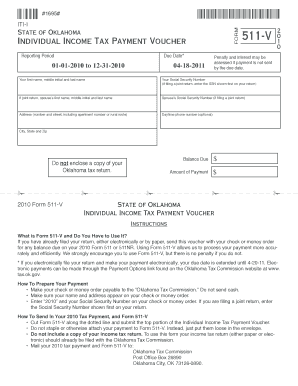

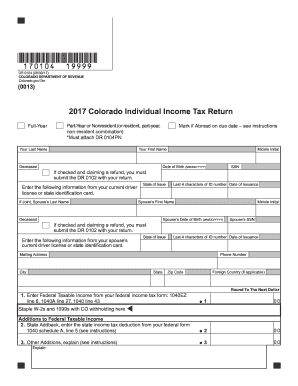

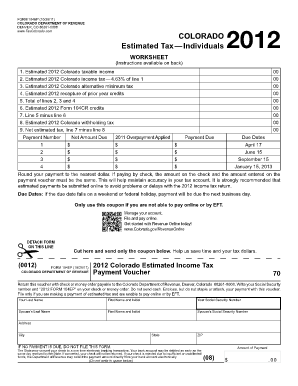

Individual Tax Form

What is Individual Tax Form?

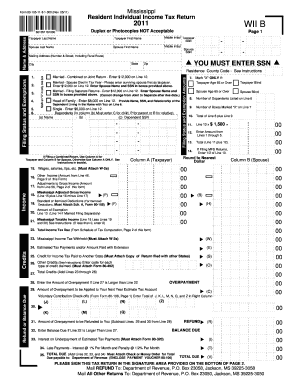

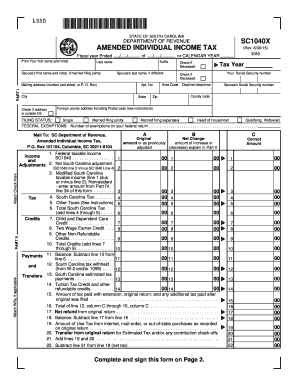

An Individual Tax Form is a document provided by the government that allows individuals to report their income, deductions, and credits to calculate the amount of tax they owe or the refund they are entitled to. It is a crucial form for every taxpayer and is used to determine their tax liability.

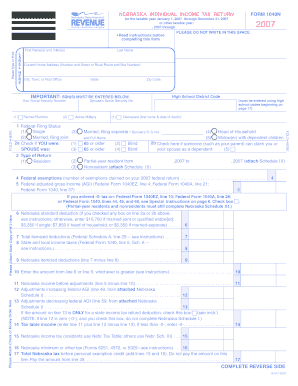

What are the types of Individual Tax Form?

Individual Tax Forms come in various types, including:

Form This is the most common form used by individuals to file their taxes. It is for taxpayers with complex financial situations or those who itemize deductions.

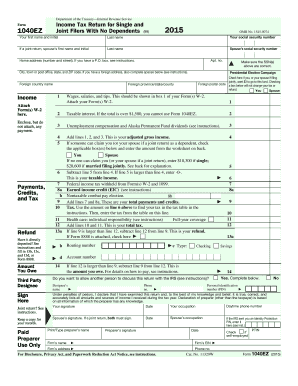

Form 1040EZ: This is the simplest form for individuals with no dependents, no itemized deductions, and an income of less than $100,000.

Form 1040A: This form is slightly more complex than the 1040EZ but simpler than the regular Form It is designed for taxpayers with certain types of income and deductions.

Form 1040NR: This form is used by non-resident aliens to report their U.S. income and claim any applicable deductions or credits.

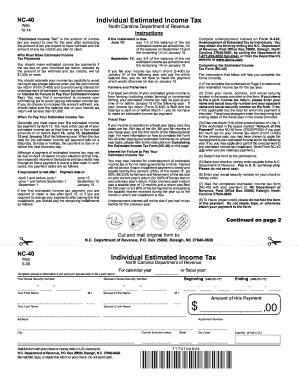

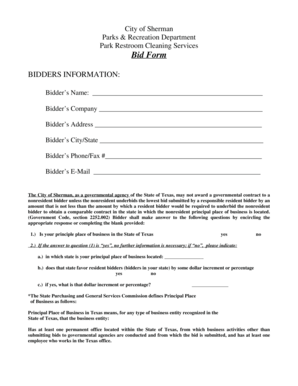

How to complete Individual Tax Form

Completing an Individual Tax Form may seem daunting, but with the right guidance, it can be a straightforward process. Follow these steps to complete your form:

01

Gather all necessary documents, including W-2s, 1099s, and receipts for deductions.

02

Carefully review the form's instructions and select the appropriate form based on your financial situation.

03

Provide accurate personal information, including your name, Social Security number, and filing status.

04

Enter your income details, including wages, interest, dividends, and any other sources of income.

05

Determine your deductions and credits and enter them in the appropriate sections.

06

Double-check all the information you've entered and make sure there are no errors or omissions.

07

Sign and date your form before submitting it to the appropriate tax authority.

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Where can I get IRS booklets and forms?

Call 1-877-CDFORMS (1- 877-233-6767), or save the handling fee by ordering online at www.irs.gov/cdorders. Finally, you can get that last-minute or forgotten form by fax by dialing 703- 368-9694 (not a toll-free call) from your fax machine and following the voice prompts to have the form you need faxed back to you.

How do I file an individual income tax return?

Step 1: Calculation of Income and Tax. Step 2: Tax Deducted at Source (TDS) Certificates and Form 26AS. Step 3: Choose the right Income Tax Form. Step 4: Download ITR utility from Income Tax Portal. Step 5: Fill in your details in the Downloaded File. Step 6: Validate the Information Entered.

Are 2022 tax forms available?

The 2022 Tax Forms can be uploaded, completed, and signed online. Then download, print, and mail the paper forms to the IRS. Detailed information on 2022 State Income Tax Returns, Forms, etc.

Can I file my tax return by myself?

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms.

How do I file an individual tax return?

Follow the steps below to file and submit the ITR through online mode: Step 1: Log in to the e-Filing portal using your user ID and password. Step 2: On your Dashboard, click e-File > Income Tax Returns > File Income Tax Return.

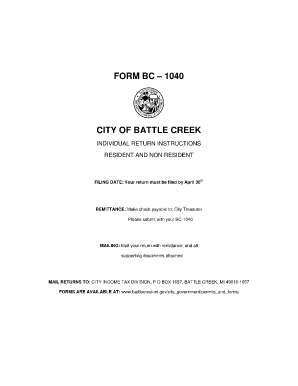

What is the tax form for individuals?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.