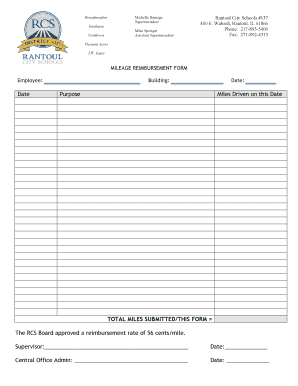

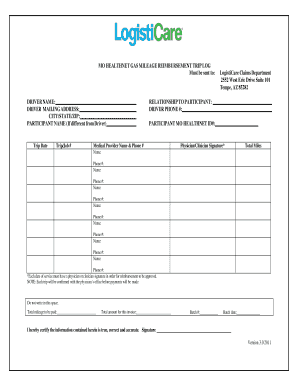

Gas Mileage Reimbursement Form

What is Gas Mileage Reimbursement Form?

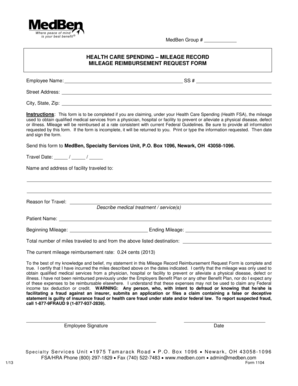

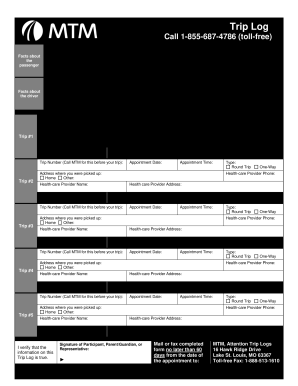

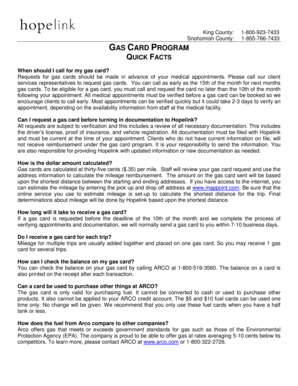

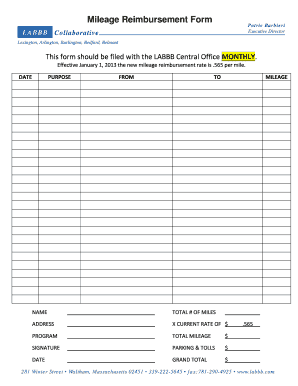

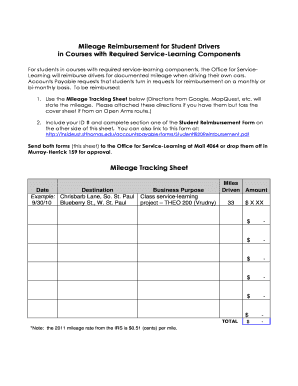

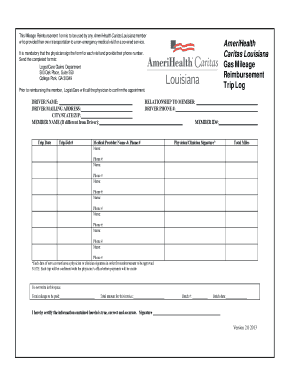

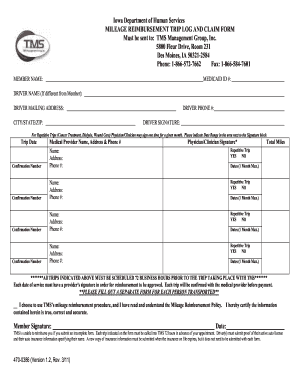

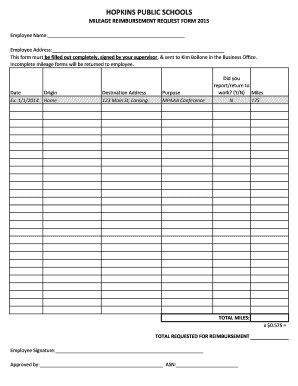

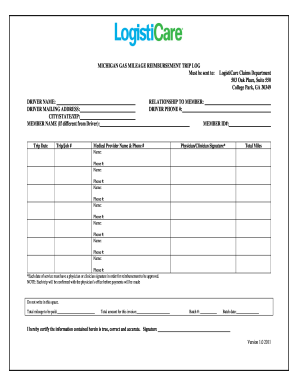

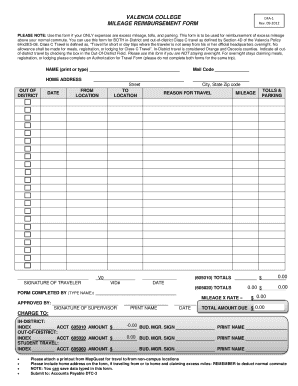

Gas Mileage Reimbursement Form is a document used by individuals or employees to request reimbursement for their travel expenses related to using their personal vehicle for work purposes. This form allows users to provide details about their mileage, such as the distance traveled and the purpose of the trip, as well as any additional expenses incurred such as tolls or parking fees.

What are the types of Gas Mileage Reimbursement Form?

There are several types of Gas Mileage Reimbursement Forms available depending on the organization or company's specific requirements. Some common types include: 1. Standard Gas Mileage Reimbursement Form: This form is used for general reimbursement of mileage expenses. 2. Daily Mileage Log Form: This form requires users to track their daily mileage and submit it for reimbursement periodically. 3. Detailed Expense Report Form: This form is used when users need to provide more detailed information about their expenses, such as the purpose of each trip and any additional costs incurred. It's important to check with your employer or the organization you're submitting the form to, to ensure you're using the correct form.

How to complete Gas Mileage Reimbursement Form

Completing a Gas Mileage Reimbursement Form is simple and straightforward. Here are the steps to follow: 1. Obtain the Gas Mileage Reimbursement Form: The form can usually be obtained from your employer or the organization you're submitting it to. 2. Fill in your personal information: Provide your name, address, contact details, and any other required information. 3. Fill in the trip details: Enter the date of the trip, the starting and ending location, the purpose of the trip, and the total mileage traveled. 4. Include additional expenses: If you have any additional expenses such as tolls or parking fees, make sure to include them in the designated section. 5. Sign and submit the form: Once you have completed all the necessary sections, sign the form and submit it to the appropriate person or department for processing. Remember to keep a copy of the completed form for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.