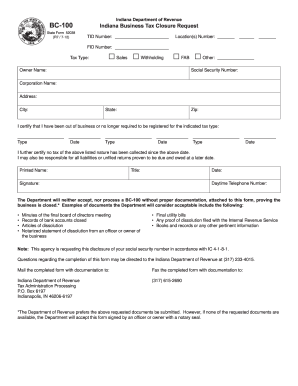

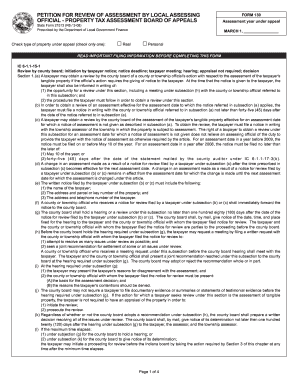

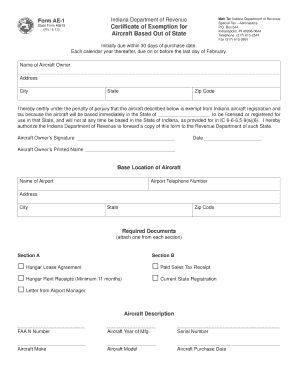

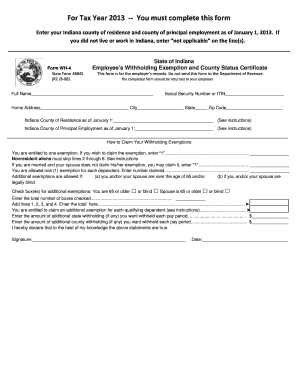

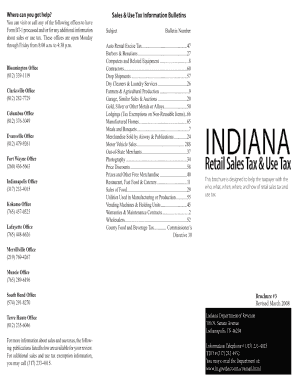

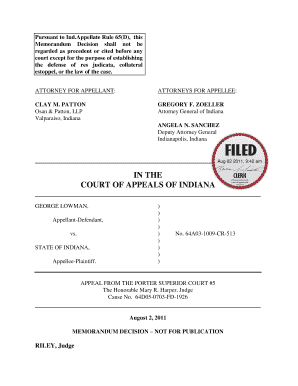

Indiana Tax Forms

What are Indiana Tax Forms?

Indiana Tax Forms are official documents that individuals and businesses in Indiana are required to fill out and submit to the Indiana Department of Revenue. These forms are used to report income, claim deductions and credits, and calculate the amount of tax owed or refunded.

What are the types of Indiana Tax Forms?

There are various types of Indiana Tax Forms, including:

Form IT-Indiana Individual Income Tax Return

Form IT-40PNR: Part-Year or Nonresident Individual Income Tax Return

Form IT-Indiana Partnership Return

Form IT-Indiana Corporate Adjusted Gross Income Tax Return

Form ST-Indiana Sales and Use Tax Return

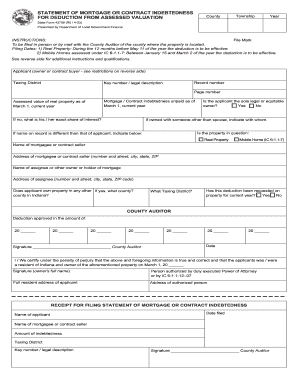

How to complete Indiana Tax Forms

Completing Indiana Tax Forms can be a daunting task, but with proper guidance, it can be simplified. Here are the steps to complete the forms:

01

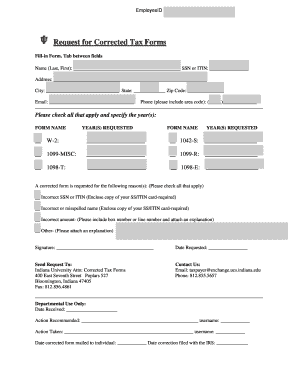

Gather all necessary documents, including W-2s, 1099s, and other income statements

02

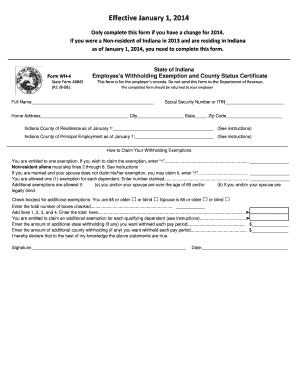

Fill out the personal information section accurately

03

Report your income and deductions in the appropriate sections

04

Calculate the tax owed or refunded using the provided instructions

05

Double-check all entries for accuracy and completeness

06

Sign and date the form

07

Submit the completed form to the Indiana Department of Revenue

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Indiana Tax Forms

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

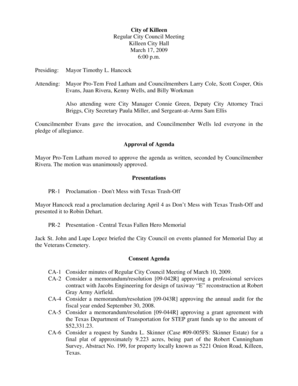

Questions & answers

Can I print my own tax forms?

We accept forms that are consistent with the official printed versions and do not have an adverse impact on our processing. This policy includes forms printed from IRS.gov and output on high-quality devices such as laser or ink-jet printers, unless otherwise specified on the form itself.

Where can I pick up IRS tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed One-Stop page. Requesting copies by phone - 1-800-TAX-FORM (or 1-800-829-3676) Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time - except Alaska and Hawaii which are Pacific time.

How do I get tax forms?

Get the current filing year's forms, instructions, and publications for free from the Internal Revenue Service (IRS). Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Are 2022 tax forms available?

The 2022 Tax Forms can be uploaded, completed, and signed online. Then download, print, and mail the paper forms to the IRS. Detailed information on 2022 State Income Tax Returns, Forms, etc.

Why can't I print my tax forms?

If you're unable to print out a form, it's because the form isn't ready to be filed yet. The form isn't ready for one of the following reasons: The IRS (for federal returns) or your state (for state returns) is still working on finalizing the form.

How do I get Indiana tax forms?

Find forms online at our Indiana tax forms website, order by phone, at 317-615-2581 (leave your order on voice mail, available 24 hours a day). Find federal tax forms from the Internal Revenue Service online, or call 1-800-829-3676.

Related templates