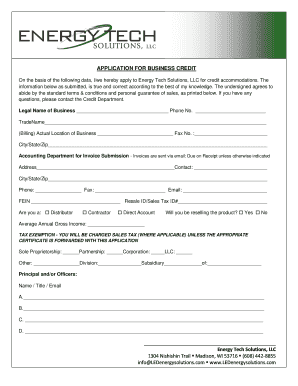

What is business credit application personal guarantee?

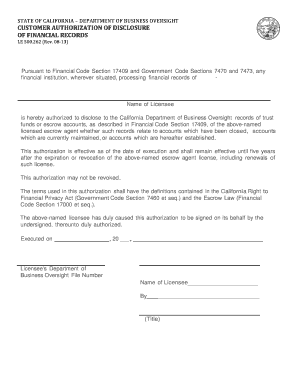

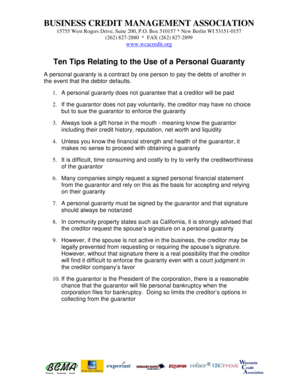

A business credit application personal guarantee is a legally binding agreement in which an individual agrees to be personally responsible for paying back a business loan or credit line in the event that the business is unable to repay the debt. By signing the personal guarantee, the individual agrees to assume the financial risk of the loan and can be held personally liable for any outstanding debts. This provides the lender with an added layer of security and increases the likelihood of repayment.

What are the types of business credit application personal guarantee?

There are three common types of business credit application personal guarantees:

Unlimited Personal Guarantee: In this type, the guarantor is personally liable for the full amount of the debt, including interest and fees, with no cap on the maximum liability.

Limited Personal Guarantee: This type limits the guarantor's liability to a specific dollar amount. Once the debt exceeds the capped amount, the guarantor is no longer responsible for the remaining balance.

Joint and Several Guarantee: In this type, multiple individuals (such as business partners or officers) are collectively and individually responsible for the debt. This means that each guarantor can be held liable for the full amount of the debt if other guarantors are unable to fulfill their obligations.

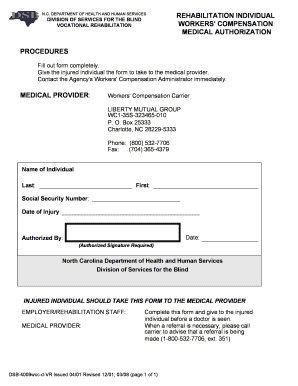

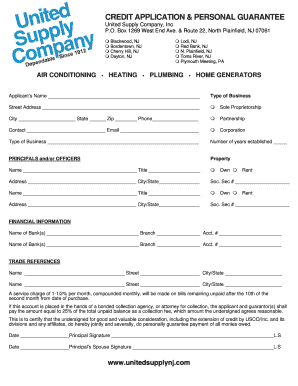

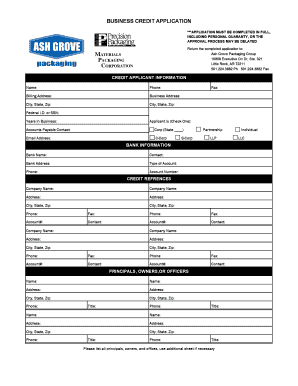

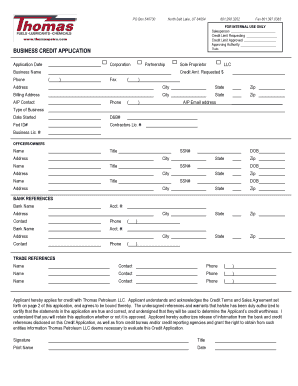

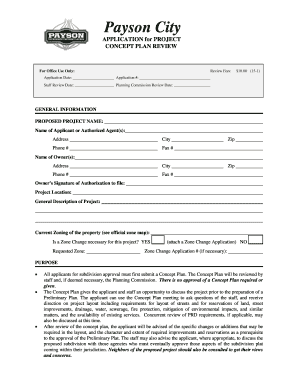

How to complete business credit application personal guarantee

Completing a business credit application personal guarantee involves the following steps:

01

Review the terms and conditions of the personal guarantee carefully. Understand the extent of your liability and seek legal advice if needed.

02

Provide accurate personal information, including your full name, address, social security number or taxpayer identification number, and contact details.

03

Read the business credit application and ensure you understand the purpose and terms of the credit line or loan.

04

Sign the personal guarantee section of the application form, acknowledging your agreement to assume the financial responsibility for the debt.

05

Submit the completed application form to the lender or financial institution.

06

Keep a copy of the signed personal guarantee for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.