Opening Balance Entry

What is opening balance entry?

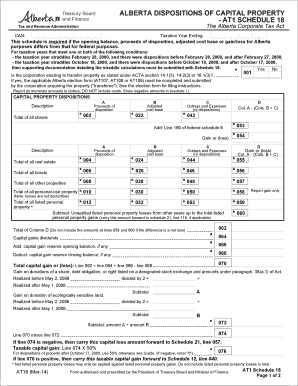

The opening balance entry is an important accounting term that refers to the initial entry made at the beginning of a new accounting period. It represents the starting point for a company's financial records and includes the balances of various accounts such as assets, liabilities, and equity. By recording the opening balance entry, businesses can accurately track their financial transactions and ensure the integrity of their accounting records.

What are the types of opening balance entry?

There are two main types of opening balance entry: positive balance and negative balance. A positive balance entry occurs when the amount of assets and equity exceeds the amount of liabilities, indicating a healthy financial position. On the other hand, a negative balance entry indicates that the company has more liabilities than assets and equity, suggesting a potential issue with the financial stability. Both types of opening balance entry require careful monitoring and adjustments to ensure accurate financial reporting.

How to complete opening balance entry

Completing the opening balance entry involves several steps to ensure accuracy and consistency in financial records. Here's a simple guide to completing the opening balance entry:

By following these steps, you can successfully complete the opening balance entry and start the new accounting period with accurate financial records.

pdfFiller: Empowering users to create, edit, and share documents online

pdfFiller provides users with a comprehensive set of tools to create, edit, and share documents online. With unlimited fillable templates and powerful editing features, pdfFiller is the ultimate PDF editor for individuals and businesses alike. Whether you need to fill out a form, annotate a document, or collaborate with others, pdfFiller offers a seamless and intuitive experience. Say goodbye to the hassle of paper-based workflows and embrace the convenience of digital document management with pdfFiller.