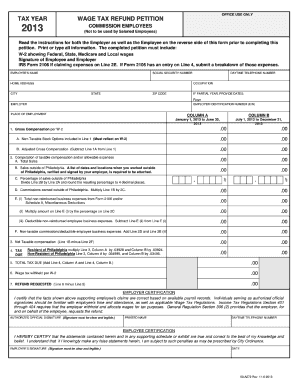

What is Paycheck Calculator?

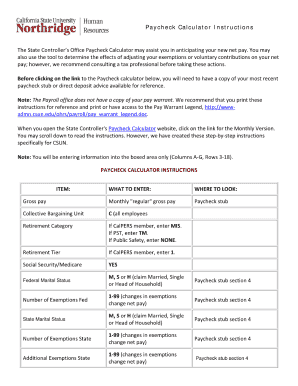

Paycheck Calculator is a tool that helps individuals calculate their income after taxes and deductions. It takes into account various factors such as gross salary, income tax rates, deductions for Social Security and Medicare, and any additional taxes or withholdings. By inputting the necessary information, users can determine their net pay, which is the amount they actually receive in their paycheck.

What are the types of Paycheck Calculator?

There are several types of Paycheck Calculators available to cater to different needs. Some common types include:

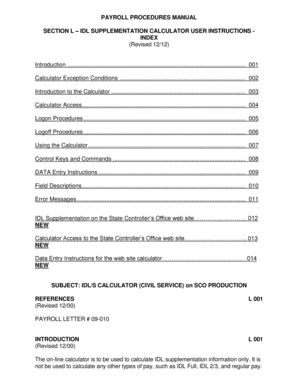

Hourly Paycheck Calculator: This calculator is designed for individuals who are paid on an hourly basis. It calculates the net pay based on the number of hours worked and the hourly rate.

Salary Paycheck Calculator: This calculator is suitable for individuals who receive a fixed salary. It helps determine the net pay by considering the annual salary, tax deductions, and other factors.

Self-Employed Paycheck Calculator: This calculator is specifically tailored for self-employed individuals who need to calculate their net pay after accounting for self-employment taxes and other business expenses.

How to complete Paycheck Calculator

Completing a Paycheck Calculator is a simple process. Follow the steps below to get accurate results:

01

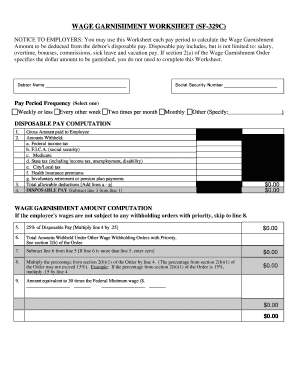

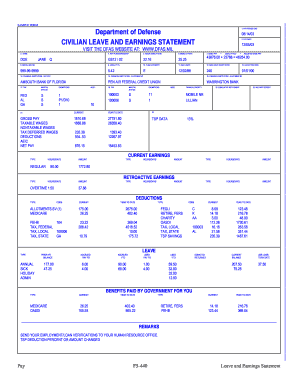

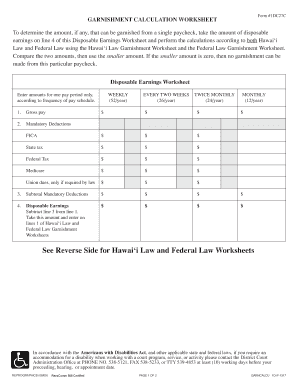

Gather necessary information: You will need details such as your gross salary, federal and state tax rates, Social Security and Medicare percentages, and any other relevant deductions.

02

Enter information into the calculator: Input the required data into the appropriate fields of the Paycheck Calculator. Make sure to double-check the accuracy of the information entered.

03

Review the calculated results: Once you have entered all the necessary information, the Paycheck Calculator will generate the net pay amount. Take the time to review the results and ensure they align with your expectations.

04

Make adjustments if needed: If the calculated net pay is not as expected, you can go back and modify the input values to see how it affects the final amount.

05

Save or print the results: Once you are satisfied with the calculated net pay, you can save or print the results for your records.

pdfFiller, a leading online document management platform, offers a comprehensive Paycheck Calculator that incorporates all the necessary features. With pdfFiller, users can easily create, edit, and share documents online. Additionally, it provides unlimited fillable templates and powerful editing tools, making it the ideal choice for all document-related needs.