Sample Proof Of Income Letters

What is Sample Proof Of Income Letters?

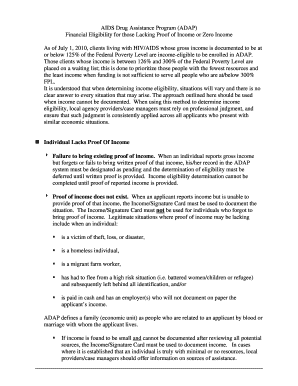

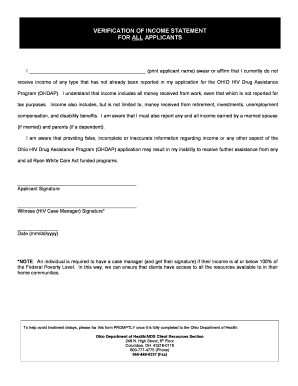

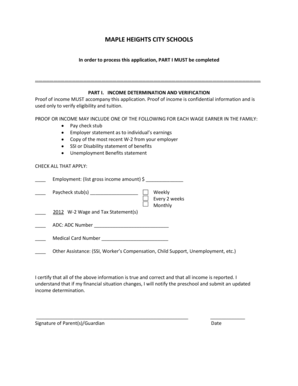

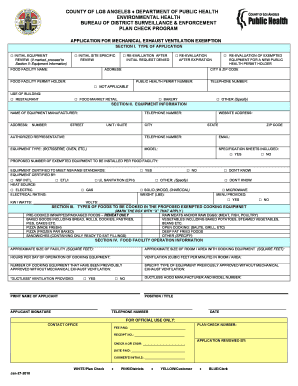

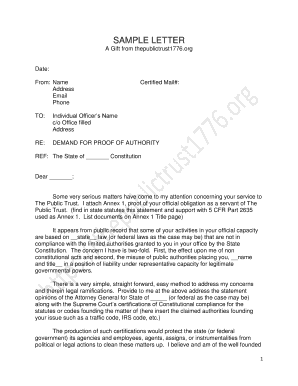

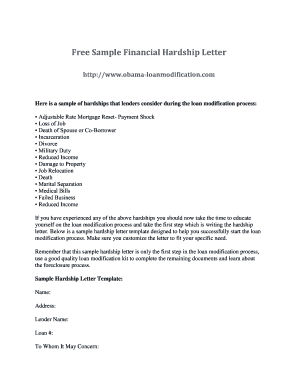

Sample Proof Of Income Letters are documents that provide evidence of an individual's income. These letters are often requested by lenders, landlords, or government agencies to verify income details for various purposes. The letters typically include information such as the individual's name, employer, salary, and duration of employment.

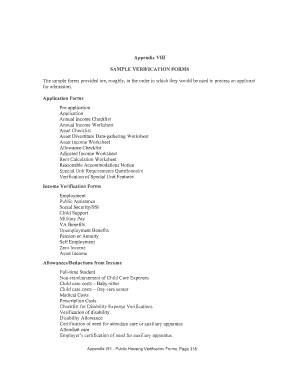

What are the types of Sample Proof Of Income Letters?

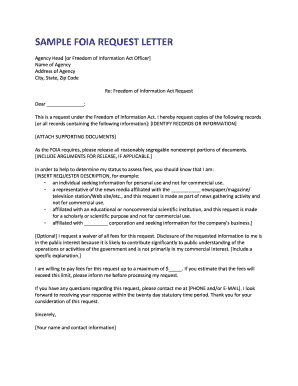

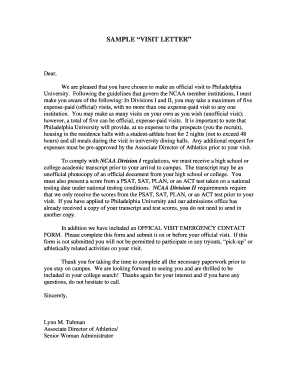

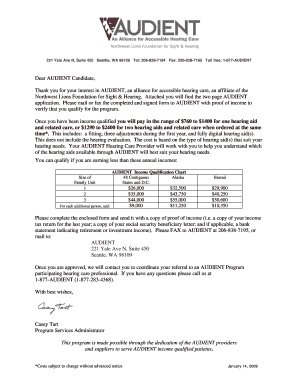

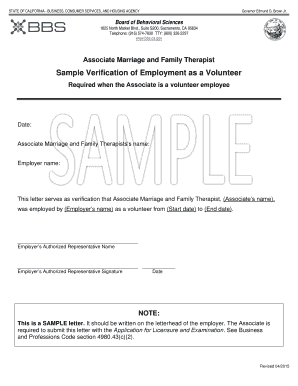

There are several types of Sample Proof Of Income Letters that can be used depending on the specific requirement. The most common types include: 1. Employment Verification Letter: This letter is issued by an employer to confirm an individual's employment and income details. 2. Pay Stub: A pay stub is a document issued by an employer to an employee that shows the details of their wages for a specific period. 3. Tax Returns: Tax returns can also serve as proof of income as they show an individual's reported income for a given year.

How to complete Sample Proof Of Income Letters

Completing Sample Proof Of Income Letters is a straightforward process that requires attention to detail. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that users need to efficiently complete their documents.