1099-int Minimum

What is 1099-int minimum?

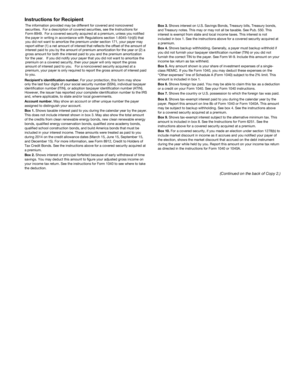

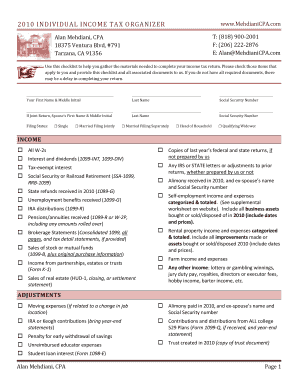

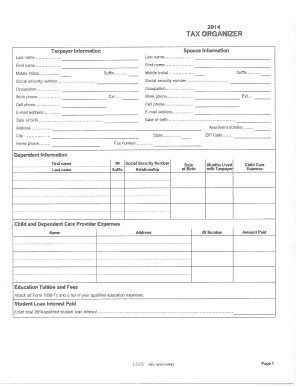

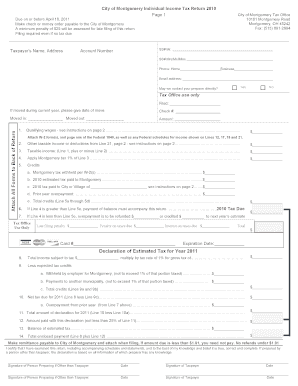

The 1099-int minimum is the minimum amount that an individual or entity must earn from interest income in order to receive a 1099-INT form for tax reporting purposes. The specific minimum amount is determined by the Internal Revenue Service (IRS) and is subject to change each year. The 1099-INT form is used to report interest income earned from various sources, such as bank accounts, loans, and investments.

What are the types of 1099-int minimum?

There are different types of 1099-INT minimum based on the various thresholds set by the IRS. These types include:

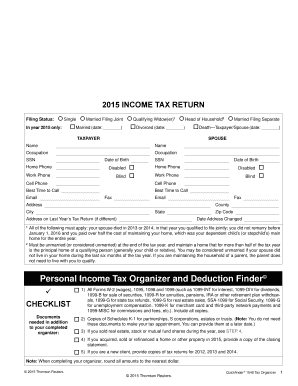

How to complete 1099-int minimum

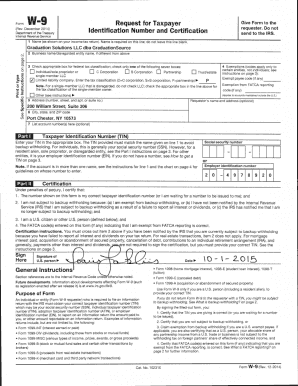

Completing a 1099-INT form is an important step in accurately reporting your interest income for tax purposes. Here's a step-by-step guide to help you complete this form:

pdfFiller is an excellent tool that empowers users to create, edit, and share documents online. With its unlimited fillable templates and powerful editing tools, pdfFiller stands out as the go-to PDF editor for completing various forms, including the 1099-INT form. Give it a try and experience the ease and convenience of managing your documents online.