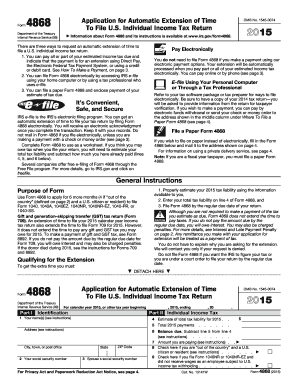

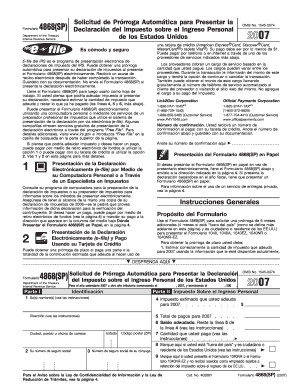

Irs Form 4868 Automatic Extension 2016

What is irs form 4868 automatic extension 2016?

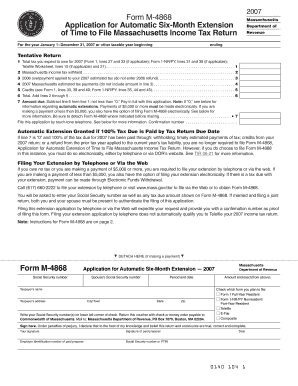

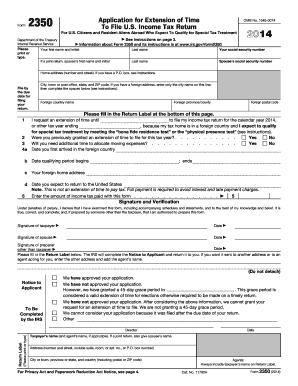

The IRS Form 4868 automatic extension 2016 is a tax form that allows individuals to request additional time to file their income tax return. It provides an automatic extension of up to six months, moving the deadline from April 15th to October 15th. This form is particularly useful for those who need extra time to gather all the necessary documents or to accurately calculate their tax liabilities.

What are the types of irs form 4868 automatic extension 2016?

The IRS form 4868 automatic extension 2016 comes in two types: individual and joint. The individual extension applies to taxpayers filing as single, head of household, married filing separately, or qualifying widow(er) with dependent child. The joint extension is for married couples who are filing a joint tax return. Both types of extensions offer the same extended deadline and give taxpayers more time to meet their tax obligations.

How to complete irs form 4868 automatic extension 2016

To successfully complete IRS form 4868 automatic extension 2016, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done. With pdfFiller, completing IRS form 4868 automatic extension 2016 becomes a seamless and hassle-free process.