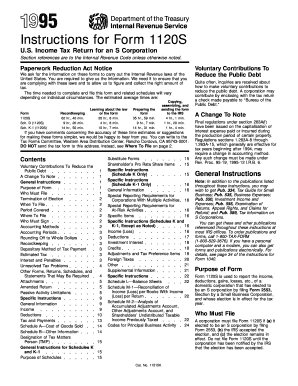

What is form 1120s instructions?

Form 1120s instructions are guidelines provided by the Internal Revenue Service (IRS) to help taxpayers accurately complete their Form 1120s. This form, also known as U.S. Income Tax Return for an S Corporation, is used to report the income, deductions, and other information of S corporations. By following these instructions, users can ensure they are fulfilling their tax obligations correctly.

What are the types of form 1120s instructions?

Form 1120s instructions consist of several key types of guidelines that cover various aspects of completing the form. These include:

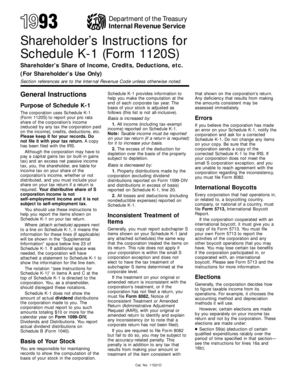

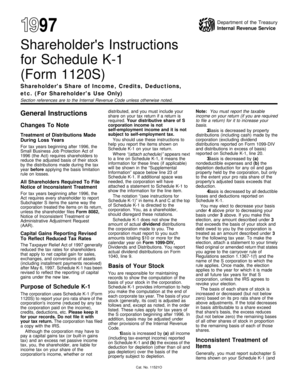

General instructions: These provide an overview of the purpose and filing requirements of Form 1120s.

Specific instructions: These offer detailed explanations for each line item on the form, assisting users in reporting their income, deductions, credits, and other information accurately.

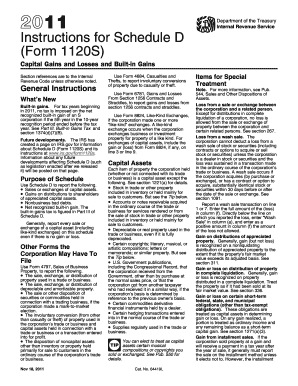

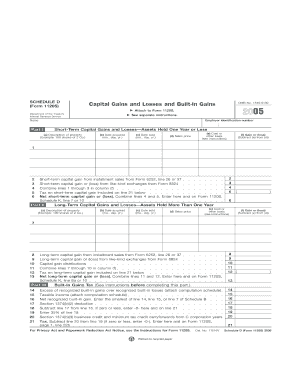

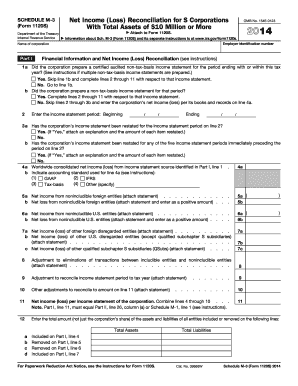

Additional schedules and forms: There are specific instructions for various schedules and forms that may need to be attached to Form 1120s, depending on the nature of the S corporation's activities and transactions.

Filing and payment instructions: These guide users on how and where to submit their completed Form 1120s and make any necessary tax payments.

How to complete form 1120s instructions

Completing form 1120s instructions may seem daunting, but by following these steps, you can efficiently navigate the process:

01

Gather necessary information: Collect all essential financial records and supporting documents, such as income statements, balance sheets, and expense receipts.

02

Review and understand the instructions: Take the time to read and comprehend the form 1120s instructions thoroughly. Familiarize yourself with the different sections and line items, paying attention to specific requirements and explanations.

03

Fill out the form: Methodically complete each section of the form, ensuring accuracy and clarity. Use the provided instructions to guide you through each line item.

04

Attach additional schedules and forms: If applicable, prepare and attach any required schedules and forms mentioned in the instructions. These may include Schedule K-1, Schedule D, or Form 4562, among others.

05

Double-check the information: Before submitting your completed form, review all the details for any errors or omissions. Rectify any mistakes to avoid potential issues with the IRS.

06

Submit the form: Once you have reviewed and confirmed the accuracy of your form 1120s instructions, you can submit it to the IRS. Follow the filing and payment instructions provided to ensure proper submission.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.