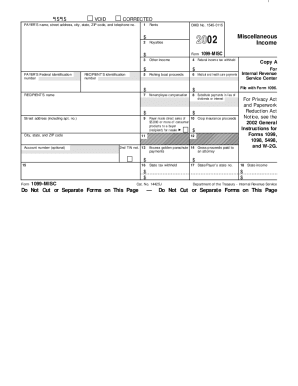

1099 Misc 2015

What is 1099 misc 2015?

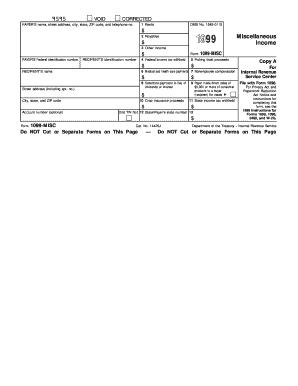

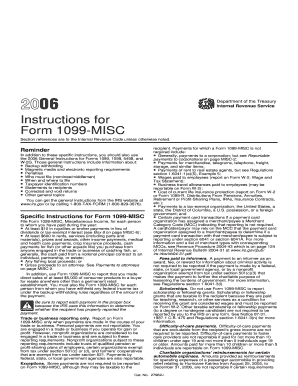

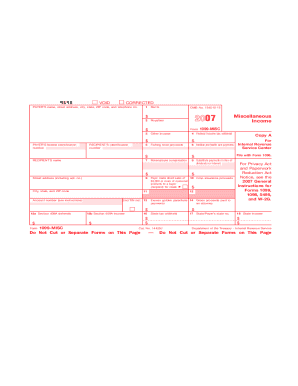

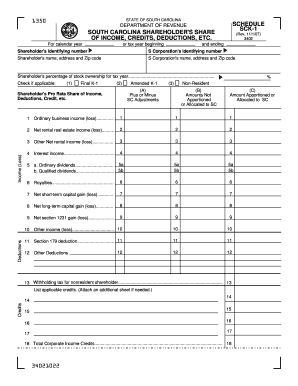

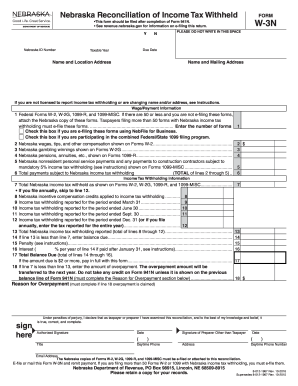

1099 misc 2015 is a tax form that serves to report income received outside of regular employment. It is usually used by freelancers, independent contractors, and self-employed individuals to report their income to the IRS. This form is specifically for the tax year 2015.

What are the types of 1099 misc 2015?

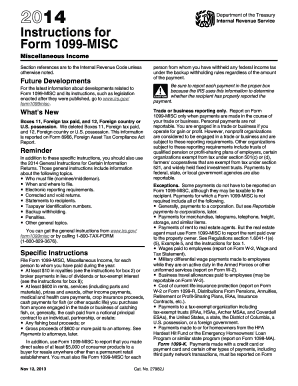

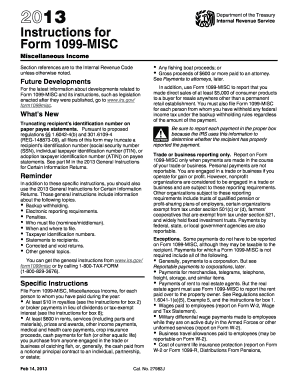

There are several types of income that fall under the 1099 misc 2015 category. These include:

How to complete 1099 misc 2015

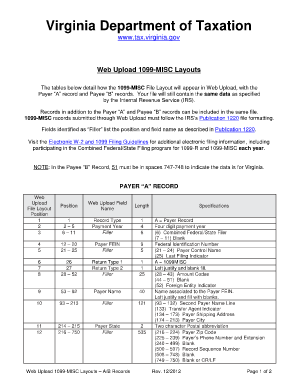

Completing the 1099 misc 2015 form is a straightforward process. Here is a step-by-step guide to help you:

pdfFiller is the perfect tool to assist you in completing the 1099 misc 2015 form. With pdfFiller, you can easily create, edit, and share the form online. Unlimited fillable templates and powerful editing tools are at your disposal. Say goodbye to complicated paperwork and let pdfFiller simplify your document management process!