Macrs Depreciation Table 2016

What is macrs depreciation table 2016?

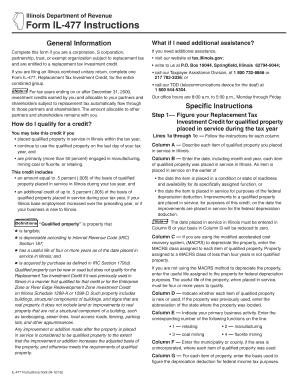

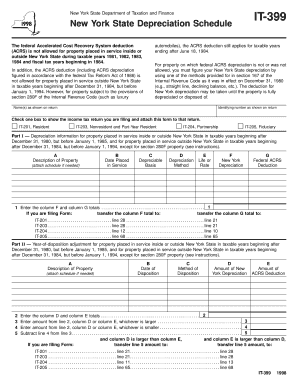

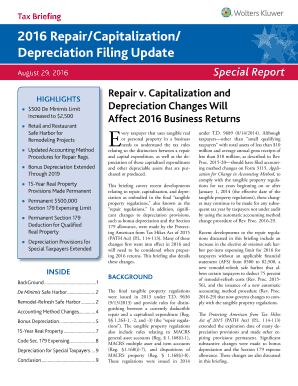

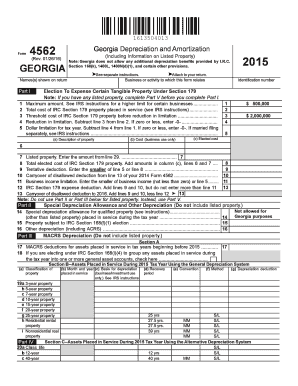

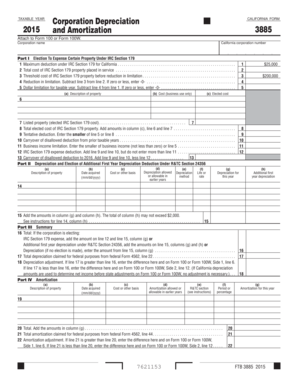

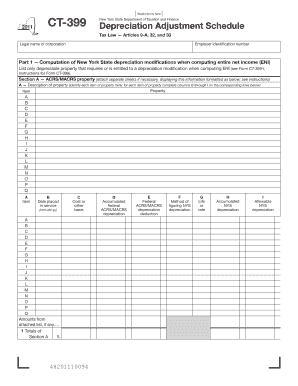

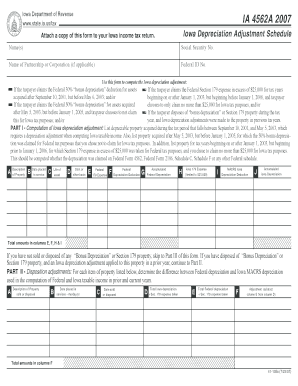

The MACRS (Modified Accelerated Cost Recovery System) depreciation table for the year 2016 is a tax method used by businesses to recover certain costs of tangible assets over a specified time period. It provides a way to deduct the cost of qualifying property using a specific depreciation schedule.

What are the types of macrs depreciation table 2016?

There are several types of macrs depreciation tables for the year 2016, which are determined based on the class of the asset. The main types include:

How to complete macrs depreciation table 2016

Completing the macrs depreciation table for the year 2016 involves the following steps:

pdfFiller is an excellent tool for creating, editing, and sharing documents online. With its unlimited fillable templates and powerful editing tools, pdfFiller makes it easy to complete the macrs depreciation table for 2016. Get your documents done quickly and efficiently with pdfFiller.