Word Tool For Tax Online Gratis

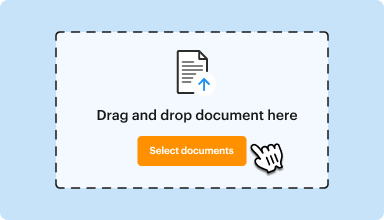

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

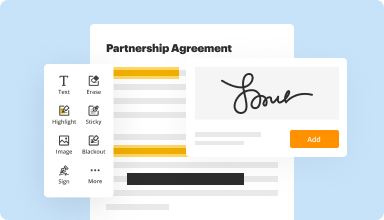

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

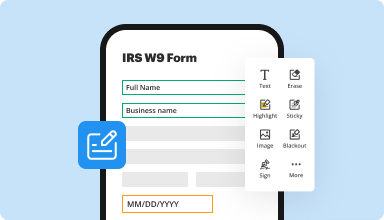

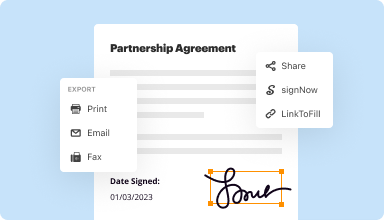

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

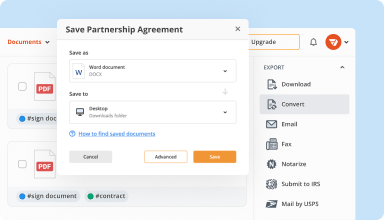

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

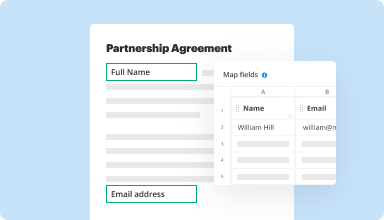

Collect data and approvals

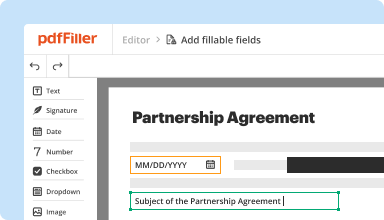

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

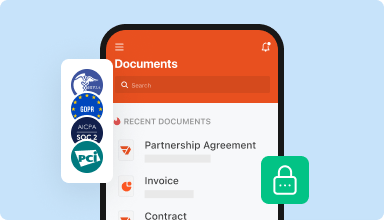

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

The forms are easy to find with the search tool, and very easy to use. There are even pop-ups to tell you what type of information to enter in the different fill-in fields. I'm sure I will be using more forms in the future here.

2016-11-28

The court PDF form did not allow the case number to be filled in on the second page "PDF filler to the rescue!" Thank you for your valuable program.

2017-05-15

I like using the program the only downfall for me is unless I pay more for the subscription I'm not allowed to use the premier options. That is my opinion It's already expensive for me since I really only use it for tax returns.

2019-03-07

The name truly fits

This program is very easy to use and gives the user lots of tools. I had to make a few changes to a large and older PDF and I was able to make those changes. Even those that I had to erase, draw and finally add the text. To a very important document. (The name truly fits)

Thank you pdfFiller,

2024-05-01

Was not sure about the monthly versus the yearly and almost paid too much! In my opinion: There should be an option for businesses with more than one licensed user to have access too, versus giving out my personal login so my partners can benefit from the same resource. Such as a link where up to two are licensed and covered and then the rest have to get their own subscription.

2023-03-08

What do you like best?

Not much not to like. Spell checker would be nice. though.

What do you dislike?

After creating a document and saving it, it landed back in the template folder. Have to switch over to documents to access

What problems is the product solving and how is that benefiting you?

Editing PDF DOCs. Ability to search works great.

2022-11-03

My printing is horrible. This allow me to fill out legal forms without having to do them over and over. I will say getting the cursor right where you needed it was difficult.

2021-10-18

What do you like best?

It is much easier to use than Adobe Acrobat. Much more intuitive functions and file management. It has saved me a ton of time with the cloud storage of documents. I have used effectively for construction related documents.

What do you dislike?

Very rarely I have needed to use another platform because some municipalities require it but 98% of what I need to do is supported.

What problems are you solving with the product? What benefits have you realized?

Remote completion of forms and extracting text from PDF documents mostly.

2021-02-16

PDFfiller Review

Inexpensive and easy to use. I would definitely recommend this product to anyone .

Easy to figure out and use. Worked well.

There wasn't anything I did not like. It was easy to use and figure out.

2020-11-27

Word Tool For Tax Feature

The Word Tool For Tax feature simplifies your tax preparation process. With this tool, you can easily manage your tax documents, ensuring accuracy and efficiency throughout the entire process.

Key Features

Easy document creation for tax forms

User-friendly interface for quick navigation

Automated calculations to reduce errors

Integration with popular tax software

Secure storage for sensitive information

Potential Use Cases and Benefits

Streamline your tax returns to save time and effort

Organize your financial documents in one place

Simplify communication with your tax advisor

Reduce stress during tax season

Ensure compliance with current tax regulations

This tool addresses common tax preparation challenges. By offering a straightforward solution for document management and calculations, you can focus on what matters most. You will find that the Word Tool For Tax feature not only improves your efficiency but also gives you peace of mind during the tax process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Can I claim my tools on my taxes?

You can fully deduct small tools with a useful life of less than one year. The deduction is limited to the amount of your self-employment income. You can deduct the cost of the tools as an reimbursed employee expense on Schedule A if both of these apply: You work for an employer, rather than being self-employed.

Can I claim my tools on my taxes 2018?

No, you will not be able to deduct Tool Expenses or any other reimbursed employee expenses on your 2018 tax return if you are an employee.

Can I claim tools on my taxes 2019?

When you work for someone else, you can only deduct tools and other expenses exceeding two percent of your adjusted gross income (AGI), according to Bank rate. For example, if your AGI is $40,000, you can only deduct expenses over 0.02 x $40.0 = $800. The tools must be necessary for you to do your job.

Can I claim second hand tools on tax?

”Being second hand does not in itself mean the depreciation of the asset is calculated differently from that of a new asset. Depreciation for second hand or new assets can be claimed in an income year, provided the asset purchased is installed ready for use in the income year.

How do I claim tools on my tax return?

To deduct the cost of tools as an employee business expense, you can't be self-employed and the tools must be necessary for your job or trade. Reimbursed employee expenses are subject to a 2 percent floor. That means you can claim employee business expenses that exceed 2 percent of your adjusted gross income.

How much can you claim for tools without receipts?

The ATO generally says that if you have no receipts at all, but you did buy work-related items, then you can claim them up to a maximum value of $300. Chances are, you are eligible to claim more than $300. This could boost your tax refund considerably. However, with no receipts, it's your word against theirs.

How much can I claim for tools on my taxes?

For any tool under $300, you can claim the full cost on this year's tax return. For any tool over $300, you need to claim the cost of the tool progressively over the course of its lifespan.

How much do you have to spend on tools to claim on taxes?

When you work for someone else, you can only deduct tools and other expenses exceeding two percent of your adjusted gross income (AGI), according to Bank rate. For example, if your AGI is $40,000, you can only deduct expenses over 0.02 x $40.0 = $800. The tools must be necessary for you to do your job.

#1 usability according to G2

Try the PDF solution that respects your time.