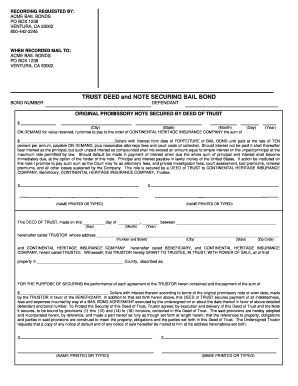

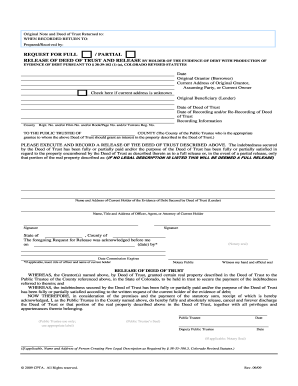

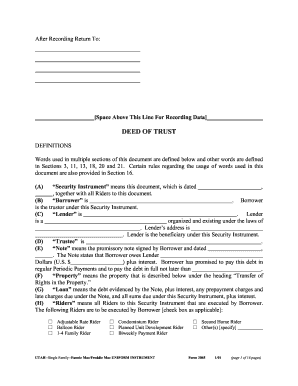

What is Deed Of Trust Form?

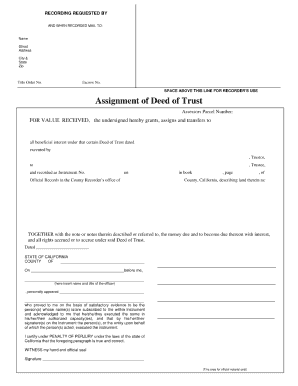

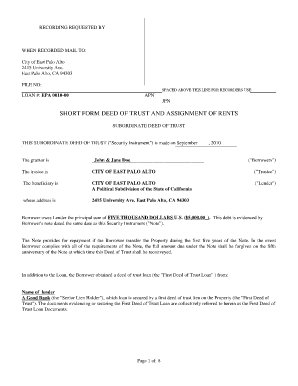

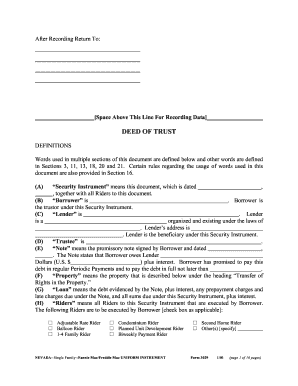

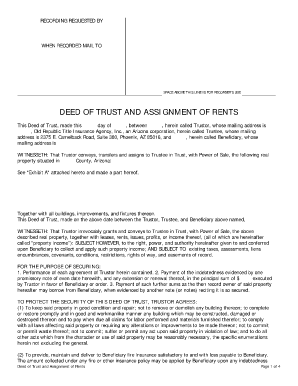

A Deed of Trust form is a legal document that is used in real estate transactions to secure a loan. It is commonly used in mortgage transactions to transfer property rights to a trustee, who holds the property as security for a loan. The Deed of Trust outlines the terms and conditions of the loan, as well as the responsibilities of the borrower and the lender.

What are the types of Deed Of Trust Form?

There are different types of Deed of Trust forms that can be used depending on the specific requirements of the transaction. Some common types include:

General Warranty Deed of Trust: Provides the highest level of protection for the lender by guaranteeing that the title to the property is free and clear of any encumbrances.

Special Warranty Deed of Trust: Provides limited protection to the lender by guaranteeing that the title to the property was free and clear during the seller's ownership but does not cover any encumbrances that may have existed before the seller's ownership.

Quitclaim Deed of Trust: Provides the least amount of protection to the lender by merely transferring the seller's interest in the property without any warranties regarding the title.

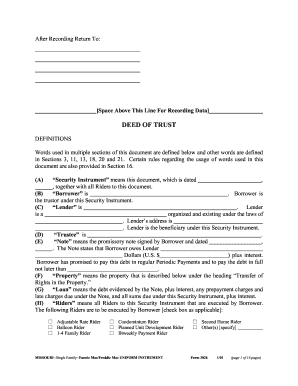

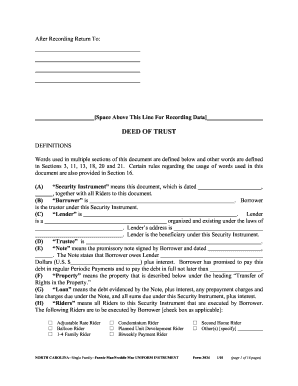

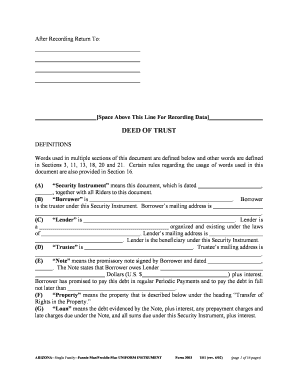

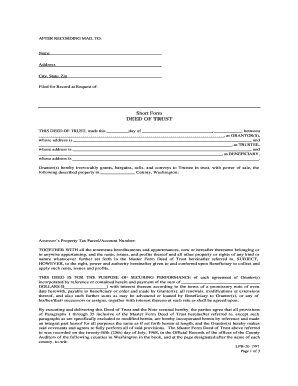

How to complete Deed Of Trust Form

Completing a Deed of Trust form is a crucial step in securing a loan for a real estate transaction. Here are the steps to follow:

01

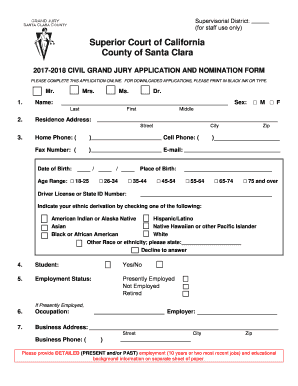

Identify the parties involved: Include the names and addresses of the borrower, lender, and trustee in the form.

02

Describe the property: Provide a detailed description of the property being used as collateral for the loan.

03

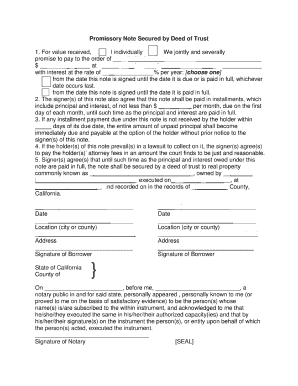

Specify loan terms: Outline the loan amount, repayment terms, interest rate, and any other relevant conditions.

04

Sign and notarize: Ensure that all parties sign the Deed of Trust form in the presence of a notary public.

05

Record the form: File the completed and notarized Deed of Trust form with the appropriate county office to make it a public record.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.