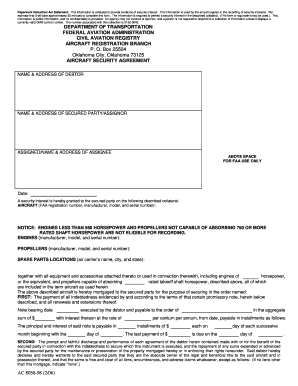

What is security agreement template?

A security agreement template is a legally binding document that outlines the terms and conditions of a secured loan. It establishes a relationship between a borrower and a lender, detailing the rights and responsibilities of both parties. This agreement helps ensure that the lender has a legal claim over the borrower's assets in case of default or non-payment.

What are the types of security agreement templates?

There are several types of security agreement templates available, each catering to different borrowing scenarios. These include:

Real Estate Security Agreement Template

Personal Property Security Agreement Template

Uniform Commercial Code (UCC) Security Agreement Template

Accounts Receivable Security Agreement Template

Inventory Security Agreement Template

How to complete a security agreement template

Completing a security agreement template can be done in a few simple steps. Here's how:

01

Download a security agreement template from a trusted source or use an online platform like pdfFiller to access pre-made templates.

02

Identify the parties involved, including the borrower and lender. Provide their full legal names and contact information.

03

Describe the collateral being used to secure the loan. Be specific about the assets and their location.

04

Clearly outline the terms of the loan, including the loan amount, interest rate, repayment schedule, and any penalties or fees.

05

Include any additional clauses or provisions necessary to protect both parties' interests.

06

Review the completed agreement with all parties involved and make any necessary revisions.

07

Sign the agreement and have it notarized if required by law.

08

Keep a copy of the agreement for your records.

pdfFiller is an online platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done efficiently and securely.