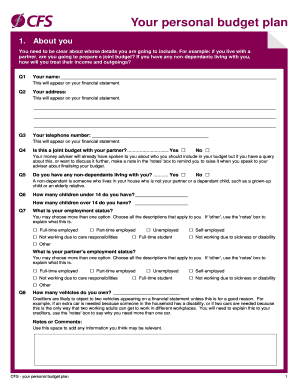

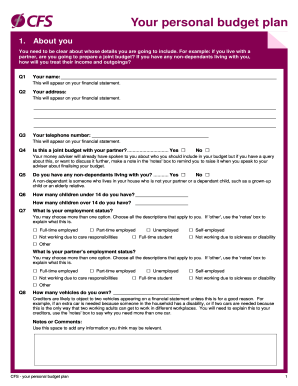

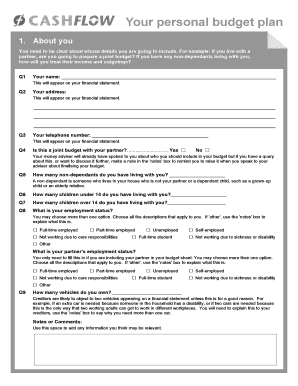

What is personal budget example?

A personal budget example is a detailed breakdown of income and expenses that an individual or household uses to manage their finances. It helps individuals track their income sources, such as salary, investments, or side hustles, and understand how they are allocating their money towards various expenses. By creating a personal budget example, individuals can gain insights into their spending habits, identify areas where they can save or cut back, and work towards achieving their financial goals.

What are the types of personal budget example?

There are several types of personal budget examples that individuals can choose from based on their needs and preferences. Some common types include:

Traditional Budget: This is a basic budgeting method where individuals allocate their income towards various expense categories, such as housing, transportation, groceries, and entertainment. It provides a general overview of spending and helps individuals prioritize their expenses.

Zero-based Budget: In this budgeting method, every dollar of income is assigned a specific purpose, leaving no room for unallocated money. It helps individuals track and control their spending more precisely.

Envelope Budget: This method involves dividing cash into different envelopes labeled with specific expense categories. Individuals can only spend the money available in each envelope, helping them stay within their budget.

50/30/20 Budget: This approach suggests allocating 50% of income towards needs, such as housing and utilities, 30% towards wants, such as dining out or vacations, and 20% towards savings and debt repayment. It provides a balanced approach to budgeting.

App-based Budget: There are various mobile apps available that help individuals track their expenses, set budget limits, and receive notifications when they overspend. These apps provide convenience and real-time insights into spending habits.

How to complete personal budget example

Completing a personal budget example is a relatively straightforward process. Here are the steps to follow:

01

Determine your income sources: Make a list of all the income sources you have, such as salary, freelance work, investments, etc.

02

Track your expenses: Keep track of all your expenses for a certain period, such as a month. Categorize them into different expense categories, such as housing, transportation, groceries, etc.

03

Calculate your income and expenses: Add up your total income and total expenses for the chosen period.

04

Analyze your budget: Compare your income and expenses to see if there is a surplus or deficit. Identify areas where you can cut back or reallocate funds.

05

Set financial goals: Based on your analysis, set realistic financial goals for saving, debt repayment, or any other financial aspirations.

06

Monitor and adjust: Regularly review and monitor your budget to ensure you are staying on track. Make adjustments as needed to accommodate changes in income or expenses.

With all these steps, completing a personal budget example will provide you with a clear understanding of your financial situation and help you make informed decisions about your money. Remember, tools like pdfFiller empower users to create, edit, and share documents online, providing unlimited fillable templates and powerful editing tools. With pdfFiller, you have everything you need to effectively manage your budget and financial documents.