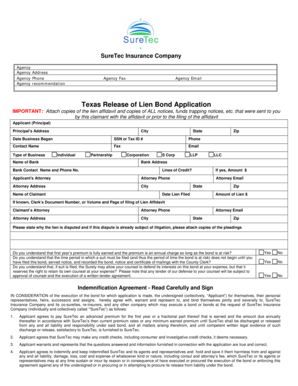

Lien Release Form - Page 2

What is Lien Release Form?

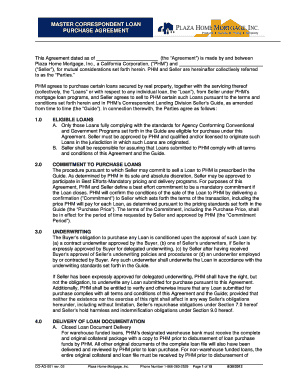

A Lien Release Form is a legal document used to release a claim on a property or asset that has been previously secured by a lien. This form certifies that the lienholder no longer has a financial interest in the property and all obligations have been fulfilled.

What are the types of Lien Release Form?

There are several types of Lien Release Forms depending on the specific situation. The most common types include:

Conditional Lien Release Form

Unconditional Lien Release Form

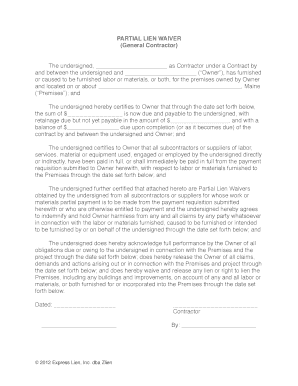

Partial Lien Release Form

Final Lien Release Form

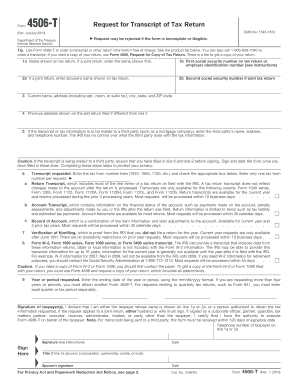

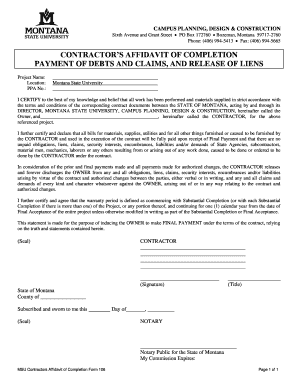

How to complete Lien Release Form

Completing a Lien Release Form is a straightforward process. Here are the steps to follow:

01

Gather the necessary information such as the property details, lienholder's information, and the date of lien release.

02

Fill in the required fields carefully, ensuring accuracy and double-checking all details.

03

Review the completed form for any errors or missing information.

04

Sign the form, indicating your consent to release the lien.

05

Share the form with all relevant parties involved in the lien release process.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Lien Release Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

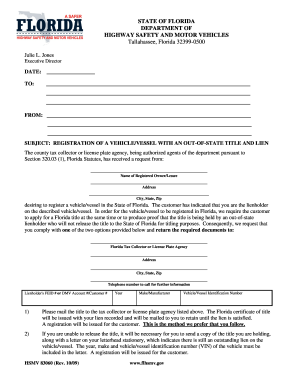

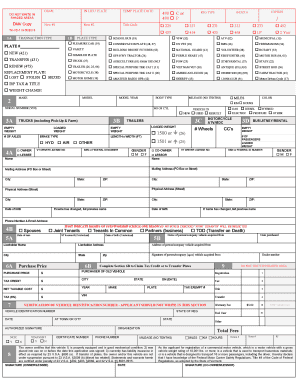

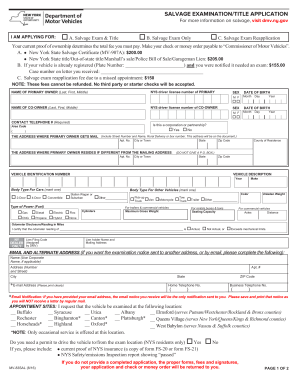

How do I get a new title after paying off my car in Oklahoma?

When you pay off your car loan, you'll be able to remove the lien from the Certificate of Title. In most cases, your lender should send you a lien release statement and the signed title within a few weeks of your final payment. After that, you'll be able to complete a lien release with your local Oklahoma DMV office.

How long does it take to remove a lien from property?

If you are seeking to remove a lien from a vehicle, the lender will typically send the release of lien once the loan is paid in full. It can take up to thirty days to receive the title and the lien release after the final payment.

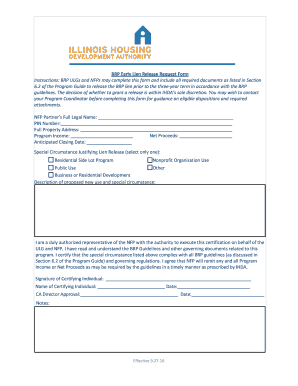

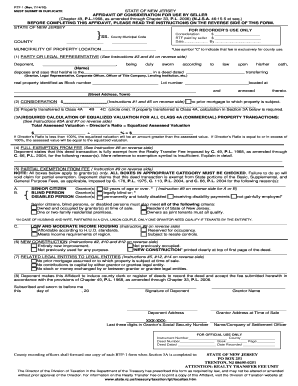

How do I remove a tax lien in California?

To receive a partial release of lien, you must provide documentation to prove there's not enough money to pay off all of our state tax lien(s). Typical situations include: A sale (transfer the rights) of the property (short escrow) A short sale (pre-foreclosure)

How do I remove a lien from a title in Oklahoma?

To release a lien, the lien holder must sign and date two (2) release of lien forms. Mail one (1), signed and dated, copy of a lien release to the Oklahoma Tax Commission, P.O. Box 269061 Oklahoma City, Ok 73126, and one (1), signed and dated, copy of the lien release to the debtor.

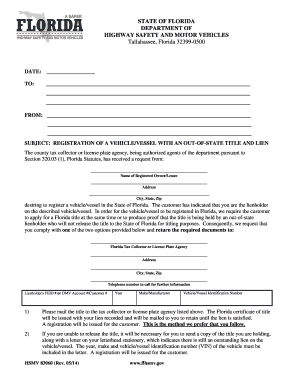

How do I file a lien release in California?

Lien Release: After a lien has been filed, the California claimant can release or cancel the lien by filing a Mechanics Lien Release form with the county recorder's office where the lien was originally recorded.

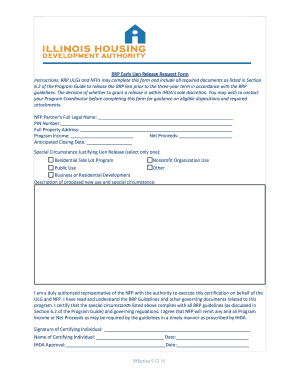

What is the Title 42 process in Oklahoma?

Snap Title 42 will complete all required information that must be filed to obtain a registration and title. This process is used for abandoned property on your land or as a mechanics lien for business owners with signed work orders and the owner fails to return without payment for your services.

Related templates