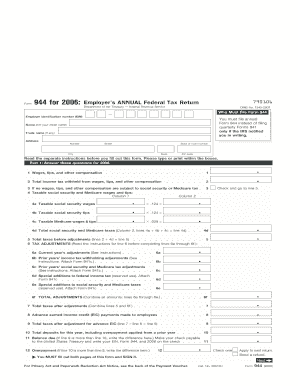

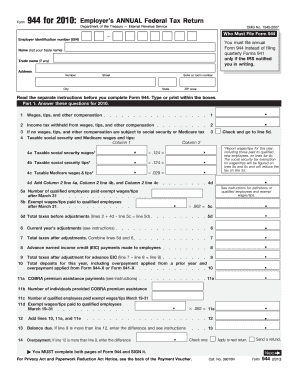

Form 944

What is Form 944?

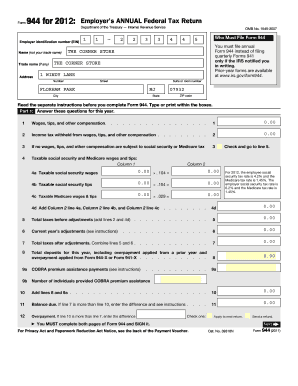

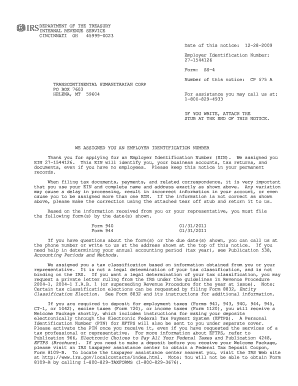

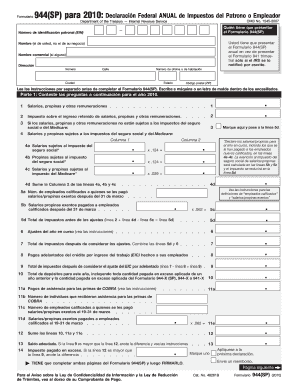

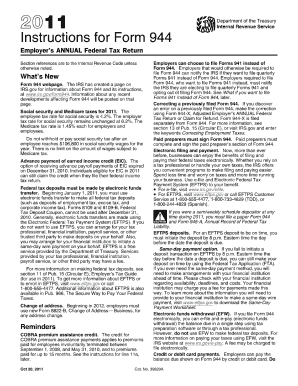

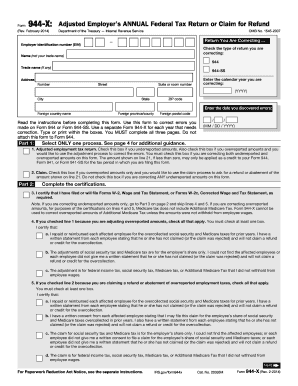

Form 944 is a tax form used by small businesses to report their annual federal tax liability and payroll taxes. Unlike Form 941, which is used by most employers to report taxes on a quarterly basis, Form 944 is filed once a year. It is specifically designed for small businesses with annual payroll tax liability of $1,000 or less.

What are the types of Form 944?

There is only one type of Form 944, which is the Annual Federal Tax Return for Small Businesses. This form is used to report the amount of federal income tax withheld from employees' wages, as well as the employer's share of Social Security and Medicare taxes. It also includes information on any adjustments or credits that may apply to the business.

How to complete Form 944

Completing Form 944 is a simple process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.