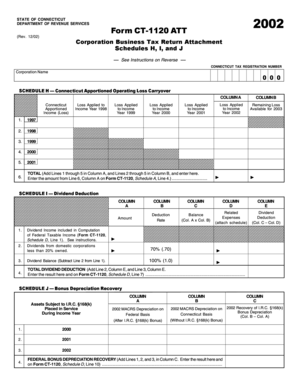

Bonus Depreciation Calculator

What is Bonus Depreciation Calculator?

A Bonus Depreciation Calculator is a tool that allows businesses to determine the amount of bonus depreciation they can claim for tax purposes. Bonus depreciation refers to the additional depreciation expense that can be deducted in the first year of owning qualifying assets.

What are the types of Bonus Depreciation Calculator?

There are several types of Bonus Depreciation Calculators available, including:

Online Bonus Depreciation Calculator

Offline Bonus Depreciation Calculator

Excel-based Bonus Depreciation Calculator

How to complete Bonus Depreciation Calculator

Completing a Bonus Depreciation Calculator is a straightforward process. Here are the steps to follow:

01

Enter the cost basis of the qualifying assets.

02

Specify the applicable bonus depreciation percentage.

03

Provide the recovery period for the assets.

04

Input any Section 179 deductions, if applicable.

05

Calculate the bonus depreciation amount and total depreciation expense.

06

Review and verify the results.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Bonus Depreciation Calculator

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can you choose how much bonus depreciation to take?

As mentioned above, you can elect not to take 100% bonus depreciation, but you must make an active election on the tax return.

How do I calculate bonus depreciation?

Bonus Depreciation is calculated by using the bonus rate, which is prevailing in the market. The calculation involves multiplying the rate with the cost of the asset. The tax on the property is then deducted from the cost of the asset. On that deducted value, the additional first-year depreciation is calculated.

What is the bonus depreciation for 2022?

A big tax benefit from 2017's TCJA begins phasing out at the end of 2022. The 100% bonus depreciation will phase out after 2022, with qualifying property getting only an 80% bonus deduction in 2023 and less in later years.

Does 2022 have bonus depreciation?

A big tax benefit from 2017's TCJA begins phasing out at the end of 2022. The 100% bonus depreciation will phase out after 2022, with qualifying property getting only an 80% bonus deduction in 2023 and less in later years.

What assets are eligible for 100% bonus depreciation?

2) Which assets are subject to bonus depreciation? Qualified business property that has a useful life of 20 years or less. Examples include equipment, furniture, fixtures, machinery, computer software, and costs of qualified film or television productions, and live theatrical productions.

Does bonus depreciation have to be 100 %?

A big tax benefit from 2017's TCJA begins phasing out at the end of 2022. The 100% bonus depreciation will phase out after 2022, with qualifying property getting only an 80% bonus deduction in 2023 and less in later years.

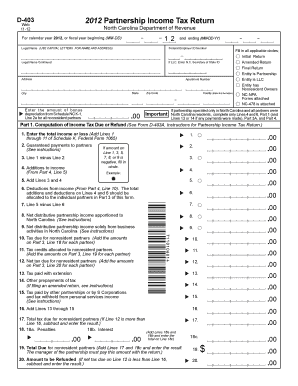

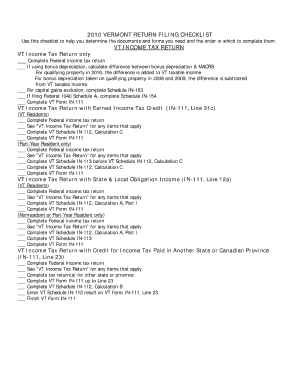

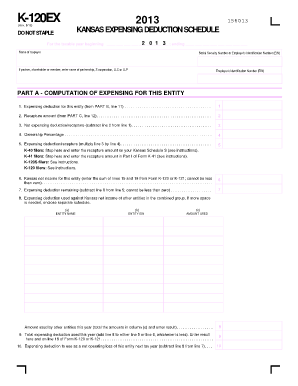

Related templates