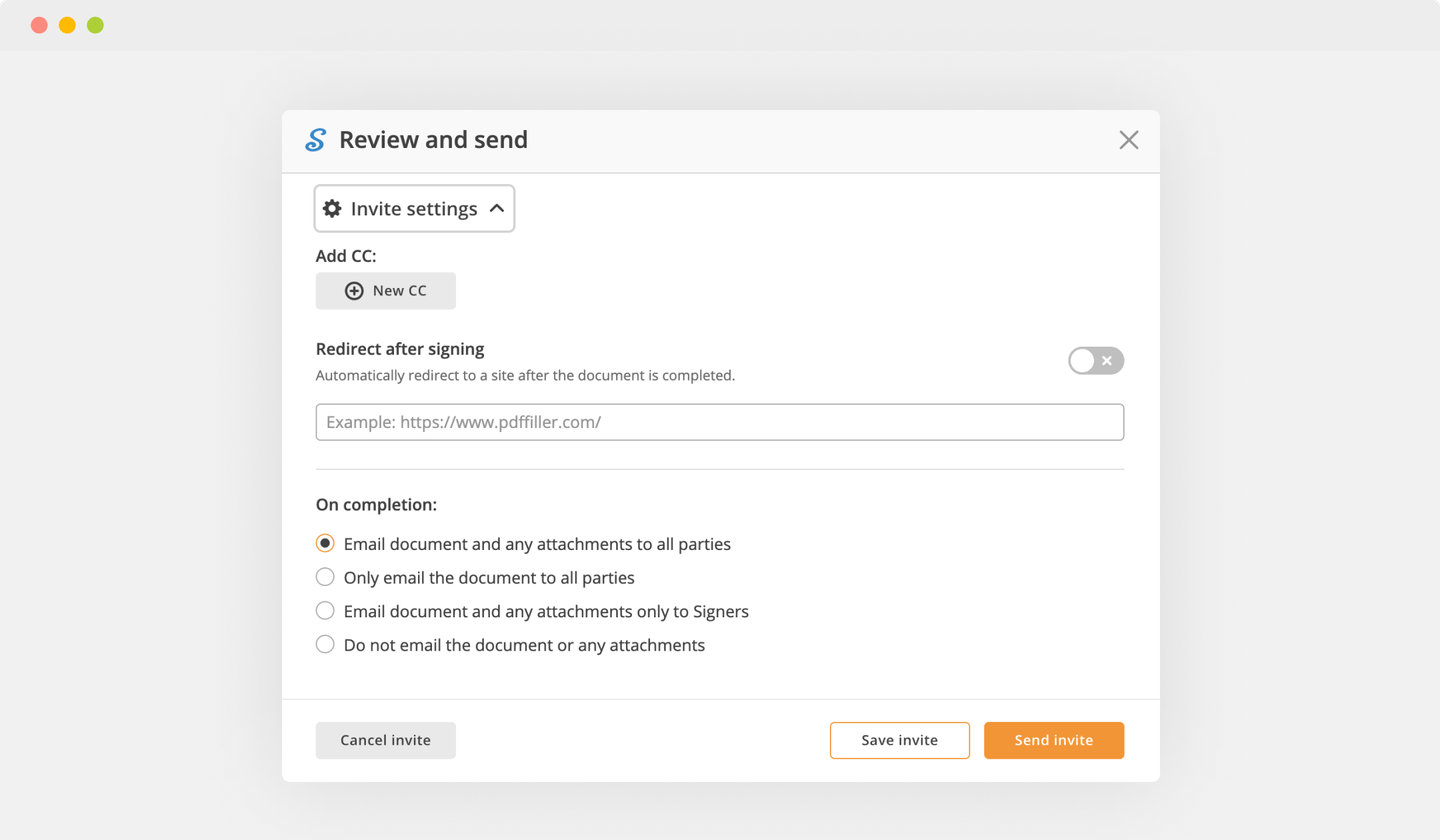

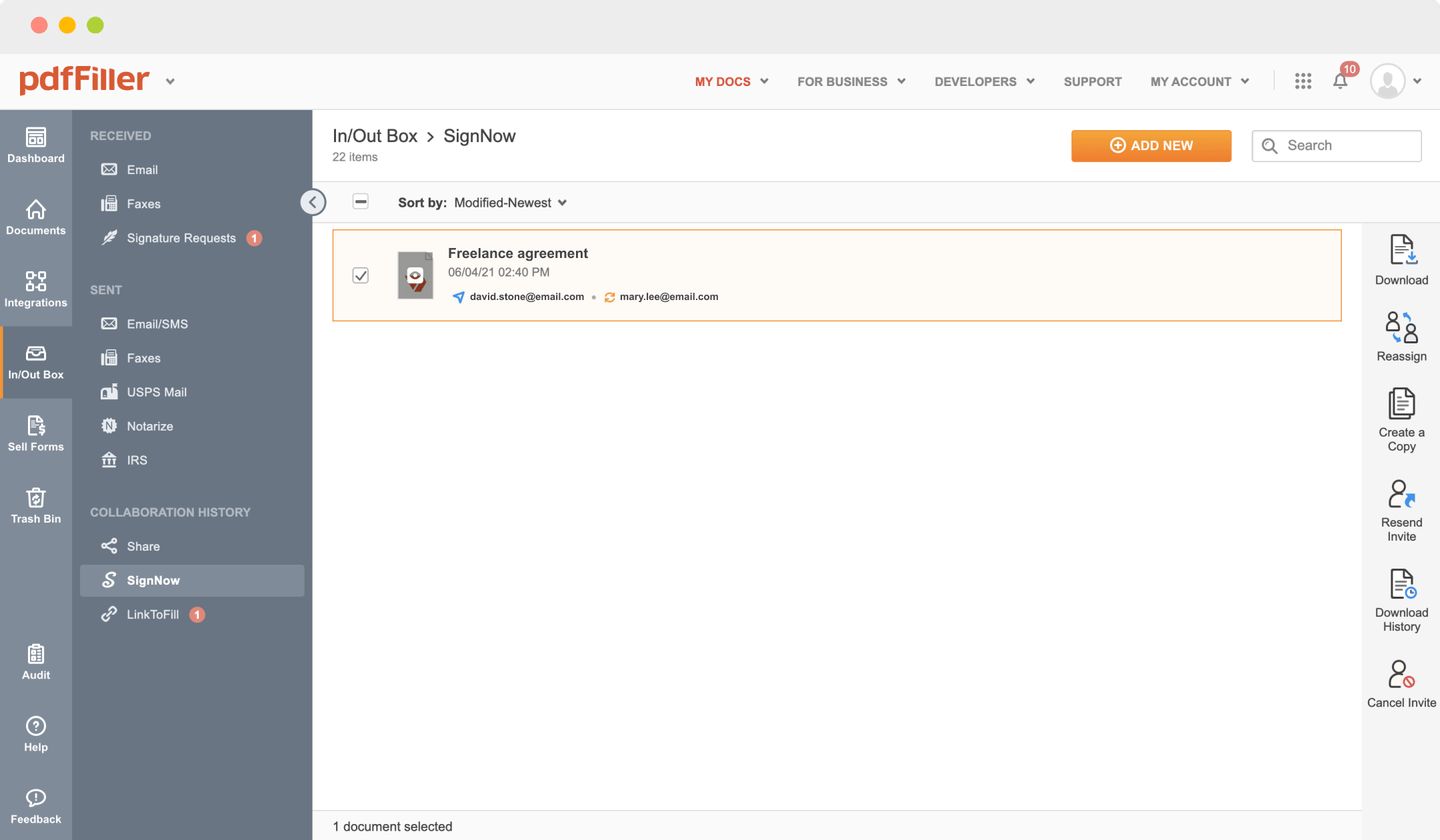

Send documents for eSignature with signNow

Create role-based eSignature workflows without leaving your pdfFiller account — no need to install additional software. Edit your PDF and collect legally-binding signatures anytime and anywhere with signNow’s fully-integrated eSignature solution.

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

pdfFiller scores top ratings in multiple categories on G2

How to Underwrite Signature Block Request

Still using different applications to manage and sign your documents? We have a solution for you. Use our document management tool for the fast and efficient workflow. Create fillable forms, contracts, make templates and other useful features, within your browser. Plus, it enables you to Underwrite Signature Block Request and add other features like orders signing, alerts, attachment and payment requests, easier than ever. Pay as for a lightweight basic app, get the features as of a pro document management tools. The key is flexibility, usability and customer satisfaction. We deliver on all three.

How-to Guide

How to edit a PDF document using the pdfFiller editor:

01

Upload your document using pdfFiller

02

Select the Underwrite Signature Block Request feature in the editor's menu

03

Make the necessary edits to the document

04

Click the “Done" button at the top right corner

05

Rename the form if it's necessary

06

Print, save or email the template to your desktop

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

LOUISE M

2016-01-14

ONLY HAD TO CONTACT SUPPORT ONCE. GREAT FOR ME. I DO WISH THAT YOU COULD FILL AND PRINT W-2 INFOR ABOUT TWO PEOPLE AT A TIME. IT WOULD BE GREAT IF THE IRS WOULD EXCEPT THE W-3 INFO BUT OH WELL GLAD TO HAVE WHAT I DID GET. THANK YOU

john r.

2018-11-16

Manage and edit your PDF easily and quickly.

pdffiller is a pdf processor quite different from the others, you can not only convert your files from pdf to other formats (and obviously from word, excel and others to pdf), but you can directly edit and process your texts online, so which you can write about the document, underline, place images, delete phrases and all the other things that a word processor allows you to do.

Another advantage and surprises that you have, is that you can use files that are not only on your hard drive, but you can also use files from the web (through the address of the document) and you can integrate pdffiller with some app that you use daily as google drive, box, one drive and others.

Finally, a very remarkable feature is that once you finish editing the file, you can choose some classic options such as the format in which you save it, but it also gives you the option to share it via mail, print it, send it by fax and use it in some social networks like facebook.

Even if it is a bit strange, I miss the function of compressing the files, because whenever you add images to some document, the weight of the file increases a lot and makes the handling of the file more difficult. Besides that, there is nothing more to comment.

Get a powerful PDF editor for your Mac or Windows PC

Install the desktop app to quickly edit PDFs, create fillable forms, and securely store your documents in the cloud.

Edit and manage PDFs from anywhere using your iOS or Android device

Install our mobile app and edit PDFs using an award-winning toolkit wherever you go.

Get a PDF editor in your Google Chrome browser

Install the pdfFiller extension for Google Chrome to fill out and edit PDFs straight from search results.

List of extra features

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Why is underwriting taking so long?

Underwriters often request additional documents. Underwriting is the most intense review. Underwriters often request additional documents during this stage, including letters of explanation from the borrower. It's another reason why mortgage lenders take so long to approve loans.

How long does it take for underwriters to approve a VA loan?

Under normal circumstances, your purchase application should be underwritten within 72 hours of underwriting submission and within one week after you provide your fully completed documentation to your loan officer.

What does the underwriter look for?

An underwriter is a financial expert who takes a look at your finances and assesses how much risk a lender will take on if they decide to give you a loan. More specifically, underwriters evaluate your credit history, assets, the size of the loan you request and how well they anticipate that you can pay back your loan.

What does it mean when a loan is in underwriting?

The term “underwriting" refers to the process that leads to a final loan approval or denial, which is determined by a professional underwriter. Many factors are at play in a lender's final decision on a mortgage loan. These factors are all analyzed during the underwriting process through specialized software programs.

What is the underwriting process?

Underwriting is the mortgage lender's process of assessing the risk of lending money to you. The underwriter verifies your identification, checks your credit history, and assesses your financial situation including your income, cash reserves, equity investment, financial assets and other risk factors.

How do I fill out an FHA addendum?

Suggested clip

How To Fill Out A FHA Financing Contract Addendum For Realtors YouTubeStart of suggested clipEnd of suggested clip

How To Fill Out A FHA Financing Contract Addendum For Realtors

What is the FHA addendum for?

The FHA Amendatory Clause protects the buyer's deposit if the home appraisal comes in lower than expected. It also prohibits the seller from charging a penalty to the buyer if the appraised value is lower than the purchase contract price.

When must the FHA amendatory clause be signed?

3-4 AMENDATORY CLAUSE. An amendatory clause must be included in the sales contract when the borrower has not been informed of the appraised value by receiving a copy of Form HUD-92800.5B, Conditional Commitment/DE Statement of Appraised Value or VARY before signing the sales contract.

What is FHA VA addendum?

What is the FHA addendum for? The FHA Financing Addendum is a document that must be filled out prior to the extension of an FHA-insured mortgage. This agreement is made between the buyer and the seller of the property in question.

Can a seller refuse to accept a VA loan?

In some cases, home sellers won't accept purchase offers backed by VA-guaranteed mortgages for fear of low appraisal value. Because VA appraisals may increase their repair costs, home sellers sometimes refuse to accept purchase offers backed by the agency's mortgages.

How long is a FHA conditional commitment good for?

Validity Period: This document expires 120 days from the effective date of the appraisal or the appraisal update.

How long are FHA case numbers valid for?

So the general requirement for mortgage documents used on an FHA loan is that they be no more than 120 days old at the time of disbursement. So in most cases, the initial FHA appraisal is valid / good for 120 days. But there are cases where the mortgage lender can extend the initial appraisal.

How long does it take to close a commitment letter?

The date of when the commitment was created, the expiration date, and the first payment date. The average time it takes a lender to close on mortgage is 53 days.

Is VA a HUD loan?

The two government-backed loan programs have distinctions. VA loans offer now down payments and a federal guarantee while FHA mortgages can be obtained for 3.5% down and are insured through HUD.

What happens after underwriting is approved and conditions are met?

When a loan request has met the underwriting requirements and has been reviewed and approved by an underwriter, you will receive a commitment letter. The letter will indicate your loan program, loan amount, loan term, and interest rate. Though it, too, may include conditions that may need met before closing.

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.