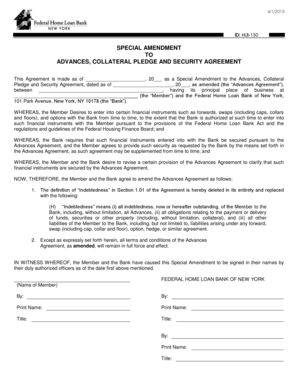

Difference Between Pledge Agreement And Security Agreement

What is the difference between a pledge agreement and a security agreement?

A pledge agreement and a security agreement are two legal contracts that involve the use of collateral to secure a loan or debt. However, the main difference between the two lies in the way the collateral is handled.

What are the types of difference between a pledge agreement and a security agreement?

The key difference between a pledge agreement and a security agreement can be categorized into the following types:

Nature of collateral: In a pledge agreement, the borrower physically transfers the possession of the collateral to the lender as a form of security. On the other hand, a security agreement involves granting the lender a security interest in the collateral, without transferring its possession.

Rights to the collateral: In a pledge agreement, the lender has the right to possess and sell the collateral in case of default. In a security agreement, the lender has a security interest in the collateral but may not necessarily possess or sell it right away.

Risk and liability: In a pledge agreement, the borrower carries all the risk and liability associated with the collateral. In a security agreement, the lender shares the risk and liability with the borrower, as they hold a security interest in the collateral.

Enforcement: In a pledge agreement, the lender can enforce their rights immediately after default. In a security agreement, the lender needs to follow certain legal procedures, such as going through the court, to enforce their rights.

How to complete a difference between a pledge agreement and a security agreement

To clearly differentiate between a pledge agreement and a security agreement, consider the following steps:

01

Understand the purpose of the agreement: Determine whether the agreement is intended to transfer possession of the collateral or grant a security interest.

02

Identify the type of collateral: Determine if the collateral can be physically transferred or if it requires a security interest.

03

Specify the rights and obligations: Clearly outline the rights and obligations of both parties regarding the collateral.

04

Include default and enforcement provisions: Define the consequences of default and the procedures for enforcing rights.

05

Consult legal professionals: Seek advice from legal professionals to ensure the agreement complies with applicable laws and regulations.

pdfFiller provides users with a powerful online platform, empowering them to create, edit, and share documents easily. With unlimited fillable templates and robust editing tools, pdfFiller simplifies the document management process, making it the go-to PDF editor for users.

Video Tutorial How to Fill Out difference between pledge agreement and security agreement

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the difference between pledge and collateral?

A pledged asset is a valuable possession that is transferred to a lender to secure a debt or loan. A pledged asset is collateral held by a lender in return for lending funds. Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged.

What is a pledge document?

Pledge Document means the Pledge Agreement over deposits and securities or any other security document as stipulated by the Bank, executed or to be executed by the Borrower or other third party as security for the Facilities. Sample 1Sample 2.

What is a written security agreement?

Key Takeaways. A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

What are the documents required for pledge?

Pledge Documents means a Membership Interest Pledge and Security Agreement together with a consent of the applicable Permitted Subsidiary, and an Irrevocable Proxy in form and content acceptable to Lender in its discretion to grant to Lender a security interest in and to 100% of the issued and outstanding membership

Does a security agreement have to be in writing?

A statute of frauds within UCC Article 9 requires the security agreement be in writing. An exception to this requirement is when a security interest is pledged.

What does a pledge agreement do?

An agreement typically used to create a security interest in equity interests (including capital stock, LLC interests, and partnership interests) and promissory notes.

Related templates