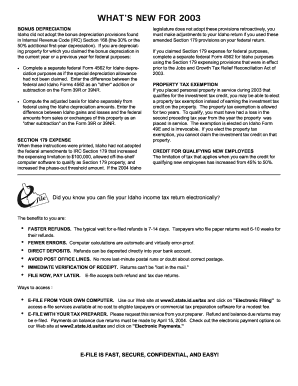

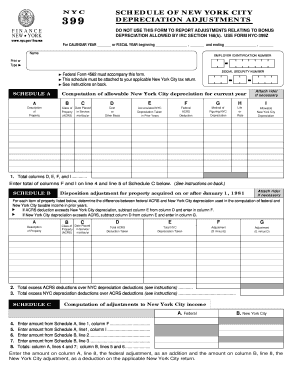

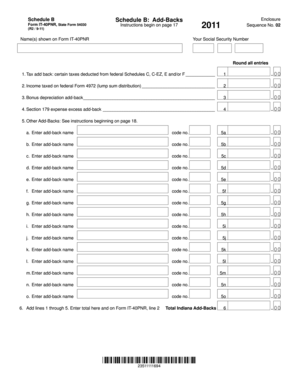

50 Bonus Depreciation Schedule

What is 50 bonus depreciation schedule?

The 50 bonus depreciation schedule refers to a tax provision that allows businesses to deduct an additional 50% of the cost of qualifying assets from their taxable income in the year the assets are placed in service. This provision was introduced to help stimulate business investment and economic growth.

What are the types of 50 bonus depreciation schedule?

There are two main types of 50 bonus depreciation schedules: general bonus depreciation and bonus depreciation for certain qualified property. The general bonus depreciation applies to most types of property qualifying for bonus depreciation, while the bonus depreciation for certain qualified property is specifically designed for certain types of assets, such as specified plants, trees, and vineyards.

How to complete 50 bonus depreciation schedule

Completing the 50 bonus depreciation schedule involves the following steps:

With pdfFiller, you can easily complete the 50 bonus depreciation schedule and other tax-related forms online. pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. It is the only PDF editor you need to get your documents done efficiently and hassle-free.