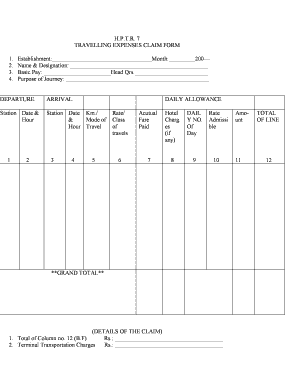

Daily Expense Excel Sheet Format - Page 2

What is daily expense excel sheet format?

Daily expense excel sheet format refers to the standardized layout and structure used to record and track daily expenses using Microsoft Excel. It provides a convenient way to organize and analyze expenses in a digital format.

What are the types of daily expense excel sheet format?

There are various types of daily expense excel sheet formats available to suit different needs and preferences. Some common types include:

Simple Expense Tracker: This format is designed for basic expense tracking and includes columns for date, description, category, amount, and total.

Advanced Expense Report: This format offers more detailed expense tracking features, including additional columns for vendor, payment method, and notes.

Budget Planner: This format combines expense tracking with budgeting capabilities, allowing users to set budget goals and track expenses against those goals.

Business Expense Sheet: This format is specifically tailored for business purposes and includes additional columns for project or client name, reimbursable expenses, and tax-related information.

How to complete daily expense excel sheet format

Completing a daily expense excel sheet format is a straightforward process. Here's a step-by-step guide to help you get started:

01

Open the daily expense excel sheet format using Microsoft Excel or any other compatible spreadsheet software.

02

Enter the date of the expense in the designated column.

03

Provide a brief description of the expense in the corresponding cell.

04

Specify the category or purpose of the expense in the appropriate column.

05

Enter the amount spent in the designated column.

06

Repeat the above steps for each expense you want to track.

07

Total up the expenses to get the overall expenditure for the day.

08

You can also use formulas and functions to automate calculations or generate reports based on the data entered.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.

Video Tutorial How to Fill Out daily expense excel sheet format

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you maintain an expense sheet in Excel?

(1) Calculate total expense of each month: In Cell B16 enter =SUM(B10:B15), and drag the Fill Handle to apply this formula to Range C16:M16. (2) Calculate total expense of each item: In Cell N10 enter =SUM(B10:M10), and drag the Fill Handle to apply this formula to Range N11:N15.

How do I create a monthly expense spreadsheet?

Table of Contents Step 1: Open a Google Sheet. Step 2: Create Income and Expense Categories. Step 3: Decide What Budget Period to Use. Step 4: Use simple formulas to minimize your time commitment. Step 5: Input your budget numbers. Step 6: Update your budget. Bonus: How to Automatically Update your Google Sheet Budget.

How do you maintain accounting in Excel?

The process of bookkeeping in excel sheets are as follows: Prepare an excel sheet to record all the invoices. Create an excel template for recording financial transactions according to the requirement of the business. Post journal entries on the excel sheet to record the transactions.

How do you maintain daily expenses and income in Excel?

Click the cell that you want to use to calculate your total in the income column, select the list arrow, and then choose the Sum calculation. There are now totals for the income and the expenses. When you have a new income or expense to add, click and drag the blue resize handle in the bottom-right corner of the table.

How do I create a daily expense report in Excel?

Using the Expense Report Template in Excel: For each expense, enter the date and description. Use the dropdown menus to select payment type and category for each expense. For each expense, enter the total cost. Attach all necessary receipts to the document. Submit for review and approval!

How do you create daily expenses?

Let's follow the steps to create a daily expense sheet format. Step 1: Create Dataset. Step 2: List All Categories and Subcategories of Expense. Step 3: Calculate Total Daily Expense. Step 4: Insert Chart for Better Visualization. Final Output of Daily Expense Sheet Format.

Related templates