Analyze Comment Invoice Gratuit

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

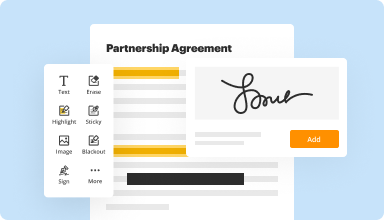

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

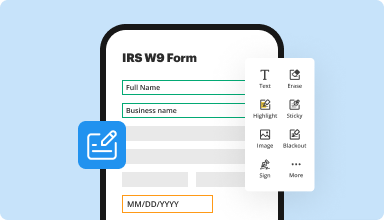

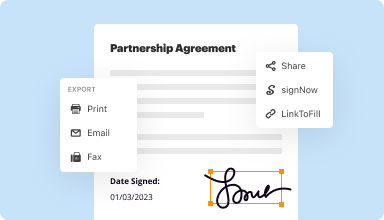

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

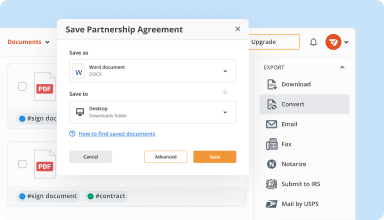

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

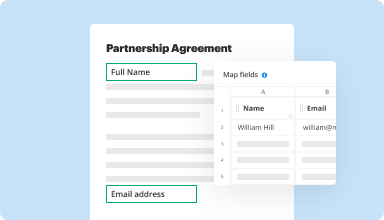

Collect data and approvals

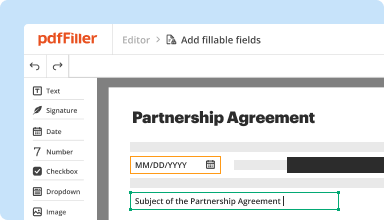

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

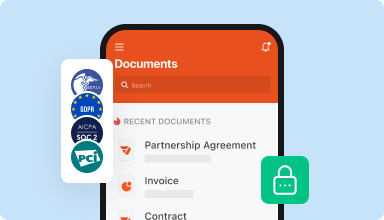

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

thumbs up! the customer care and the support are on top level!quick response and great desire to solve an issue! about the pdf filler ..easy to use ,awesome features like send to sign button!!

2014-10-19

The ease and operation was fantastic. I get confused very easily with all the new technology. With PDFFILLER I was able start at file I found in the browser and fax it, import a file and email it without any trouble. I will be using this a lot.

2016-11-04

What do you like best?

Extremely simple way to fill out, edit, and merge PDF documents.

What do you dislike?

Document uploading is slightly slow when working with larger files.

Recommendations to others considering the product:

User frindly/cost effective.

What problems are you solving with the product? What benefits have you realized?

Editing, merging, and sharing PDF files.

Extremely simple way to fill out, edit, and merge PDF documents.

What do you dislike?

Document uploading is slightly slow when working with larger files.

Recommendations to others considering the product:

User frindly/cost effective.

What problems are you solving with the product? What benefits have you realized?

Editing, merging, and sharing PDF files.

2018-01-15

im so pleased with how simple and easy it is to edit pdf files. love all the features. very user friendly. the only thing of concern is the high price

2024-05-16

Kara helped me solve a mystery…

Kara helped me to figure out a tricky issue that had to do with 'filling' a pdf. Kara figured out that it was a problem with my Chrome browser, so we switched browsers and it worked. Thanks.

2022-05-09

This morning my subscription to PdfFiller was automatically renewed. Once I realized it, I notified the company to cancel my subscription and to provide a refund. Within a short time, I received a response confirming that the subscription was canceled and that the charge was reversed. I would definitely recommend this company and would use them again if I had a need.TL

2022-04-15

I am able to send out docs for signing and convert from Word to PDf, would love to learn more!

Please contact me for classes- I want to understand the scope of opportunities that I am availed to.

Plus a few specific items like sending a cover letter with the doc.

Thanks so much!

2021-03-28

What do you like best?

Me gusta porque tiene funciones para fusionar, reordenar o añadir páginas. Tiene un costo asequible en comparación con otros programas similares. Me gusta también porque puede convertir archivos PDF en archivos rellenables de Word. Tiene un panel de administración intuitivo.

What do you dislike?

Lo único que no me gusta es que obligatorio pagar para probar la versión de prueba.

Recommendations to others considering the product:

Le sugiero contratar pdfFiller si desea contar con herramientas de edición PDF avanzadas. Tienen distintos precios basados en las capacidades de cada organización.

What problems are you solving with the product? What benefits have you realized?

En la empresa usamos pdfFiller para editar y compartir archivos PDF. Por lo general, manejamos muchos archivos de cotizaciones y ésta herramienta nos permite convertir fácilmente plantillas en archivos Word que rellenamos con los datos de los clientes, que nos ahorra mucho tiempo en la creación de documentos.

2021-01-23

I had an issue with the automatic renewal of my subscription smack in the middle of the COVID-19 pandemic. I have already been in quarantine for the past 4 weeks and cannot use the services of PDFfiller.

I got in touch with the company and I immediately received a response from Anna who refunded the draft and cancelled my subscription.

Because of the swift attention paid to my concerns, and the professional way in which it was handled, PDFfiller has earned my endorsement.

*******

2020-04-28

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you analyze accounts receivable?

One of the simplest methods available is the use of the accounts receivable-to-sales ratio. This ratio, which consists of the business's accounts receivable divided by its sales, allows investors to ascertain the degree to which the business's sales have not yet been paid for by customers at a particular point in time.

What is a good percentage for accounts receivable?

As a general rule, the average business for multiple industries across the country is shooting for a past due receivables' percentage in the neighborhood of 10-15%, but depending on your specific circumstances, your ideal number could end up being much higher or lower than that.

How do you calculate accounts receivable percentage?

Allowance for bad debts as percentage of receivables is calculated by multiplying accounts receivable by an estimated percentage of expected noncollectable debts. Accounts for bad debts are then subtracted from accounts receivable on the balance sheet and the result reported as net accounts receivable.

What percentage of accounts receivable is considered uncollectible?

Percentage of Receivables Method The resulting figure indicates what the allowance for doubtful accounts balance should be. For example, say a company estimates that 1 percent of accumulated receivables are usually uncollectible and the receivables balance is $500,000.

What constitutes a reasonable account receivable turnover ratio?

A high ratio is desirable, as it indicates that the company's collection of accounts receivable is efficient. A high accounts receivable turnover also indicates that the company enjoys a high-quality customer base that is able to pay their debts quickly.

How do you calculate accounts receivable?

To find the net credit sales, calculate your total credit sales minus returns, allowances, and discounts. The average accounts receivable is the total of the beginning and ending accounts receivable divided by two. The accounts receivable turnover ratio is simply a number.

What is the formula for accounts receivable?

The formula for net credit sales is = Sales on credit Sales returns Sales allowances. Average accounts receivable is the sum of starting and ending accounts receivable over a time period (such as monthly or quarterly), divided by 2.

What is included in accounts receivable?

Said another way, account receivable are amounts of money owed by customers to another entity for goods or services delivered or used on credit but not yet paid for by clients. Accounts receivable refers to the outstanding invoices a company has or the money clients owe the company.

What is an example of an account receivable?

Accounts receivable (AR) are amounts owed by customers for goods and services a company allowed the customer to purchase on credit. ... Instead, they might have, for example, a 30 or 60-day period before they're required to pay the invoice for those goods or services.

How do you analyze accounts receivable turnover?

Accounts receivable turnover is calculated by dividing net credit sales by the average accounts receivable for that period. The reason net credit sales are used instead of net sales is that cash sales don't create receivables. Only credit sales establish a receivable, so the cash sales are left out of the calculation.

Video Review on How to Analyze Comment Invoice

#1 usability according to G2

Try the PDF solution that respects your time.