What is macrs depreciation schedule?

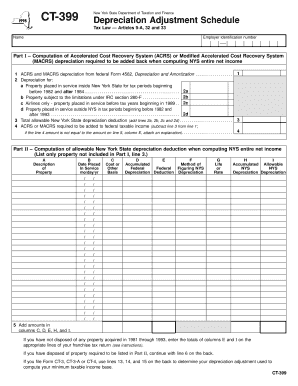

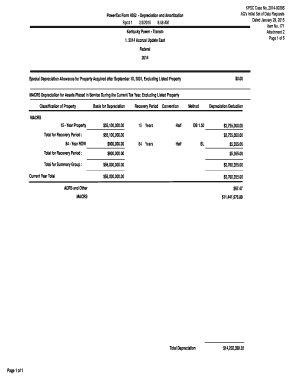

A macrs depreciation schedule is a method used for calculating the depreciation of assets for tax purposes. MACRS stands for Modified Accelerated Cost Recovery System, which is the system used by the Internal Revenue Service (IRS) in the United States. It allows businesses to recover the costs of certain assets over a predetermined period of time.

What are the types of macrs depreciation schedule?

There are several types of macrs depreciation schedules, each designed for different types of assets. The commonly used types include:

3-Year Property: This includes assets with a useful life of three years or less, such as tractors and some office equipment.

5-Year Property: This category covers assets with a useful life of five years, including vehicles, computers, and machinery.

7-Year Property: Assets like office furniture and equipment fall into this category, with a useful life of seven years.

10-Year Property: This type includes assets such as agricultural structures and certain electing real property.

15-Year Property: Assets like land improvements and certain types of qualified leasehold improvement property fall into this category.

20-Year Property: This category includes assets like water utility property and certain types of computers.

27.5-Year Property: Residential rental properties with a useful life of 27.5 years fall into this category.

39-Year Property: Nonresidential real property falls into this category, with a useful life of 39 years.

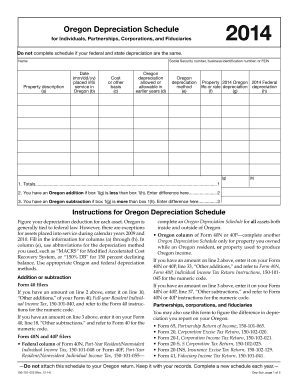

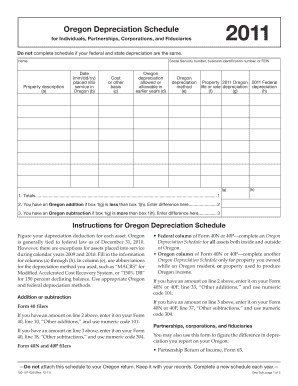

How to complete macrs depreciation schedule

Completing a macrs depreciation schedule involves several steps. Here's a simplified guide to help you navigate through the process:

01

Identify the asset: Determine the asset you want to calculate depreciation for and gather all the necessary information.

02

Determine the class: Classify the asset into the appropriate macrs depreciation class based on its useful life.

03

Calculate the depreciation: Follow the IRS guidelines to calculate the depreciation deduction for each year.

04

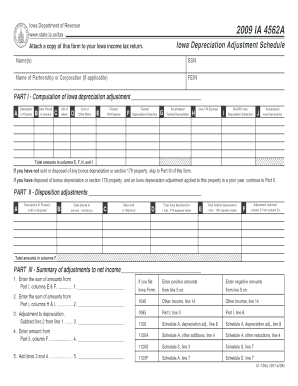

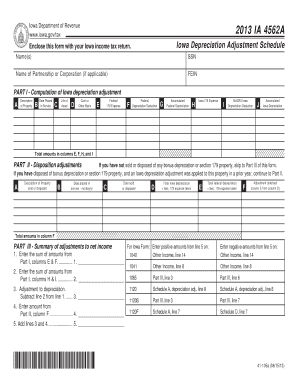

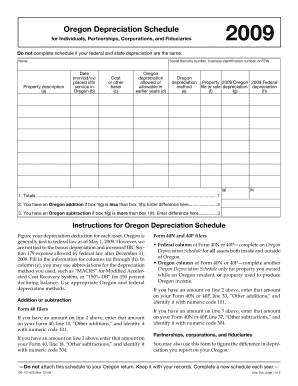

Fill out the form: Use a macrs depreciation schedule form, such as Form 4562, to input the necessary information.

05

File your taxes: Include the completed macrs depreciation schedule form with your tax return when filing with the IRS.

Remember, pdfFiller can greatly simplify the process of completing your macrs depreciation schedule. With its easy-to-use interface and powerful features, you can quickly and accurately calculate your depreciation and generate the necessary forms. pdfFiller empowers users to create, edit, and share documents online, providing unlimited fillable templates and powerful editing tools. It's the only PDF editor you need to efficiently handle your macrs depreciation schedule and other document needs.