Separation Sum Transcript Gratuit

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

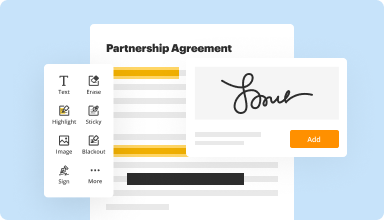

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

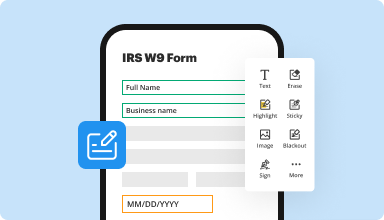

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

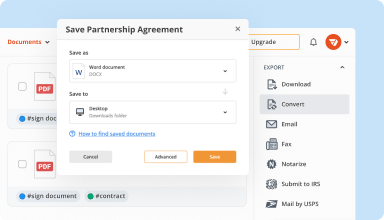

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

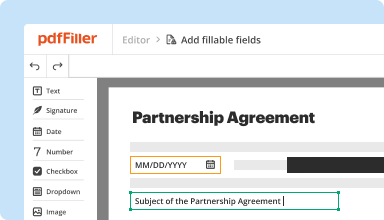

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

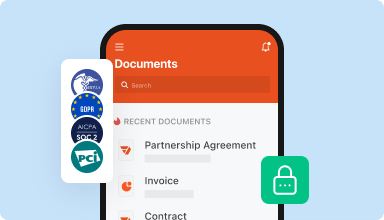

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Very intuitive and easy to use application that provides a high standard product. Much better than other applications on the market that I have tried in the past.

2017-11-19

I was extremely happy with PDFFiller until I took an entire 2 hours worth of notes on a pdf and the website froze when I tried to save it. And then lost it all with no recovery option.

2018-10-25

Thank you. I appreciate your service. As you can see, I am not in financial backing to do much business on the internet. I do thank you for this session.

2019-01-11

I was very pleased to find most of the forms I needed for filing taxes in pre-fillable forms that I could complete on my PC. And then you guys keep them and allow templates. Wow, very helpful

2019-02-01

What do you like best?

The best feature is that you can use the check and cross marks easily!

What do you dislike?

I dislike the fact that there isnt a hand-free drawing feature. I wish I could draw lines and curves on top of some pictures, for example!

What problems are you solving with the product? What benefits have you realized?

I use it to grade my students papers in Pdf. It is easier to attach hand written exercises to pdf, and then go directly to pdffiller.

2021-04-19

great product

We use this on an annual basis to prepare our tax docs for our Church employees. Great service and they are always willing to help even when its a user error. thank you

2021-02-27

Competitiveness in the market with PDF Filler

Editor of great autonomy, has added values of great importance to my daily tasks, robust and practical, I am quite satisfied with PDF Filler.

It is a great online Pdf editor, objective and competitive, compared to other Editors found in the market, its autonomy is of excellent quality in the conversion of PDF documents and electronic signatures.

It has a positive history with PDF files, it helps me with everyday tasks, how to convert documents to Pdf and send documents to a specific program for my work, I use SEI, it is also excellent in the electronic signature operation.

2020-08-18

I was freaking out that I couldn't save…

I was freaking out that I couldn't save my work on a PDF for a scholarship app, but after finding this, I am very happy and calm.

2020-04-17

It's kind of quirky, because I[m not familiar with pdfFiller and it just pops up all of a sudden out of nowhere, so I don't know where to begin.

2025-03-25

Separation Sum Transcript Feature

The Separation Sum Transcript feature simplifies your workflow by providing clear and concise transcripts tailored to your needs. This tool helps you manage, analyze, and share content effectively, ensuring that you focus on what matters most.

Key Features

Accurate transcription of audio and video content

Separation of dialogue by speaker for easy understanding

Export options in multiple formats for versatile use

Customizable settings to meet specific requirements

User-friendly interface for quick navigation

Potential Use Cases and Benefits

Enhance note-taking during meetings and lectures

Improve accessibility for individuals with hearing impairments

Facilitate content creation for podcasts and videos

Support legal documentation and analysis of court hearings

Streamline research and reference for academic studies

By offering a straightforward solution to transcript creation, the Separation Sum Transcript feature helps you save time and reduce errors. It allows you to focus on the content rather than the process, making it easier for you to achieve your goals. Enjoy a seamless experience and unlock the full potential of your audio and video assets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you file taxes if you are married but separated?

The IRS considers you married for the entire tax year when you have no separation maintenance decree by the final day of the year. If you are married by IRS standards, You can only choose “married filing jointly” or “married filing separately” status. You cannot file as “single” or “head of household.”

When should married couples file taxes separately?

Income requirements for married filing separately So where a married couple who are both younger than 65 and filing jointly wouldn't have to file unless their gross income was at least $24,000, if the same couple decides to use the married filing separately status, they would be required to file.

When should married couples file separately?

Eligibility requirements for married filing separately If you're considered married on Dec. 31 of the tax year, then you may choose the married filing separately status for that entire tax year. If two spouses can't agree to file a joint return, then they'll generally have to use the married filing separately status.

Is it better to file jointly or separately?

If you earn a much higher income than your spouse (or vice versa), filing jointly often helps you qualify for a lower federal income tax bracket compared to brackets for married couples who file separately. This means you will owe a lower tax bill and may even get a refund.

Why would you file married filing separately?

Advantages of Filing Separate Returns You will be responsible for only your taxes. By using the Married Filing Separately filing status, you will keep your own tax liability separate from your spouse's tax liability. All of these may be taken from your tax refund by the IRS after you file a joint return.

What is the best way to file taxes when married but separated?

The IRS considers you married for the entire tax year when you have no separation maintenance decree by the final day of the year. If you are married by IRS standards, You can only choose “married filing jointly” or “married filing separately” status. You cannot file as “single” or “head of household.”

Is it legal to file single if you are married?

If you are married and living with your spouse, you must file as married filing jointly or married filing separately. You cannot choose to file as single or head of household. However, if you were separated from your spouse before December 31, 2019, by a separate maintenance decree, you may choose to file as single.

Is it illegal to file single if married?

No, you cannot file single if you are married. Married taxpayers can only file married filing jointly or married filing separately. If you live in separate homes and children live with one or both of you in the separate homes, you may be able to file head of household.

#1 usability according to G2

Try the PDF solution that respects your time.