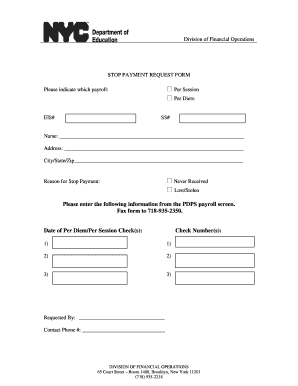

Download tax forms Forms and Templates

Download Tax Forms: Fill out, eSign, share the form with ease

If completing the paperwork like Download Tax Forms is something you do very often, then pdfFiller is the quickest, most straightforward way. Our solution lets you get ready-to-use fillable forms, generate ones from the ground up, or make the required edits to your existing document.

In addition to that, you can effortlessly eSign and quickly share the completed copy with others or securely store it for future use. pdfFiller is one of the handful of editors that mixes convenience and ideal performance powerful enough to accommodate various formats. Let’s review what you can do with our PDF form editor.

How to get the most out of pdfFiller when editing Download Tax Forms

First things first: You need to create an account with pdfFiller or log in to your existing one. If you've never used our editor before, don't stress out - it's effortless to onboard. Once you have successfully logged in to pdfFiller, you can begin working on Download Tax Forms or use our rich catalog of forms.

pdfFiller provides users with pro tools to draft forms or alter existing ones online, all from the comfort of just one application that works on desktop and mobile phone. Try it out today and see for yourself!