Financial Plan Template

What is Financial Plan Template?

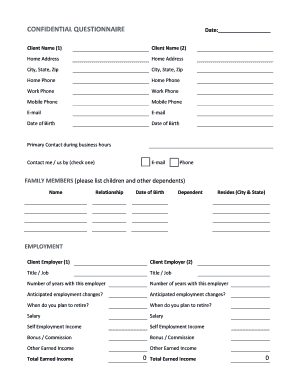

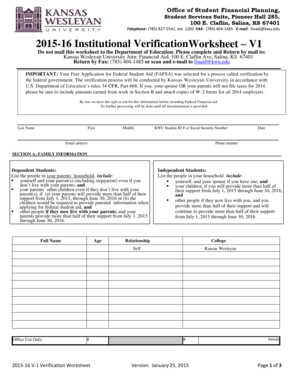

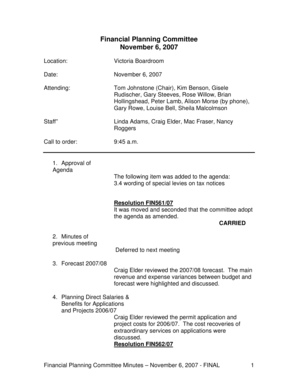

A Financial Plan Template is a document that outlines a person's or a business's financial goals and strategies. It serves as a roadmap to guide individuals or organizations in achieving financial stability, growth, and success. It typically includes sections for income, expenses, investments, savings, debts, and other financial aspects.

What are the types of Financial Plan Template?

There are various types of Financial Plan Templates available to cater to different needs and situations. Some common types include:

How to complete Financial Plan Template

Completing a Financial Plan Template is a step-by-step process that involves the following:

By using a comprehensive Financial Plan Template, individuals and businesses can effectively manage their finances and work towards their financial goals. pdfFiller, a leading online document management platform, empowers users to create, edit, and share their Financial Plan Templates easily. With unlimited fillable templates and powerful editing tools, pdfFiller provides a convenient and efficient solution for financial planning and document management.