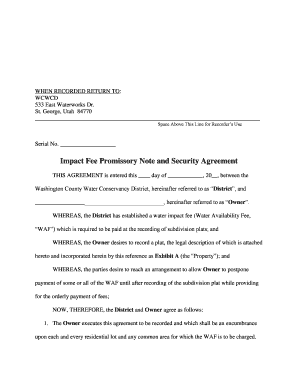

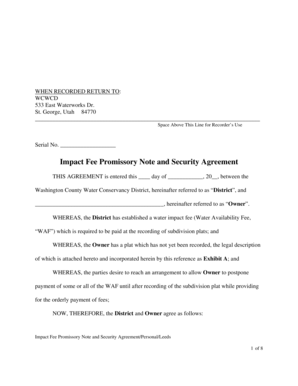

Security Agreement For Promissory Note

What is security agreement for promissory note?

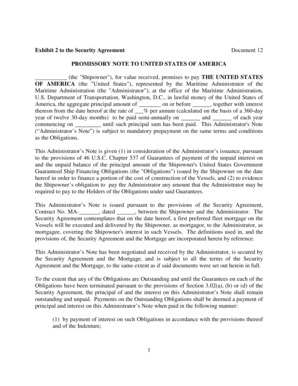

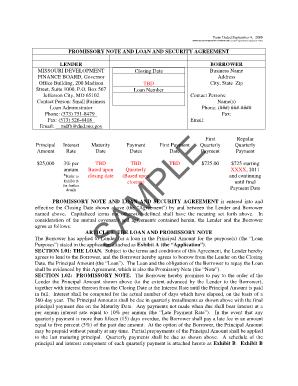

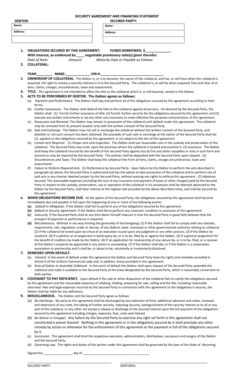

A security agreement for promissory note is a legal document that outlines the terms and conditions related to the collateral provided by a borrower as security for a promissory note. It specifies the rights and obligations of both parties in case of default or non-payment.

What are the types of security agreement for promissory note?

There are several types of security agreements for promissory notes, including:

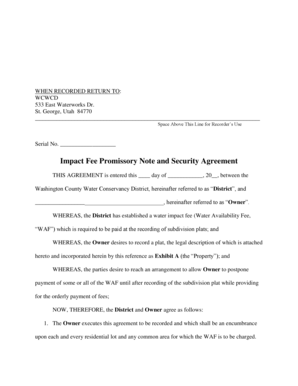

Real property security agreement: This type of agreement involves using real estate as collateral for the promissory note.

Personal property security agreement: This agreement uses personal assets, such as vehicles, equipment, or inventory, as collateral.

Intellectual property security agreement: In this type of agreement, intellectual property rights, such as patents or trademarks, are used as collateral.

Financial asset security agreement: This agreement involves using financial assets, such as stocks or bonds, as collateral.

Deposit account control agreement: This type of agreement allows a lender to control the funds in a borrower's bank account as collateral.

How to complete security agreement for promissory note

Completing a security agreement for a promissory note involves the following steps:

01

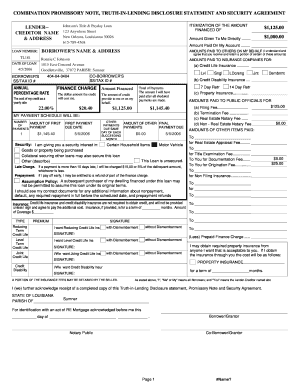

Identify the parties involved: Clearly state the names and details of both the borrower and the lender.

02

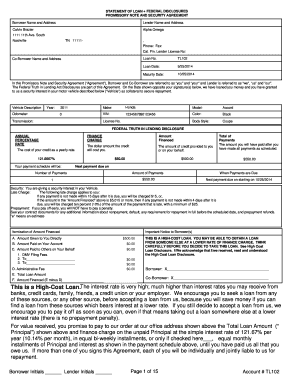

Describe the promissory note: Provide a detailed description of the promissory note, including the principal amount, interest rate, and repayment terms.

03

Specify the collateral: Clearly state the type of collateral being used to secure the promissory note.

04

Include default provisions: Outline the conditions under which a default would occur and the rights and remedies of the lender in case of default.

05

Sign and date the agreement: Both parties should sign and date the security agreement to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out security agreement for promissory note

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What acts as security for a promissory note?

The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Can you combine a promissory note and security agreement?

A security agreement is used in conjunction with a secured promissory note. The terms of the secured promissory note typically includes a reference to the security agreement and a brief description of the related collateral.

What document acts as security for a promissory note?

The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

How do you write a promissory agreement?

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Is a security agreement a loan agreement?

WHEREAS, it is a condition precedent to the Secured Party's making any loans to Debtor under the Credit Agreement that the Debtor execute and deliver a Security Agreement in substantially the form hereof. a. Overview: A security agreement is frequently one of many “loan documents” executed in conjunction with a loan.

Is promissory note a security document?

Promissory notes are defined as securities under the Securities Act. However, notes that have a maturity of nine months or less are not considered securities.

Related templates